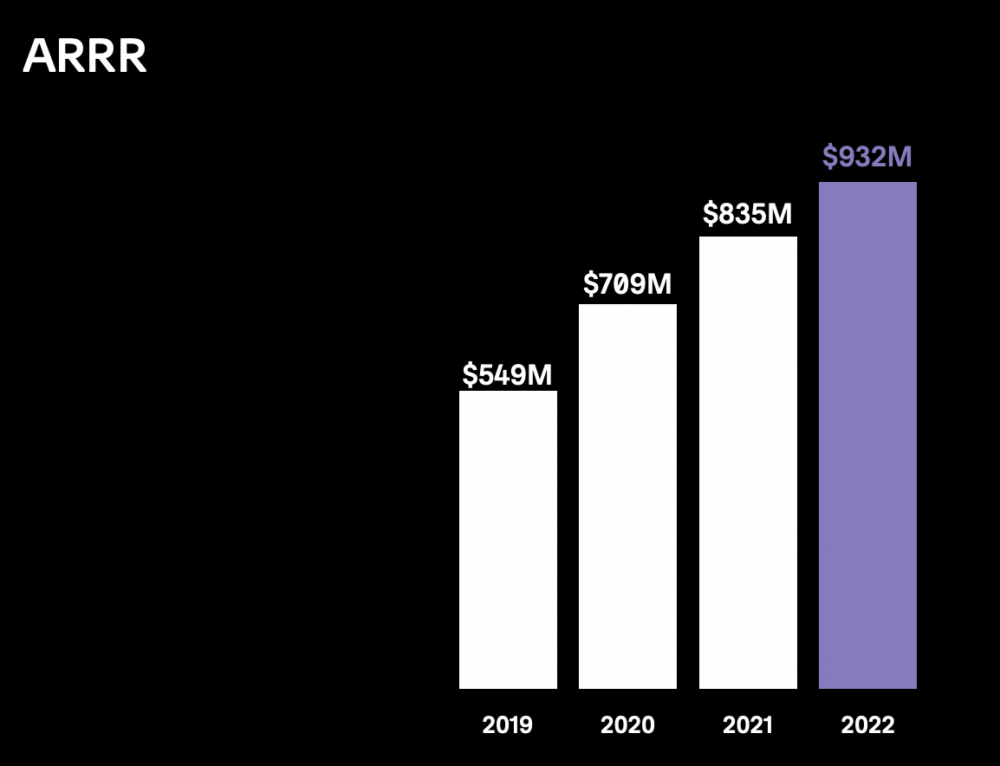

Squarespace produces amazing websites for SMBs — we are a big customer at SaaStr. And that’s powered it all the way to a $1B run-rate with 28% EBITDA. Self-serve products can and should be quite profitable at scale.

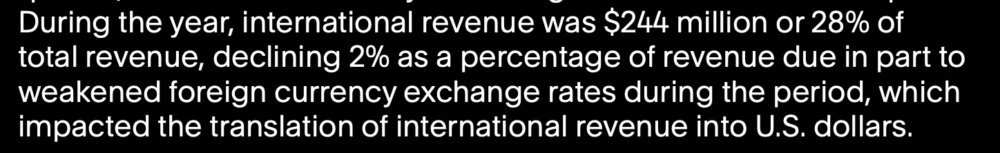

But it’s also a story of hitting some limits on TAM, and growth has slowed to 10% at $1B ARR. And subscriber growth of only 3%.

5 Interesting Learnings:

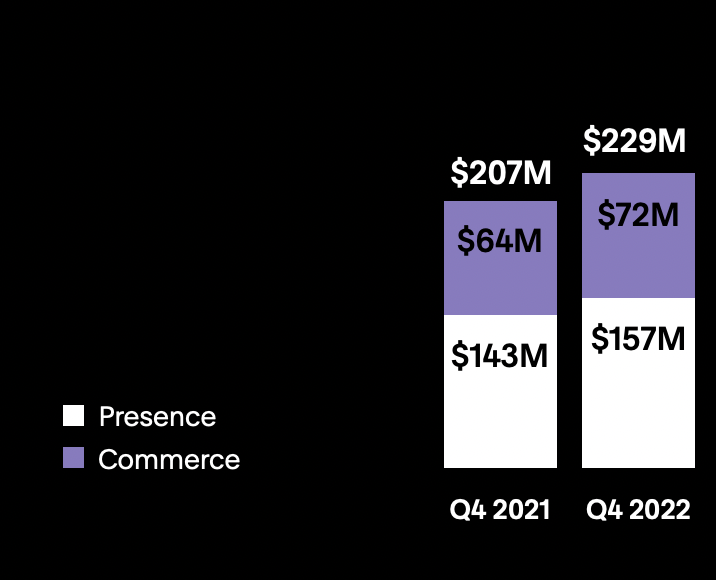

#1. Only 32% of Revenue From Websites. 68% From Ecommerce. You may think of Squarespace as a website builder, and it is. But really it’s become a low-end Shopify and Woocommerce competitor. The majority of its revenue comes from ecommerce. Their pure website revenue, which they call “Presence”, is just 32% of their revenue.

#2. Most of the website / presence growth came from price increases, which saw limited churn as a result. Churn was modest from their price increase, leading to material growth. A standard playbook when growth slows. I’ve seen similar things play out in my own portfolio. Relatively inexpensive products selling to SMBs that are truly valuable don’t see much increased churn from moderate price increases.

#3. 28% of their revenue from outside the U.S. A reminder to go global!

#4. Subscribers only grew 3% in 2022. A tough metric. Almost all the revenue growth came from price increases and transaction fee increases on commerce. New customers only grew 3%. That’s very mature. Having said that, many SMB players were hit hard in 2022. Zoom’s SMB customers shrunk for the first time ever, for example. And to some extent, the price increase impact may be muted going forward because their newer products have a lower ARPU, for now at least.

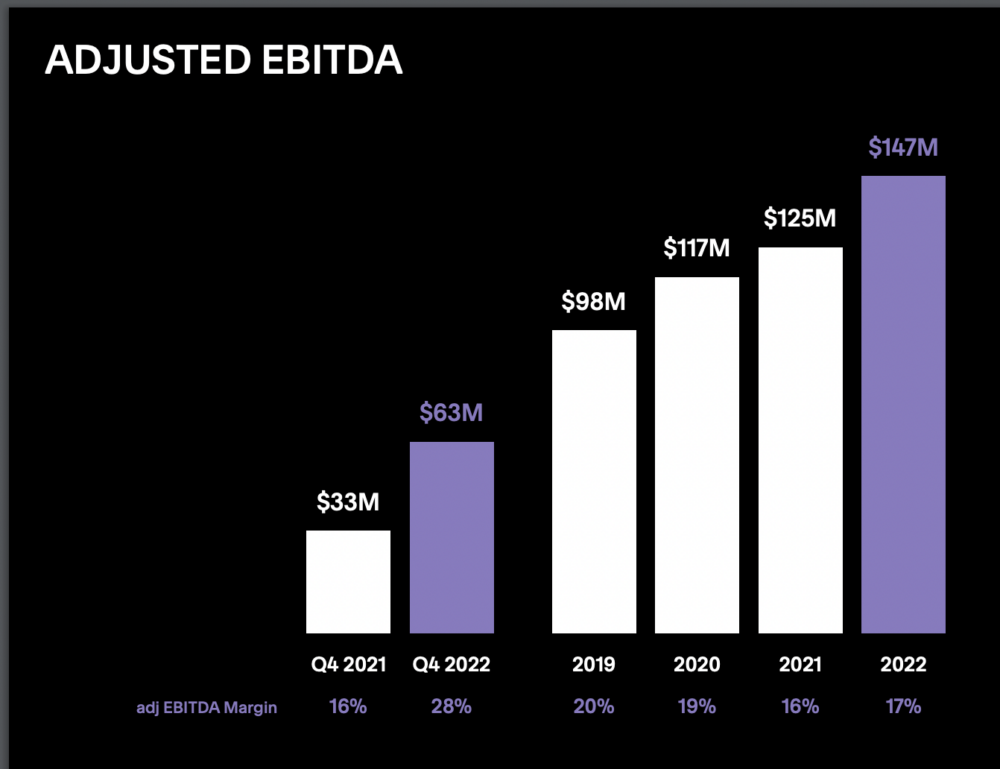

#5. Consistent EBITDA, going up. EBITDA hit a high of 28% last quarter and 17% last year. Squarespace isn’t hitting big GAAP profitability numbers yet, but it’s generating significant cash and trending past a sustained 20% EBITDA. Put differently, it has a fairly efficient self-serve model that’s getting even more efficient.

And a few other interesting learnings:

#6. Large mark-down for its $400m acquisition of Tock in 2021. Squarespace bought an online restaurant reservations player in 2021 for $400m, and that business continued. But it overpayed by the standards of 2023, and took a $200m markdown to reflect that. Diversifying into the restaurant space makes sense — it’s one of the largest segments for SMB commerce. But it’s a brutally competitive and complex space.

#7. 1,800 employees, so over $500,000 revenue per employee. That’s pretty darn efficient. That’s doing self-serve right.

Squarespace is such an interesting story. At just about a $4B market cap, it trades at only 4x ARR due to its mature growth at scale (10%), despite being fairly efficient. But the Founder CEO owns ~35% of the company. 35% of $4B is … a lot.

The post 5 Interesting Learnings from Squarespace at $1 Billion in ARR appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow