There are so many metrics out there these days on how public SaaS companies are doing. Versus last week, last month, etc. etc, So many metric sometimes it’s a little hard to get a handle on what they all mean.

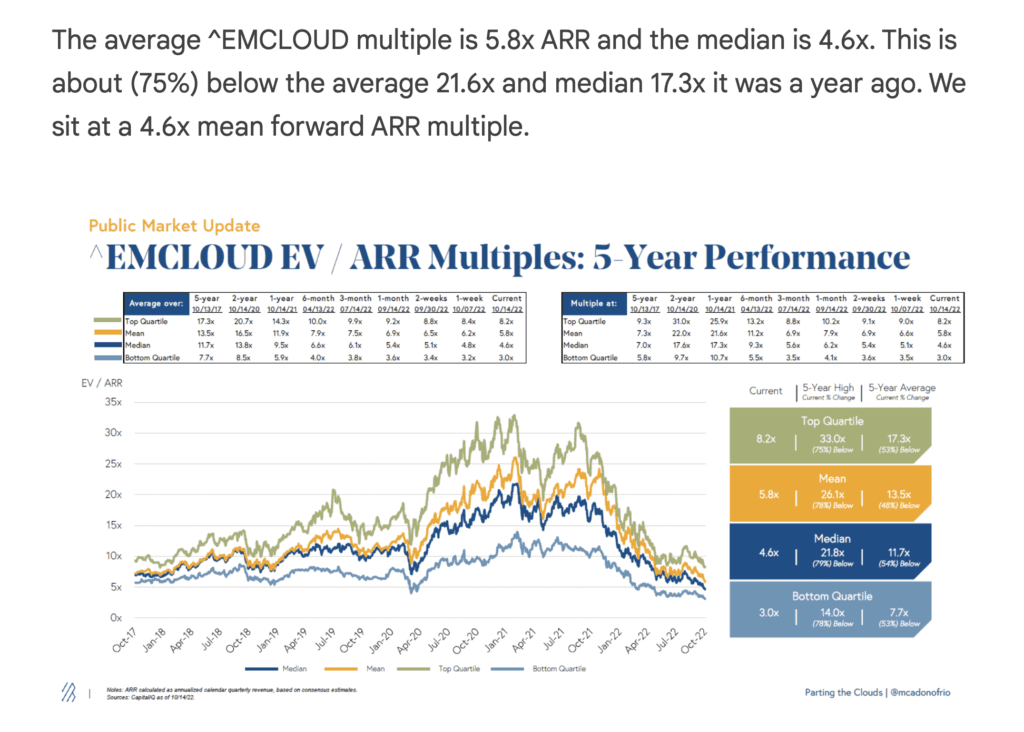

The latest Bessemer Parting the Cloud summarized it all I think with one helpful metric: SaaS multiples are down 75% from a year ago.

That means each dollar of ARR is valued at just a bit more than 25% of what it was a year ago.

This really summarizes it all in one metric. A dollar of SaaS revenue is worth about a quarter of what it was a year ago. What does this mean? A few thoughts:

- All things being equal, if your startup doubled in the past year, it’s now worth half of what it was. Are you sure you’re worth what you were in the last round? Just ask your existing investors. They’ll know, or at least have an informed opinion.

- Most unicorns are probably not unicorns anymore. Even if they doubled, it’s not enough to get back to a $1B valuation. They would have had to have quadrupled.

- Late-stage valuations are down 75% from a year ago. So late-stage deals have just frozen up. We are seeing this, even if seed valuations are all over the place. This is why it’s so, so much harder to get a Series C / D / E round done.

- Figma aside, it’s a lot harder to get acquired for a high price. Most of your potential acquirer’s share prices have also fallen 40%-50%. Yes, the best have all grown like a weed. But they can’t keep up with multiple compression.

- It’s still one of the worst time to raise a Series B or later round in many years. Be cognizant of this.

- IPOs have come to a halt not because SaaS companies can’t go public. but because they hate the multiples. No one wants to go public at $200m ARR and only be worth $1B. Especially if the last round was at $2B.

- SaaS is growing like a weed, but multiples have now hit an almost all-time low. It’s the Covid Hangover. Multiples are even lower than they were pre-Covid — at least for now. I’m not sure these low multiples will last, but for now, they are real and here.

These are still close to the Best of Times in SaaS for revenue, for growth. But they are close to the worse of times for revenue multiples. As founders, you have to be aware. Multiples will go up and down over your 7-10+ year journey. But you do need to know where they are at any given time.

And right now, SaaS multiples are off 75% from 1 year ago. That’s tremendous change.

The post SaaS Multiples Are Down 75% From a Year Ago appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow