So this was a Truly Terrible, Very Bad, Just Plain Awful year for SaaS IPOs — and IPOs in general. The IPO window is closed. Shut, mostly. In fact, IPOs had their biggest slump since 2008:

IPO listing volume is down a stunning 93%(!) since 2021. Last year, it seemed like everyone at $100m+ ARR could IPO. Today, it looks like almost no one will. At least, not. for a while. The downstream effects on venture capital and more are still to come.

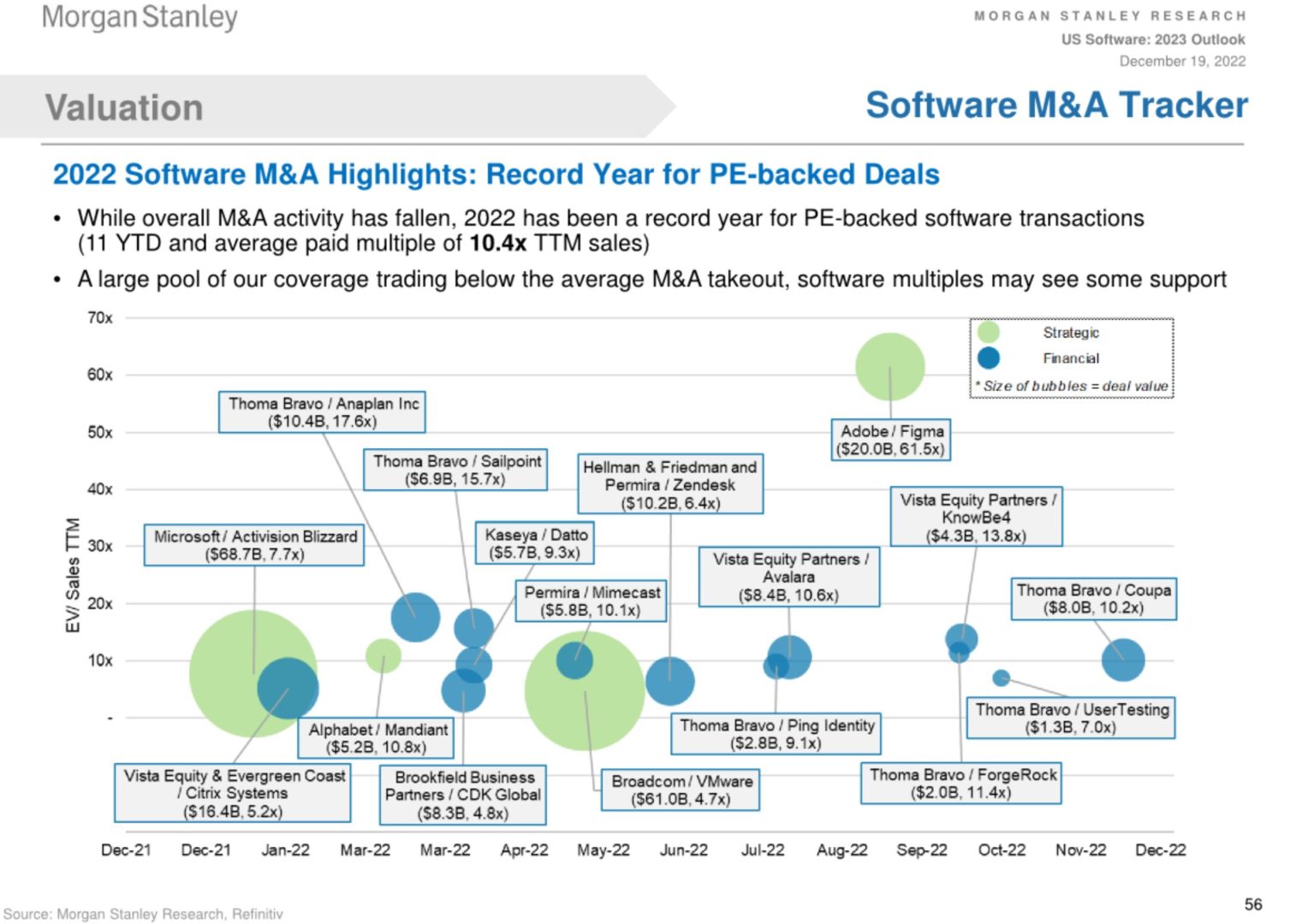

And yet … acquisitions still had a pretty darn good year. Not like 2021 Good, but pretty darn good. Because in large part, Private Equity firms like Vista, Thoma Bravo and more saw bargains in today’s beating down multiples. In fact, per Morgan Stanely, 2022 was a record for Private Equity-backed software transactions:

Add in the fact that every year there is at least one Figma-type deal, when fear trumps all else … and 2022 wasn’t quite as bad as it looked.

Bargain hunters still came out. And they paid 10x+ TTM sales for these deals.

It could be worse. The IPO market is shut, but liquidity is still out there for the best properties. And with Thoma Bravo alone raising $32B more in December, there will be plenty more big acquisitions to come.

A related post here:

The post 2022: A Cr*p Year for SaaS IPOs. But a Pretty Good Year for M&A. appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow