Our recent SaaStr Summit: Bridging the Gap was the first time I’ve had a chance to be a participant at a SaaStr event in a long, long time. Too much planning, moderating, etc. I thought I’d share my learnings from the sessions as we put them up on YouTube.

My first set of 10 Learnings is from Mark Suster of Upfront Ventures. The presentation is not only very good, but very compellingly narrated and put together. Take a watch before or after you read the learnings:

1. Remember, We’re Only 30-60 Days Into This. This is something we all almost half forget. Whatever happens, it is still very early.

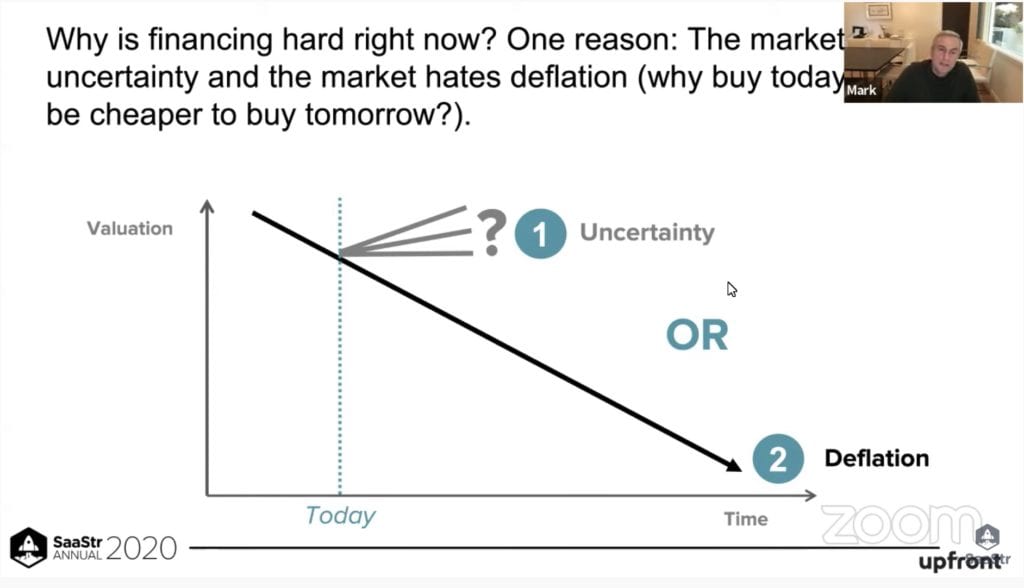

2. VCs are Worried about “Deflation” in terms of pricing funding rounds. Mark sees multiples falling, which doesn’t just lead to lower prices … it leads to a Stop. “It makes price discover much more difficult.”

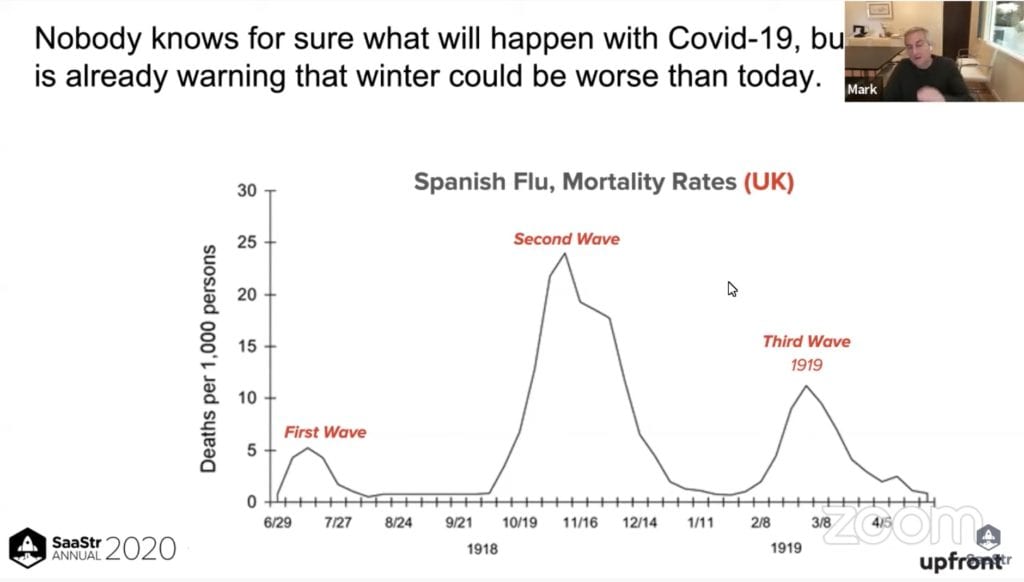

3. There Could be Three Waves. We’re mostly focused on when we can get past things we are seeing and feeling now. But what is there are 3 waves?

4. VC’s Don’t Want to Lead Downrounds. It Angers Folks, So VCs Default to Newer Deals vs. Lower Priced Rounds. This is an important and what should be an obvious point that Twitter and the media overlook. There is a lot of talk about “downrounds”. But no VC really wants to do them. Not really. It’s easier just to go find a brand new investment with less overhang and fewer issues.

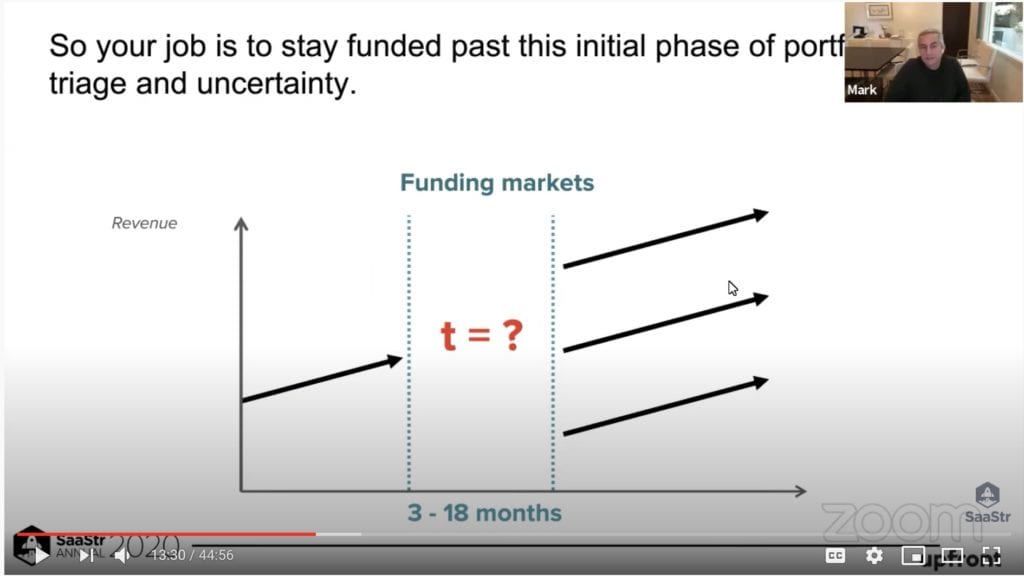

5. VC Slowdown Could Exist Anywhere From 3-18 Months. No one knows. What we do know is that overall, Q2 will be a much rougher quarter in the public markets overall than Q1.

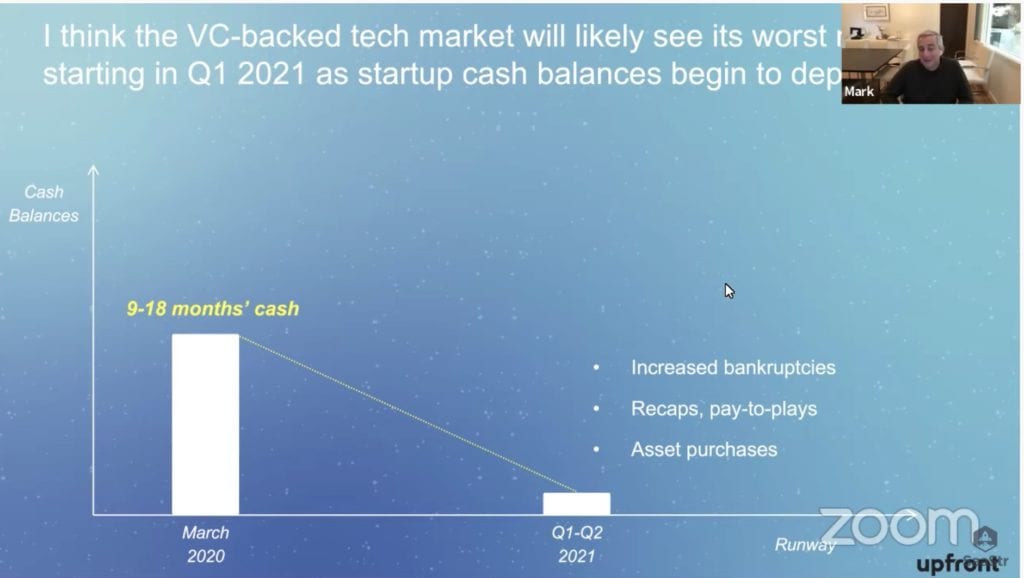

6. VC Will Be Much Worse in 2021 Than 2020. Perhaps Mark’s most interesting point. He believes things will be much worse next week for fundraising and venture capital. He thinks we’re just start to see shutdowns and bankruptcies.

7. Innovation Is Dead in Enterprise. In Bear Markets, Folks Are Paid to Consolidate and Cut Costs. This is an important point. For the past 5-7 years, SaaS in the enterprise has been turbocharged by CIOs and buyers wanting to bring innovation into the enterprise. That’s on hold. But there is also a re-allocation to need (Zoom, Slack, etc).

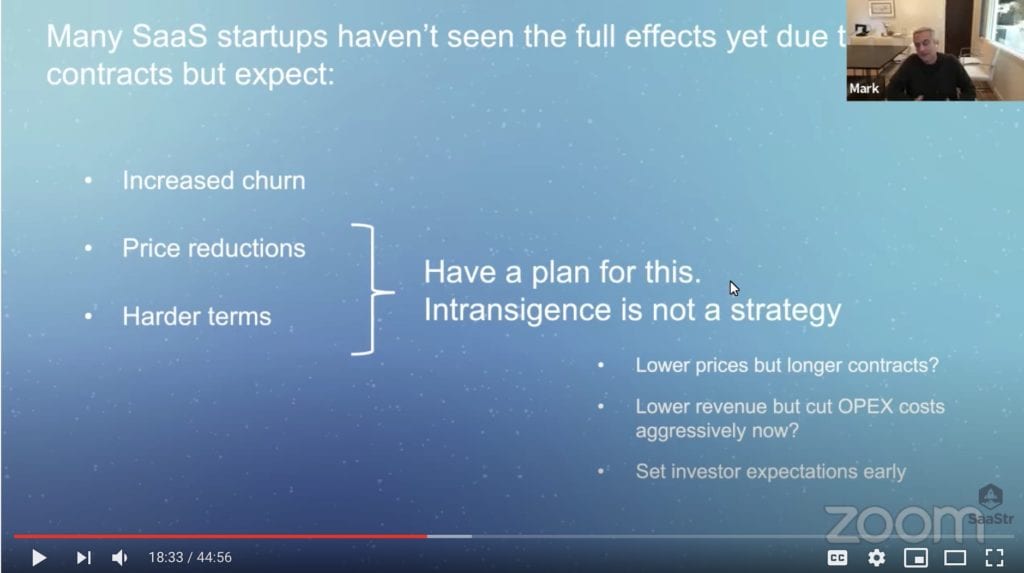

8. If You “Hold The Line” on Pricing, But Churn Goes Up, You May be Losing, Not Winning. I agree here. The goal now for most SaaS start-ups is to retain as many logos and customers as possible. Especially many enterprise customers want flexibility now. Mark advises trading off lower prices for longer commitments or other trade-offs that help more in the long term.

9. Can you change your positioning to the market so it reduces other costs? Mark recommends changing product marketing ASAP. He says “productivity gains are so last year.”

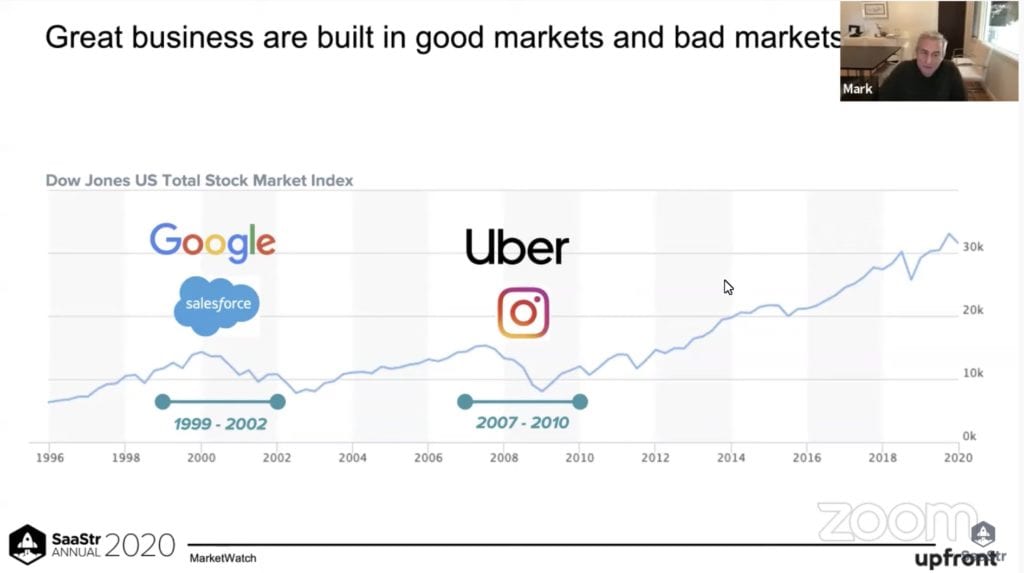

10. Good Businesses are Built in Good Markets and Bad Markets. Truly differentiated products win in bad markets. Why? “Poser products” can’t get any traction in tough markets.

The post 10 Learnings From Mark Suster’s “Funding In the Time of Coronavirus” appeared first on SaaStr.

via https://ift.tt/2Jn9P8X by Jason Lemkin, Khareem Sudlow