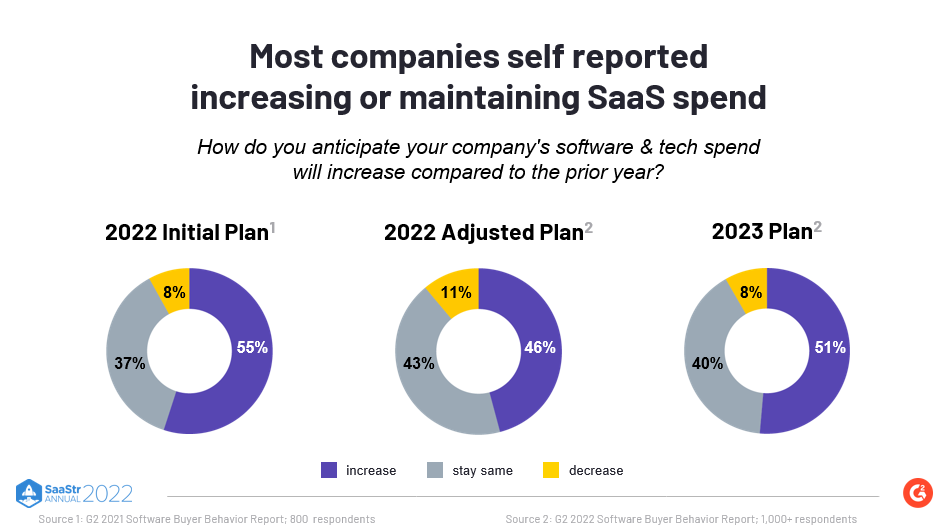

Despite economic headwinds, SaaS spending continues to grow, with most companies having self-reported increasing or maintaining SaaS spending.

Amanda Malko is CMO at G2, a software marketplace and review site that reaches over 60 million buyers annually across 2000 software categories. In this session, she shares insights and trends from research conducted this year that can help software buyers and sellers make smarter decisions about software and the market.

These insights from the world’s largest software marketplace come from 3 sources, namely:

- G2’s Annual buyer behavior report, which researches 1000+ global software users.

- G2 track, their proprietary SaaS spend management platform. This includes data from companies on how they utilize SaaS and their spending.

- Third-party partnerships, including tackle.io and go-to-market partners, to understand what’s happening in the space.

“G2 track data supports expected spending increase in 2022 with average quarterly SaaS spending up 15% YoY.”

Last year, over half the companies surveyed reported intent to increase software spending in 2022. When surveyed in 2022, only 46 percent said they would increase their spending in the year ahead, a number that is still worth mentioning because very few respondents intended to decrease spending. Next year is forecasted to be even more bullish.

Another exciting trend is that more products are being bought than ever before. Companies are witnessing slight pricing pressure, with the average spend per product dipping slightly.

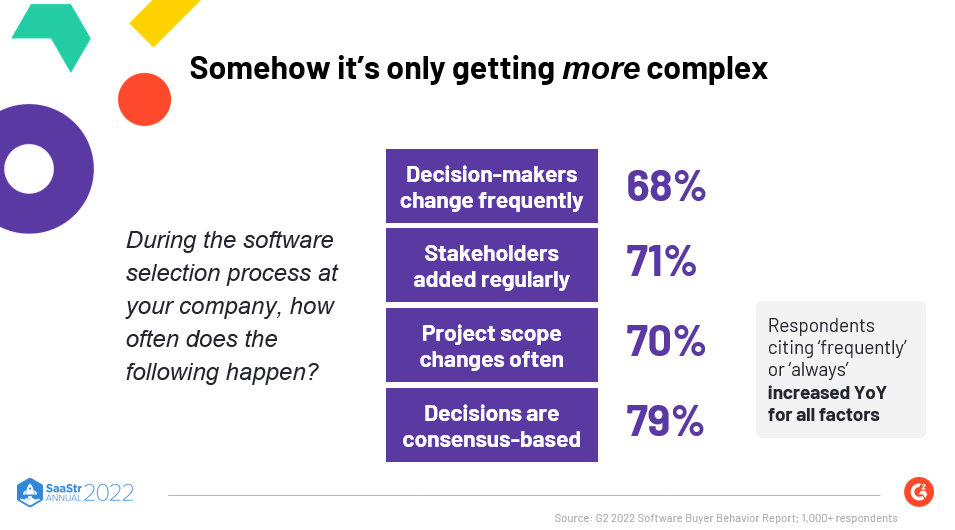

Buying and selling software is getting complex

Buyers reported the following challenges during the software buying process:

- 68% reported that decision-makers change frequently or always

- 71% said that stakeholders are added regularly

- 70% stated that project scope changes often

- 79% said that decisions are consensus-based

What do buyers want?

The three key themes that emerged from G2’s data are:

- The value of community experience

- The rise of third-party buying

- The need for ease

1. The value of community experience

Who influences software buying decisions is changing. Today, the focus is less on companies advocating for themselves but rather on building people advocates.

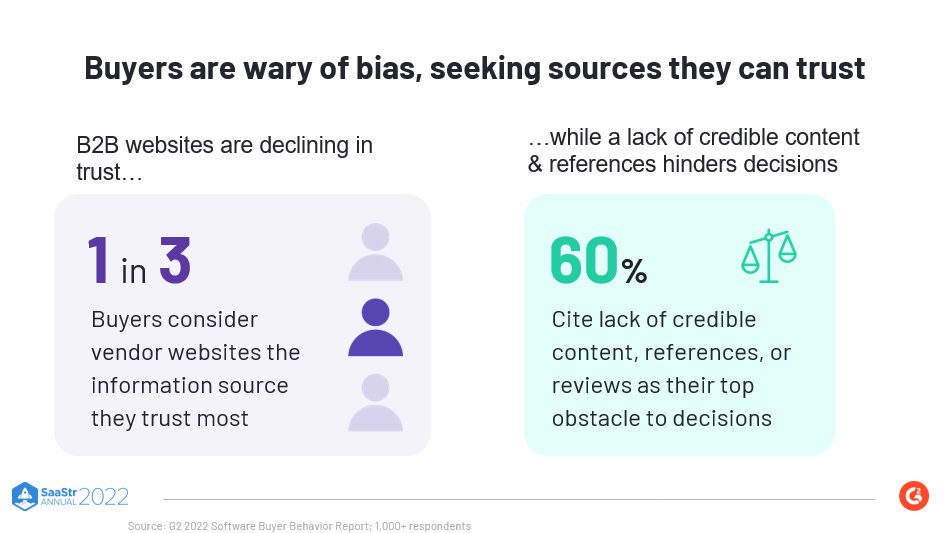

Buyers are increasingly wary of bias, seeking trustworthy sources, and B2B websites are declining in trust.

“Only 1 in 3 buyers consider vendor websites the information source they trust most.”

Establishing credibility is more likely to be successful via third parties or peer sources than your official website. 60% of respondents cited their top barriers to buying were a lack of credible content, references, or reviews.

Independent experts and peers are most valued

80% of buyers cite the following sources as most influential in their purchasing decisions.

1. Industry experts

- Professional colleagues/network

- Internal influencers

- Online reviews from peers

All of these sources share one thing in common. From a consumer standpoint, these are people like them, in similar functions or roles, who have made a similar decision and can share if their experience with your company has been positive or negative.

As a marketer or software seller, you can lean into this trend by finding community, championing advocates, and showing up where your customers want to engage with your brand.

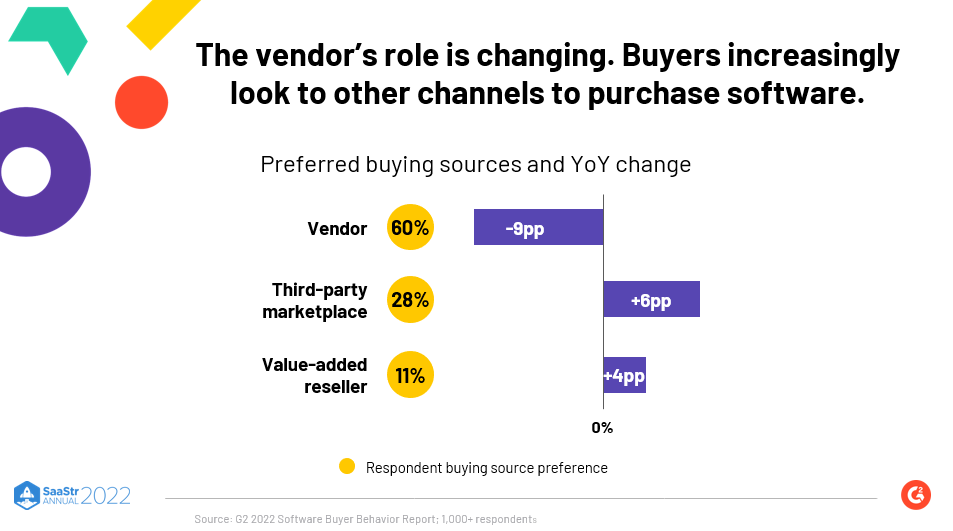

2. The rise of third-party buying

Software buying is increasingly moving beyond vendors. Previously, most buyers would make a purchase directly from the company. Not anymore.

- 60% prefer to buy from a vendor

- 28% purchase from a third-party marketplace

- 11% buy from value-added resellers

There is a 10-point percentage shift year over year, where people who previously preferred buying directly from the company now choose to buy from someone else. Some call this the ‘ecommercization of software,’ and this trend signals a highly disruptive shift in how we go to market with software.

Tackle.io’s 2021 state of cloud marketplaces report highlighted a similarly dramatic shift. In a 2020 survey, 22% purchased software through a cloud marketplace versus 60% in 2021. The role of AWS, Azure, and Google Cloud Marketplace is becoming increasingly important.

“45% of the 2021 Forbes’ Cloud 100 actively sell on at least one of the three main cloud marketplaces.”

3. The need for ease

Ease of software implementation & use is critical in driving purchasing decisions and faster ROI.

The three most important considerations when making a software purchase are:

1. Ease of implementation

- Seeing ROI in 6 months

- Ease of use

What each of these shares in common is a reflection of the immediate post-sales experience. Is this software easy to use? Is it easy to implement? Will I see value quickly?

This need for ease is even more true for enterprises. The cliche that enterprises have more money than time certainly plays out here.

“88% of enterprise buyers say that ease of software implementation is important or very important.”

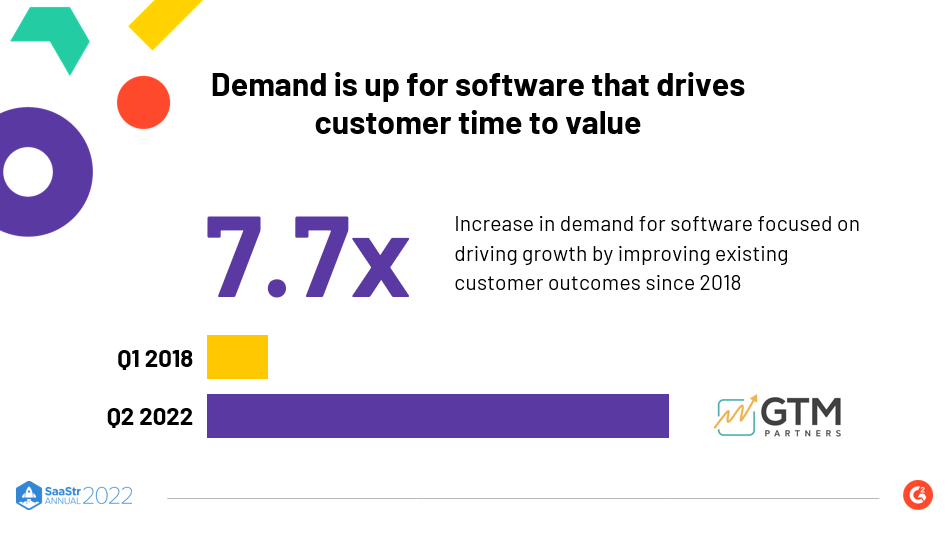

Go-to-market Partners released a report using G2 data. Their analysis was focused primarily on the growth of software categories in the go-to-market space. From the first quarter of 2018 to the last several years, there has been a nearly 8X increase in software helping companies drive existing customer outcomes. Categories like customer success, learning management platforms, and onboarding software are witnessing increased investments.

Demand is up for software that drives customer time to value

There is an increase in demand for software focused on driving growth by improving existing customer outcomes.

Salesforce is an excellent example of this. The company has launched a new product called Salesforce Easy that is marketed on the platform of ease — 3 clicks to sign up and easy self-serve onboarding. This results in reduced friction in buying and bringing forward what the post-sales experience will be like through their marketing efforts.

What do these themes mean for software sellers?

The current environment is challenging for many companies. The lesson at the moment is ‘Never waste a good crisis.’

The value of community expertise: Invest in advocacy and connecting customers with each other.

The rise of 3rd party buying: Ensure your product is represented well across all potential purchase points.

The need for ease: Eliminate friction post-sale and consider how to make your software self-serve.

Look at what you could be doing now to take advantage of the environment we are in and come out even stronger.

The post What to Know About the Software Buying Landscape in 2023: What’s Changed, What’s the Same, and What Your Buyers Want with G2 CMO Amanda Malko (Video) appeared first on SaaStr.

via https://www.aiupnow.com

Amelia Ibarra, Khareem Sudlow