Let’s all be clear, 2021 was insane:

* SPACs worth billions with no revenue

* Multiples magically tripled

* Fintechs with 10% GMs worth same as 80% GMs

* #5 in market got same premium as #1

* Growth stage seen as free money

* Seed VCs bought in $3B-10B rounds vs sell— Jason

Be Kind

Lemkin (@jasonlk) September 28, 2022

There’s so much chatter on what’s going on in venture these days — and there should be. The industry has been turned on its head, as we went from private 100x ARR deals in 2021 to public SaaS companies trading at 5x ARR on average in 2H’22 and with multiples at all-time lows for the past 6 years. That’s massive change.

This week in enterprise software: Top 10 #SaaS #Cloud multiples as of today's market close. The median multiple fell below 5x at market close for the first time since 2016 (when it briefly fell below 5x) pic.twitter.com/QZ605lMswz

— Jamin Ball (@jaminball) October 14, 2022

And with it, the venture markets have clearly slowed down. Parts of the growth market have almost shut down completely. The IPO window is effectively closed. Not literally, but no one seems willing to IPO at today’s prices.

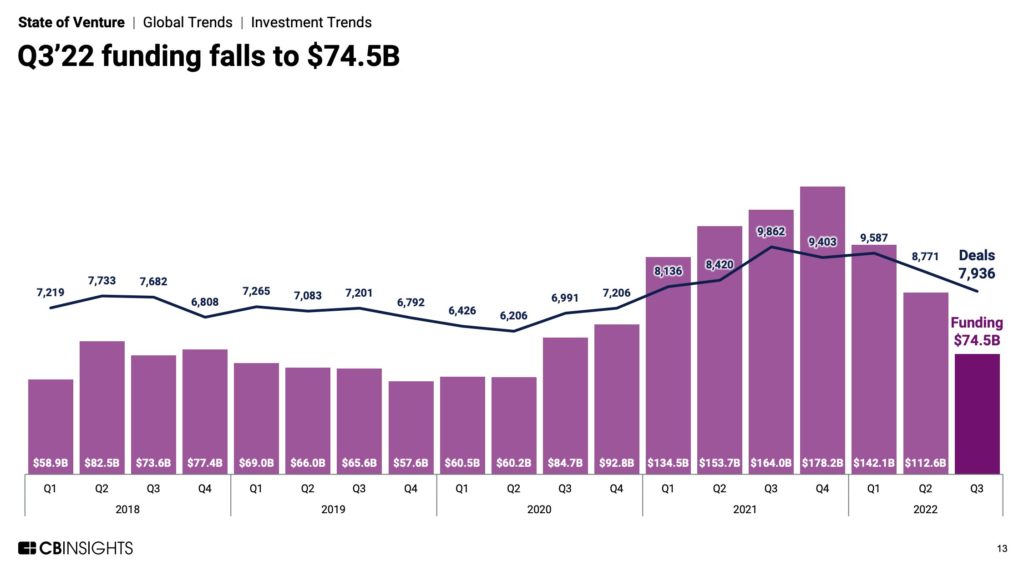

But let’s step back a bit … where are we really? I really like the latest CB Insights data because we can use it to simplify a lot of complexity in the markets:

First, yes venture has truly plummeted. Funding by dollars has fallen a stunning 54% per CB Insights, and deals are down 19.5%. This makes sense. With unicorn rounds almost nonexistent, the biggest rounds are in most cases on hold. Smaller seed rounds though are still happening, even if valuations may be down.

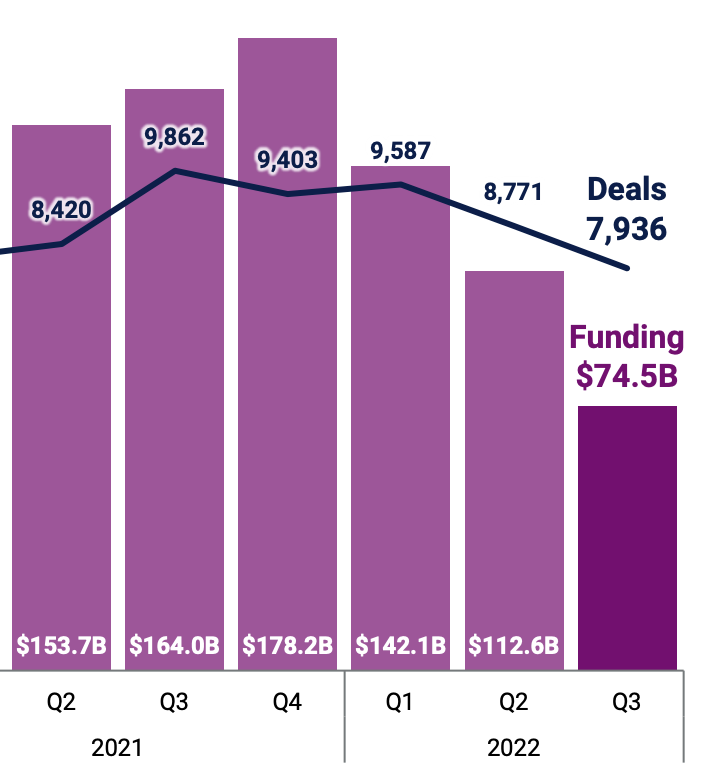

You can see that fast and steep drop-off from the Q4’21 peak here:

It looks particularly dramatic when you zoom into just late 2021 and 2022:

But second, really, in many ways it seems like we’re just back to 2018-early 2020 in venture. Back to before the Covid Crazies in venture. Let’s look at 2018-2020. Things in venture were actually kind of … consistent for the whole 2018-pre lockdown period. A consistent number of deals, with a consistent amount of capital. Seen this way, late 2020 and 2021 were really just an anomaly:

This whole pre-Covid period looks flat

Seems like we are just back there again pic.twitter.com/NRLeKt4PMf

— Jason

Be Kind

Lemkin (@jasonlk) October 14, 2022

Are we just right back where we were in venture before the pandemic? Maybe, more or less. Yes, inflation and interest rates are crazy, for now, and we have some recession risks, even with almost record low unemployment. And yes, there are many hot startups that raised at crazy valuations that are stuck and can’t raise again. But in SaaS, we may be back to the future. Where $1B exits are hard, $3B IPOs are hard, and decacorns are a rare breed indeed. And where venture in SaaS is strong, but not on insane overdrive like in 2H’20-early Q1’22. That just makes sense. We may just be back, more or less, to where we would have been without Covid.

I miss 2021 pic.twitter.com/QQjd7P7Kw0

— Jason

Be Kind

Lemkin (@jasonlk) October 7, 2022

SaaS is growing nicely, with good tailwinds, and the best are growing faster than ever. But back to a time where SaaS revenue multiples are on average around 10x for good startups and 5x for public companies, on average.

That seems to be the world we live in again.

_____

The full CB Insights report and great thread here:

10/ I'll dig into Q3'22 data a bit more in a bit, but for those interested in all of the graphs/data from above, feel free to grab the 262 page State of Venture by @CBinsights

The M&A activity in tech has also cooled as you'll see (no surprise) https://t.co/yxSCwwBL3s

— Anand Sanwal (@asanwal) October 14, 2022

The post CB Insights: Yes, Venture is Down. But Really, It Just Seems to Be Back To Where It Was Before The Covid Boom. appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow