So times are tougher for some, but for the most part, not in leaders in Cloud security. Cloudflare is a great example.

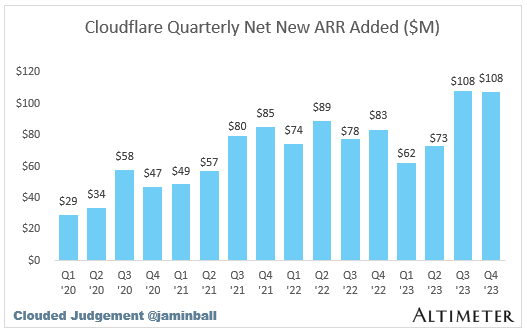

While it saw some slowdown last year, it’s now accelerating again with 2 record quarters of new bookings in a row.

At ~ $1.5 Billion in ARR, it’s still growing 32% and it’s gotten pretty darn efficient, with 14% free cash flow margins now.

And the markets really like Cloudflare. Really, really like it. It’s trading at a stunning $36 Billion market cap, or 24x ARR!

The key? They are seeing no slowdown at all in revenue growth from $100k+ customers.

5 Interesting Learnings:

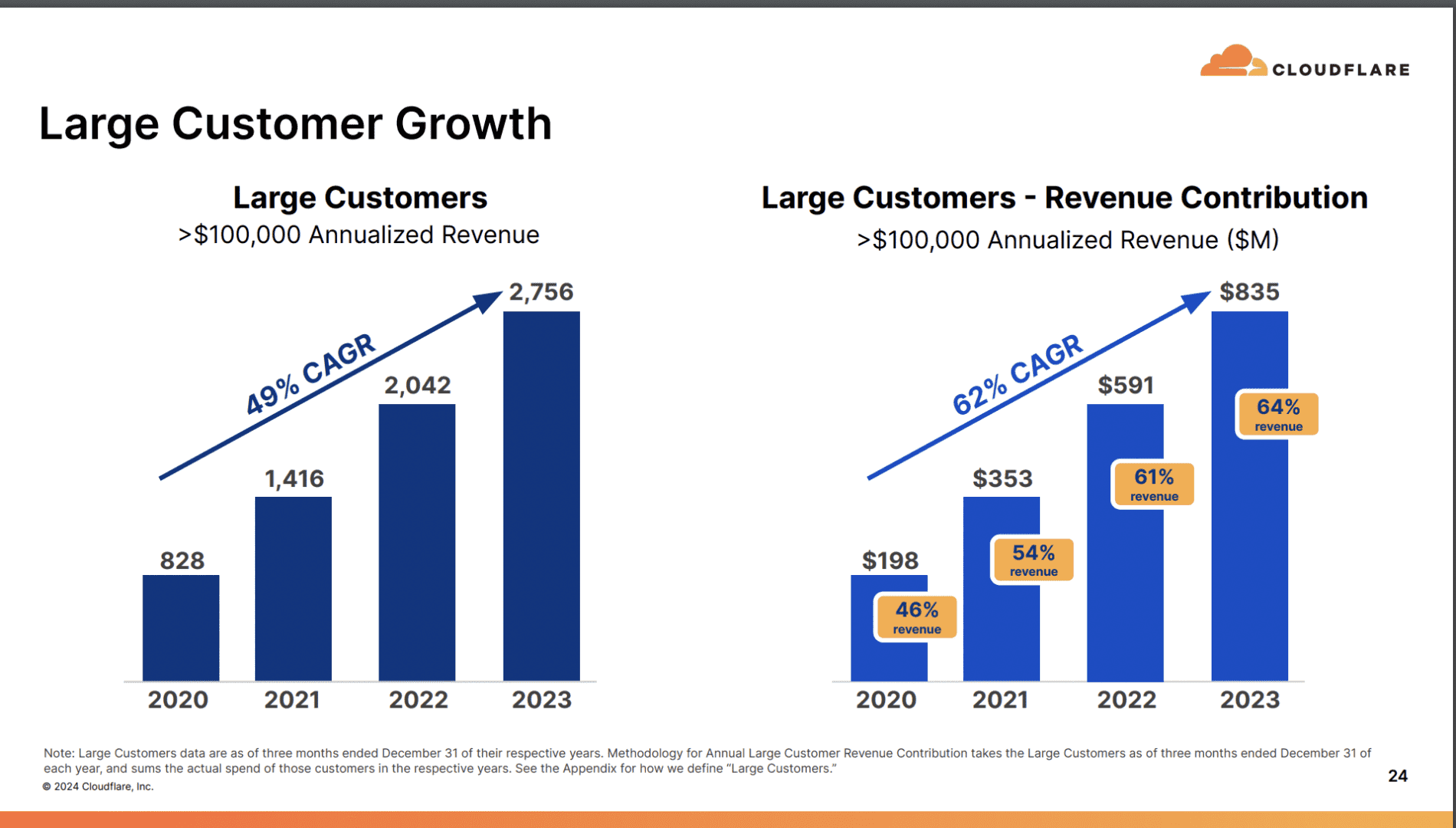

#1. $100k+ Customers Are Key To Growth at Scale. Revenue There Growing a Stunning 64% (!).

Cloudflare is getting more and more enterprise, but bear in mind that’s at $1.5 Billion in ARR. It hasn’t left its free and smaller customers behind. But the big ones are growing fast faster by revenue at scale. They’ve also now crossed 2,750 $100k+ customers and 100 $1m+ customers.

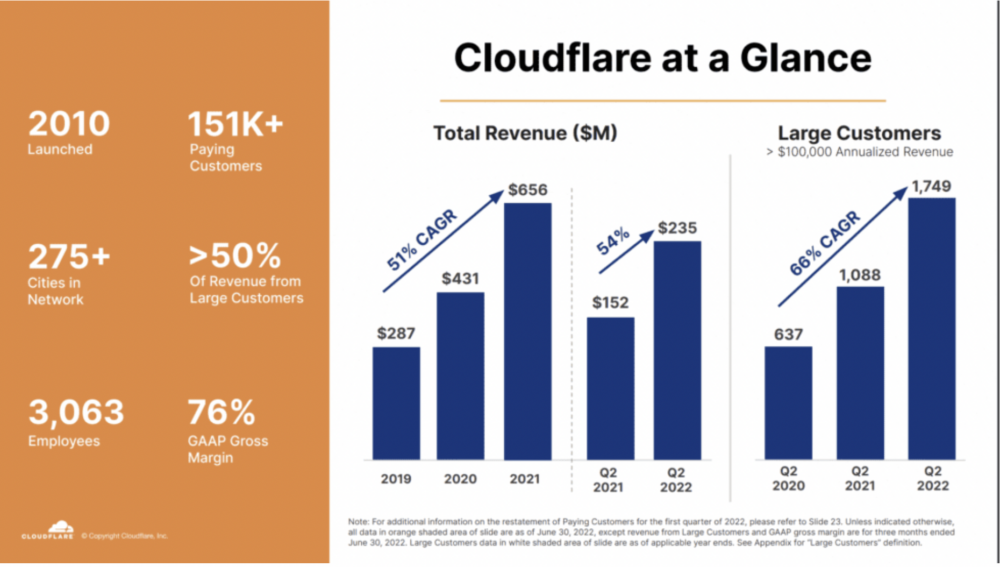

#2. 3,063 Employees — So About $400,000 in Revenue Per Employee

This is the age of New Efficiency. Public SaaS and Cloud companies now average $400,000 in revenue per employee, and many of the most efficient leaders are at $400,000 or higher. Add Cloudflare to that club.

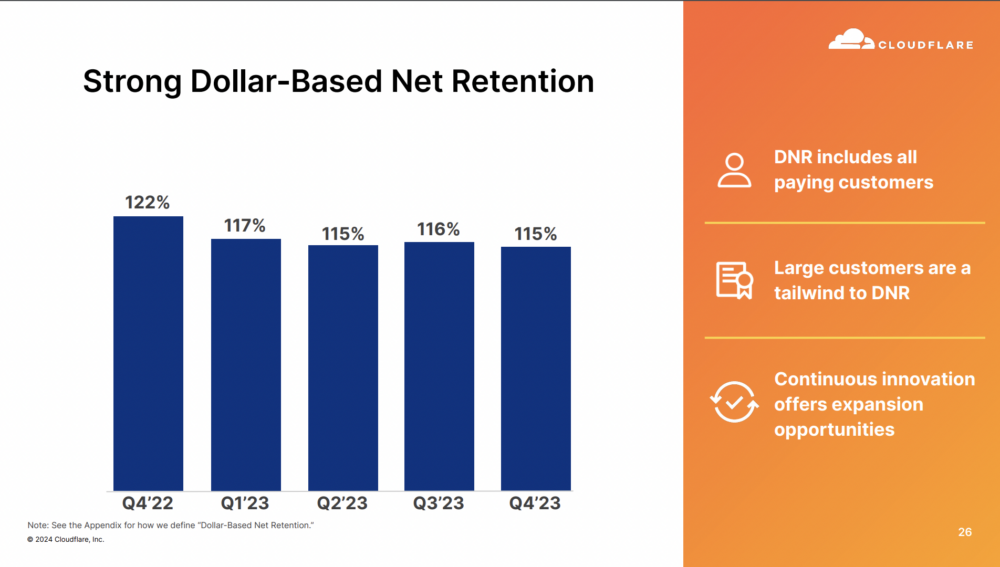

#3. NRR Has Come Down From 2 Years Ago, But Stable Now At 115%

Cloudflare hasn’t been immune the past 24 months from customers looking to optimize their Cloud spend, so NRR has come down from where it was 5+ quarters ago. But it’s been stable since at 115%.

#4. Gottom Much More Efficient — But Still in Investment and Growth Mode

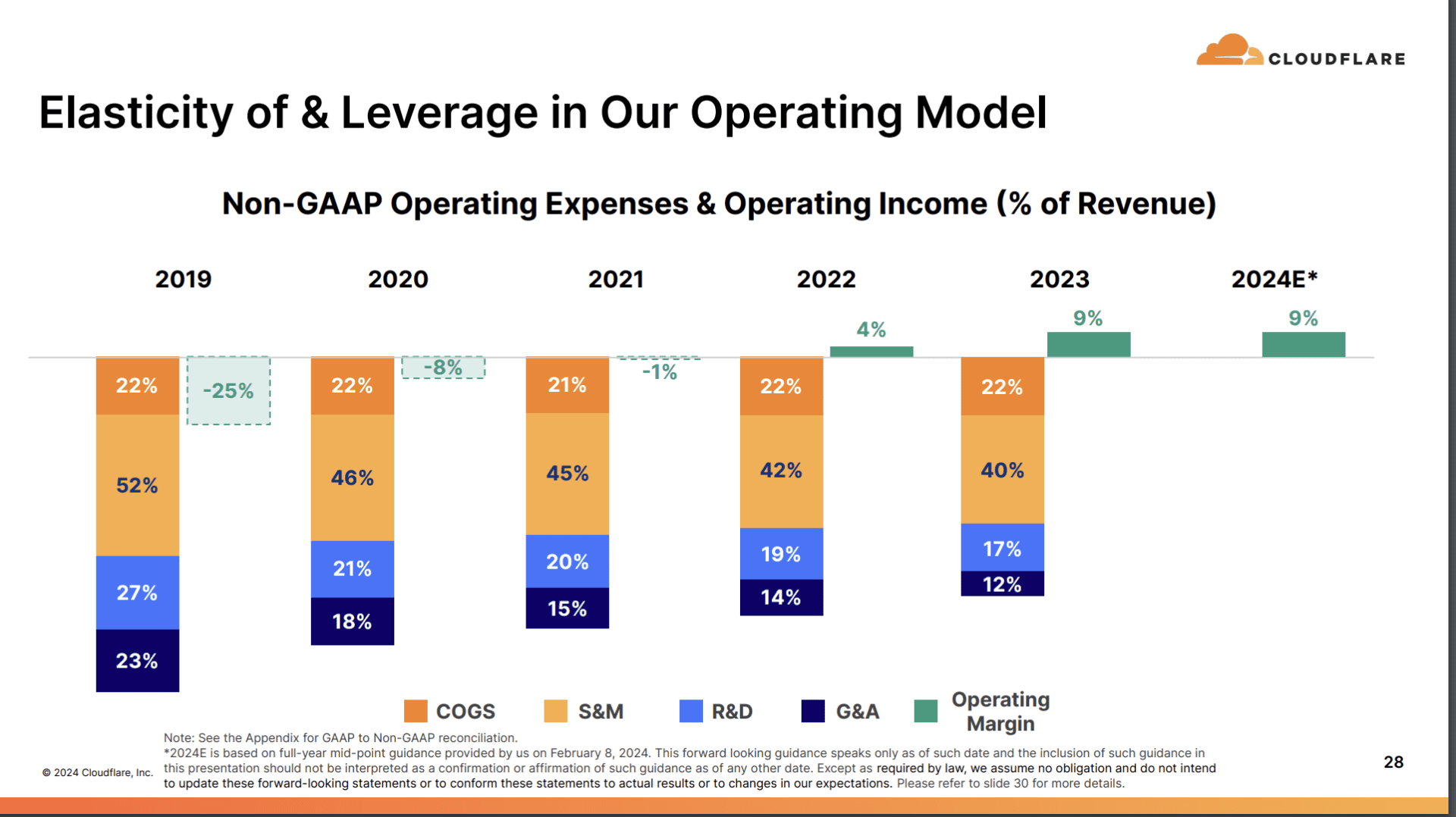

Cloudflare has gotten much more efficient than where it was 2-3 years ago, like almost every SaaS and Cloud leader. In 2021, it’s non-GAAP operating margins was -1%. Today? +9%. That’s much, much more efficient.

But for now, they aren’t pushing all the way to 20%+ margins. They’re still trading off some margin expansion to invest in growth. And the markets are good with that.

Efficient Growth. Just not the hyper-efficiency we see of some whose growth is slower.

#5. 48% of Revenue From Outside the U.S.

This isn’t new, but a good reminder to go as global as your product allows.

And a few other interesting learnings:

#6. First $30m TCV New Deal and First $60m (!) Total TCV Renewal.

Cloudflare really scales into some big deals! That $60m total TCV customer started with one $60k deal.

#7. A $6.6 Million Dollar Deal They Just Closed — They Lost on the First RFP

A great reminder to not give up on lost deals. You often get another chance if you’re patient!

#8. Finally, I really like Jamin Ball’s chart of their new bookings here. You can see Cloudflare’s re-acceleration clearly:

Wow, Cloudflare. It doesn’t get much better.

The post 5 Interesting Learnings from Cloudflare at $1.5 Billion in ARR appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow