Raising capital is hard. It’s even harder in a recessionary environment simply because funding options are limited. Contributing factors for why it isn’t easy to get funding include:

- Not being able to articulate the customer value propositions

- Lack of clear leadership

- Inexperienced team

- Growing too slowly

- Lack of market knowledge

- Not having a scalable business model

Many of the world’s most successful startups once struggled to raise capital. Regardless of your current situation, what can you, as a founder, do differently when securing funding?

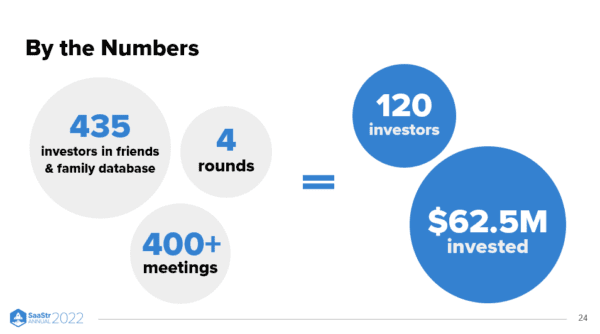

David Karandish, CEO and Founder of Capacity, remembers what it was like to raise funds for his startup and describes how he secured $62 million without giving away chunks of the business.

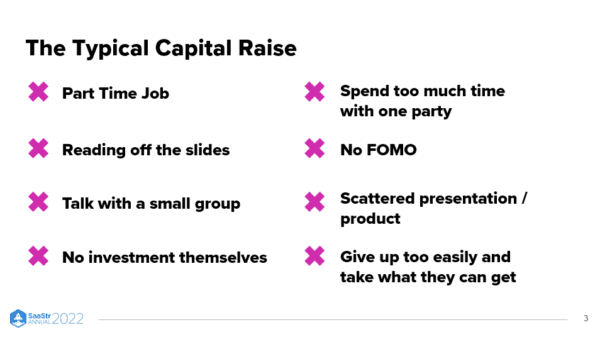

What does the typical capital raise look like?

Capital raising is rarely anyone’s full-time job. Often, founders are busy setting up systems and procedures, identifying new opportunities for revenue growth, evaluating new technologies, and making critical operational decisions. It’s difficult for founders to give the effort and attention that successful capital-raising requires.

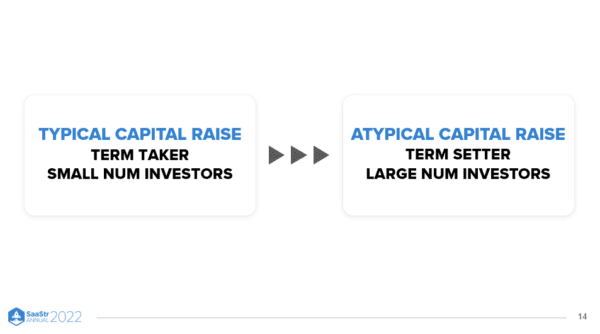

Founders will begin by talking to investors—15 or 20 potential funders aren’t enough. Speak with as many investors as possible to increase your reach and probability. It’s essential to talk about your business in such a way that creates FOMO around it to help increase the demand of interested investors. Many founders fail to leverage the existing fear into a powerful funding asset and generate FOMO.

What should new founders do while raising capital?

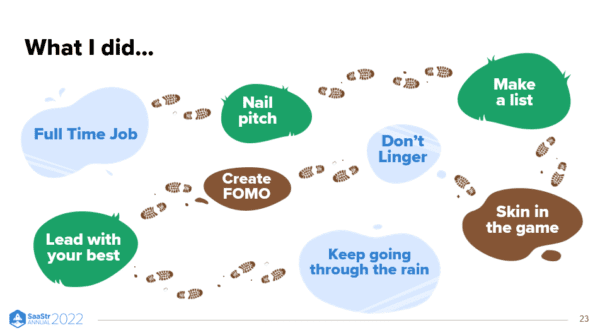

1. Make it your full-time job

Raising capital demands an investment of time, energy, and resources. Founders must start researching potential investors, putting together a pitch deck, crunching their numbers, and contacting their shortlisted investors. This signals that it’s time for you to get to work in a full-time capacity.

2. Perfect your investor pitch

When you get an opportunity to pitch to an investor, make sure you adequately prepare. Work on your pitch repeatedly, refining it and perfecting it to build a strong first impression. Investors are giving out money, but you need to prove that your idea is a sustainable and worthy investment. Every pitch you make is an opportunity to improve your pitch deck presentation and the way you pitch.

“Make your presentation shorter, connect with emotion, and tell a compelling story when pitching investors.”

3. Make a list

Prepare a list of whom you’ll talk with or pitch to. You may have an initial list of people to talk to, yet you should also speak with secondary connections. Search for people around you who are well-connected or who know investors who may be interested in your business. No matter which type of investor you’re going after, this will help you get the most out of the fundraising process.

4. Have skin in the game

The easiest way to finance a new business is to invest your personal savings, which comes with risks. But, by doing so, you show the investors that you are also fully invested in the business. If you can afford it, consider investing personal money in each round.

5. Eliminate disinterested investors

Many entrepreneurs spend a lot of time with investors who will never invest in their businesses. To respect your own time and the investor’s time, have the confidence to tell your potential investor that this isn’t something for them and move on. This confidence will paradoxically raise more interest in the eyes of many investors.

6. Create FOMO

Focus on the value you deliver. Give the investors the feeling that they’re missing out if they don’t get involved now. Creating such a scarcity effect won’t go unnoticed, and the investors will appear to be in the front of the queue. Remember, creating FOMO works best when you do it early on.

7. Lead with your best

The time has arrived, and you need to show investors what your product does. First, make your demo as best as it can be. Think about the most efficient way to distill down what your product does and highlight its core strengths.

“Organize yourself and be prepared to demonstrate the working product that your business is built around. Prove that it’s more than just an idea—it solves a big enough problem.”

8. Keep going

We may be in uncertain times with unstable microeconomic conditions, but founders and entrepreneurs shouldn’t give up on trying to fund their big ideas. Some business models are more resilient to an economic downturn than others. Capital raising isn’t a pointless exercise during a recession. After all, some of the biggest companies were founded during recessions—think Microsoft, Airbnb, and Instagram.

Key takeaways

Capacity spoke with 435 potential investors in their capital-raising journey, securing $62.5 million from 120 investors. For every ten meetings they had, seven did not result in funding. To play the long game, take these strategies from Capacity’s capital-raising playbook:

- Making capital raising your full-time job will make a difference.

- Practice your pitch and outline the problem with a story.

- Create a list of primary and secondary sources you’d like to pitch to.

- Consider self-financing options if you have the funds available.

- Understand that some investors are not suitable for you.

- Create FOMO to increase your chances of investment success.

- Know how to walk the investors through your product and show them the features that make your solution more competitive.

- Have confidence that raising money during an economic downturn is still possible.

The post How I Raised $62m Without Giving Up a Single Vote with Capacity Founder & CEO David Karandish (Video) appeared first on SaaStr.

via https://www.aiupnow.com

Amelia Ibarra, Khareem Sudlow