So Dynatrace is a SaaS security leader that isn’t exactly low profile, but if you aren’t buying security software or in the space, you likely don’t know too much about it. Leaders like Crowdstrike and adjacent players from Datadog to Okta and more are higher profile.

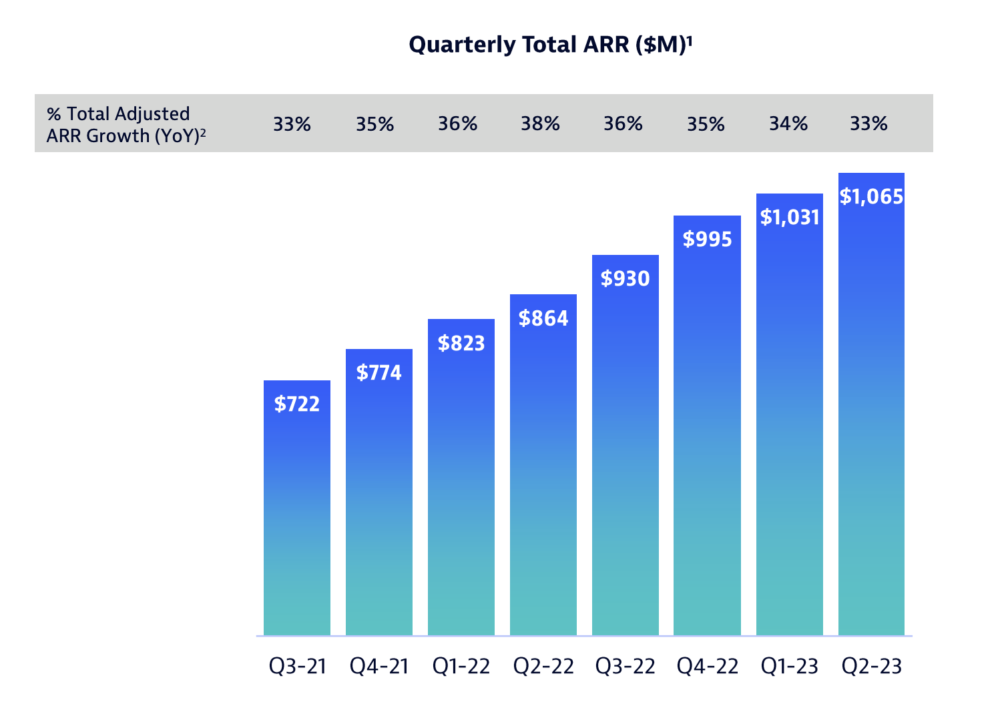

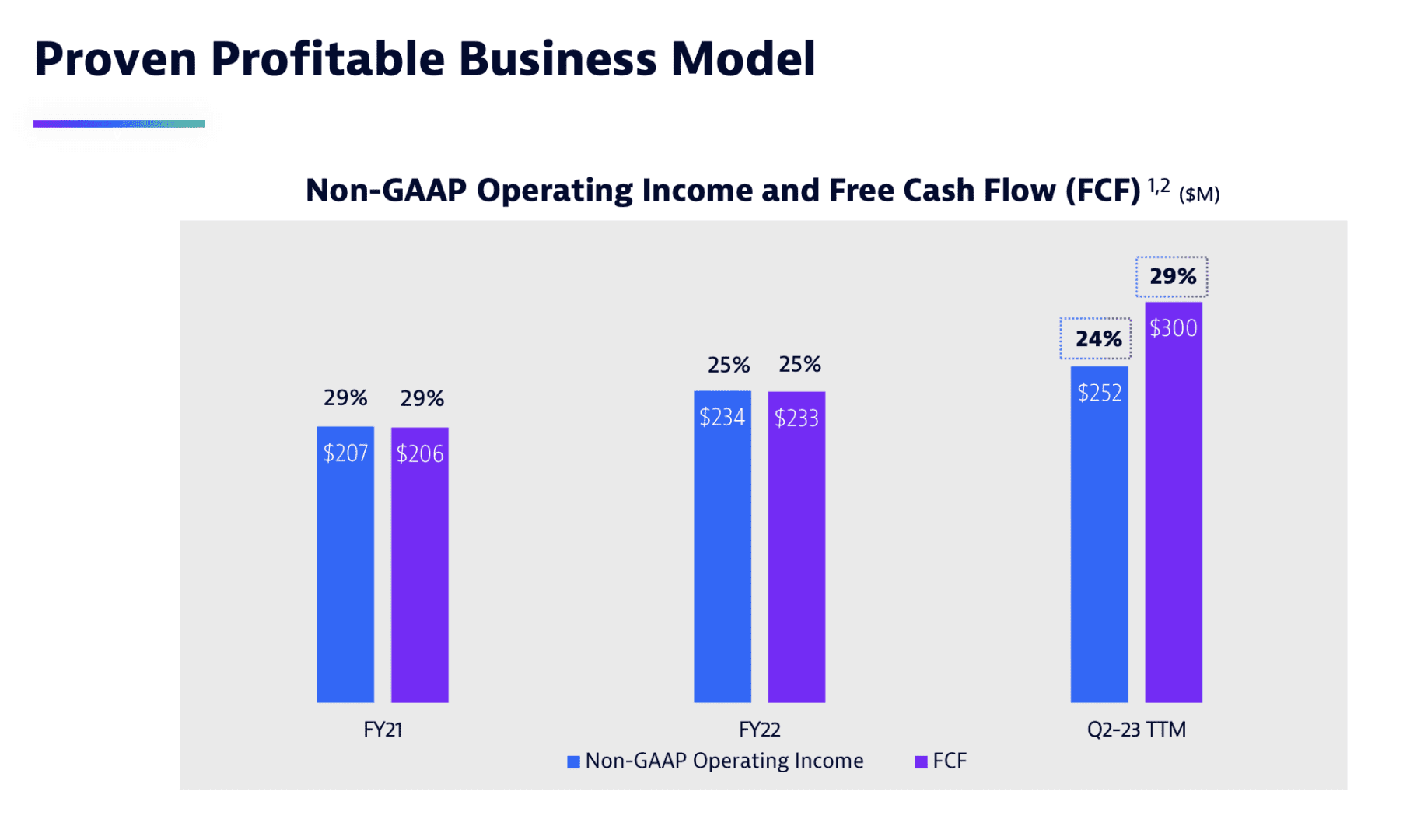

But it’s what’s in fashion today. Dynatrace was founded way back in 2005 and has been in the “steady growth” camp, now crossing $1B in ARR and a $10.5 Billion valuation, or 10x+ ARR even in today’s depressed valuations. Why? Cash. Dynatrace combines decent growth, growing a still very impressive 28% at $1B ARR (33% adjusted for current effects), with very profitable growth. 29% of that revenue falls to free-cash flow.

That’s what the markets want today. Profitable growth. Even if that means slightly slower growth.

5 Interesting Learnings:

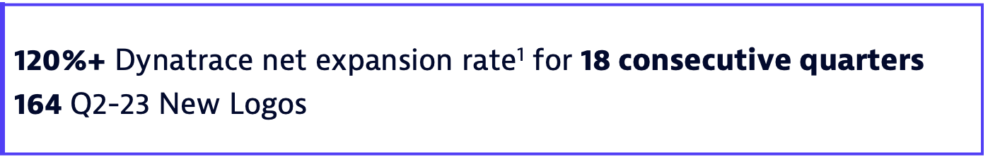

#1. 120% NRR for 4+ years. Dynatrace has had 120% NRR for 18 quarters. That in turn has fueled a stready stream of 25%-30%+ annual growth. Growing is never easy. But growing 30% at scale when you have 120%+ NRR … it’s a lot easier.

#2. Repeatable NRR Leads to Repeatable Growth. Another way to look at the prior point. 120% NRR on its own can’t fuel 300% growth in the early days. But it really, really helps with predictable growth at scale. Dynatraces 33% or so (net of currency effects) growth for the past 8+ quarters is fueled by 120% NRR. It basically creates half or more of that growth.

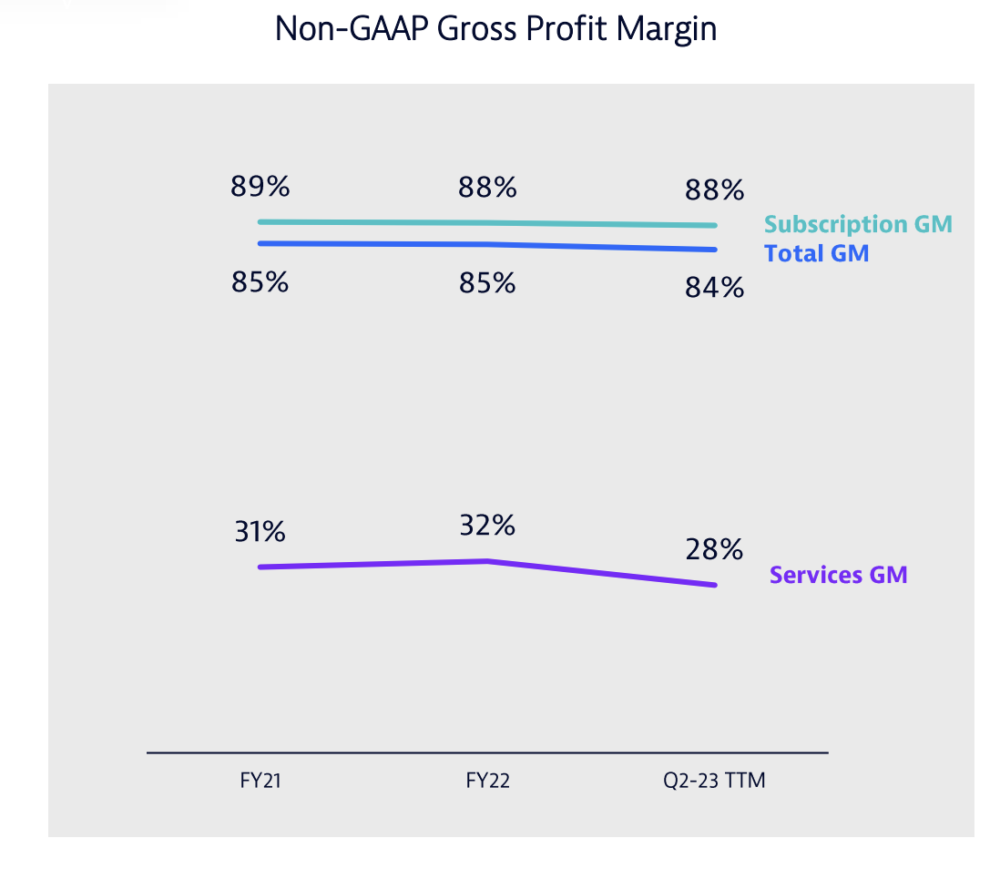

#3. Still has 28% margins on services. Different SaaS companies have different goals here in the enterprise. Some just hope to break even on services. Others like Veeva and Qualtrics insist on them being profitable. You can’t make software-like margins on services, but Dynatrace makes sure they still provide them profitably.

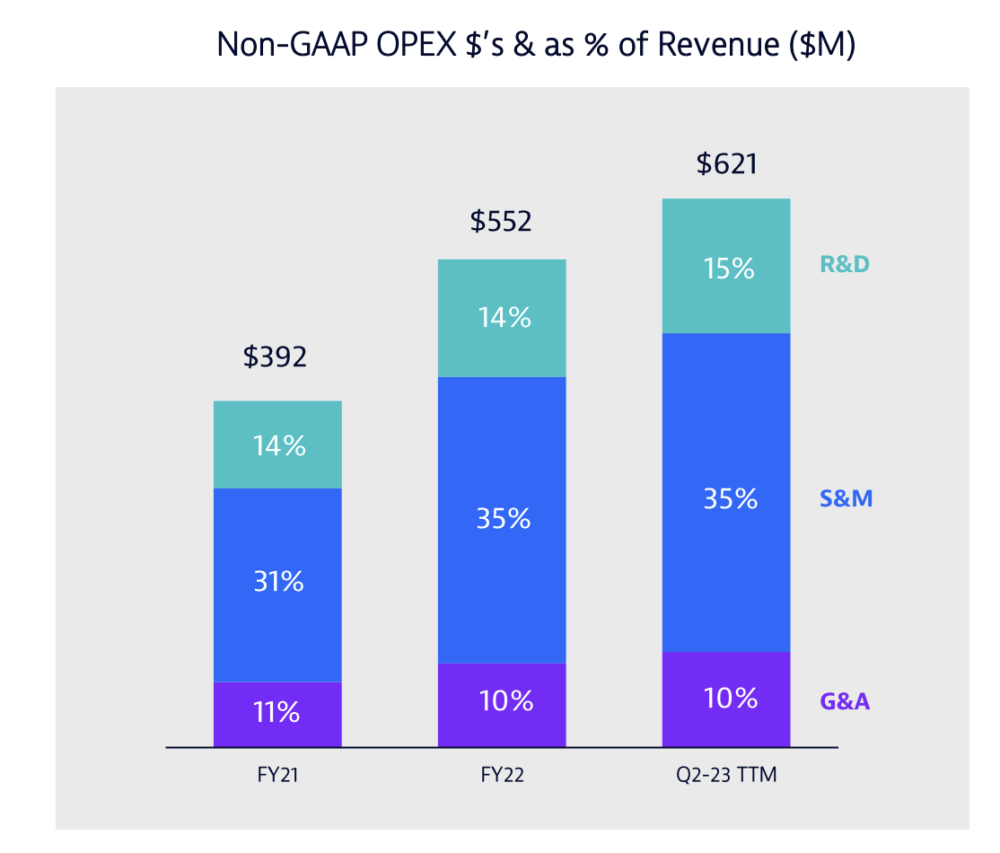

#4. Running lean, but not hyper lean, on both engineering and sales / marketing. To get that profitable. Dynatrace spends 35% of its revneue on Sales + Marketing versus the 50%+ of SaaS leaders that are less profitable, and 15% of R&D instead of 25%. But that’s how you get profitable.

#5. Consistent 29% Free-Cash Flow Margins. That’s the end goal state for software, to eventually get to 25%-30% at scale.

The post 5 Interesting Learnings from Dynatrace at $1 Billion+ in ARR appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow