So we’ve followed PagerDuty a lot at SaaStr over the years. At first, because it was one of the early DevOps tools that both broke out and that lots of folks in tech had heard about. Later, as we were lucky to have CEO Jennifer Tejada be a top-rated speaker at a number of our events.

And then, post-IPO, it became a fascinating case study.

A case study of a SaaS company that IPO’d and crossed $125m ARR being very SMB-focused, but then later became very enterprise-focused. At $250m, enterprise was the big push. And now, at $360m ARR, it’s the core. Big customers, buying more and more, is the fuel for PagerDuty’s growth today.

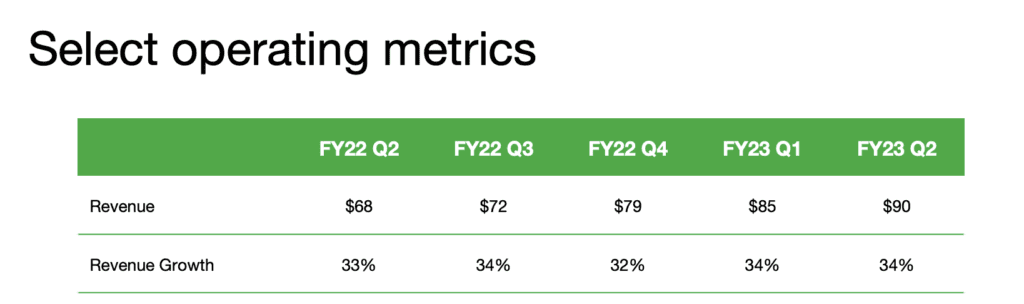

And because of it, it’s been able to maintain consistent 33%-34% growth for quarter after quarter. In fact, growth has accelerated as they’ve gone upmarket. At $250m in ARR, they were growing 28%. Today, they’re growing 34% a year. While that’s off the torrid 49% a year pace at IPO, it’s pretty darn impressive to go from 28% growth at $250m ARR to 34% at $360m in ARR.

5 Interesting Learnings:

#1. Very consistent growth of 33%-34% for 6+ quarters. No deceleration for PagerDuty! In fact, as noted above, they punched it up after $250m in ARR and just kept the higher growth going. Even though growth actually became more efficient (see #3 below).

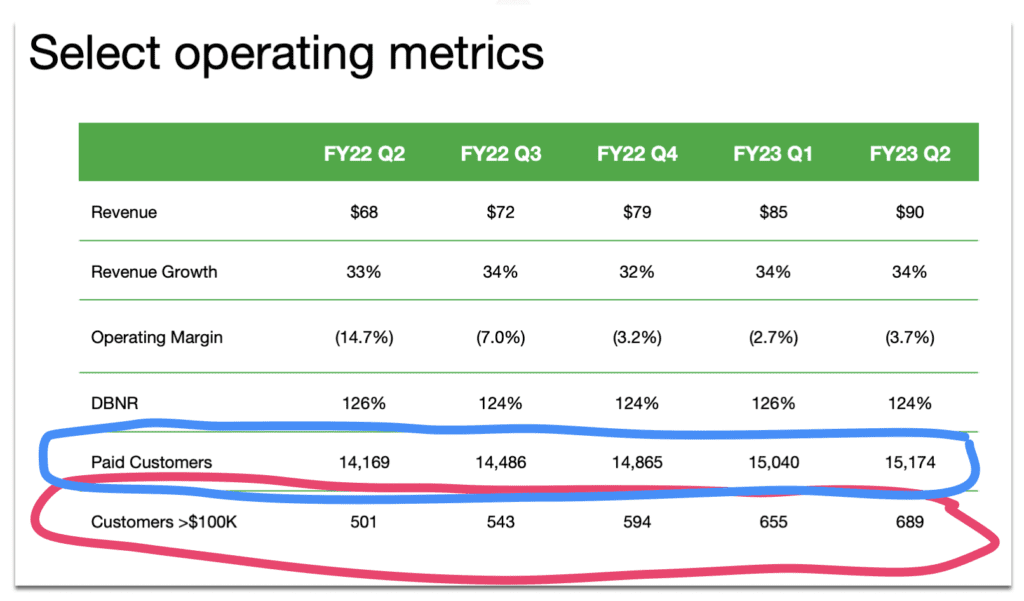

#2. 5% YoY customer growth + bigger deals + 124% NRR … fuels 34% annual growth. Ok this is fascinating. PagerDuty isn’t adding a ton of new smaller customers, but it’s added 140+ $100k+ customers this past year. That, combined with top tier NRR, is enough to fuel 34% growth. Even if logo growth is fairly modest.

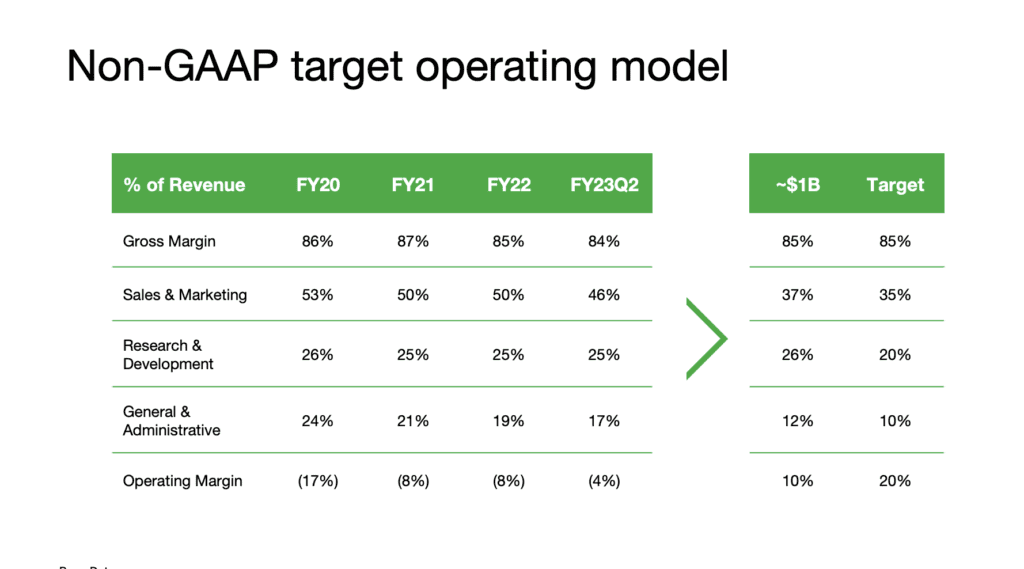

#3. On a steady path to positive operating margins and profitability. Wall Street doesn’t expect top SaaS companies at $360m in ARR to be profitable yet. But they do expect them to be on the path to get there. You can see Sales & Marketing expense has dropped from 53% of revenue to 46%, and operating margins have improved from -17% to -4%. Importantly, you can see the clear goal shared with every SaaS company to have a profitable, efficient business at $1B ARR. PagerDuty sets that out clearly:

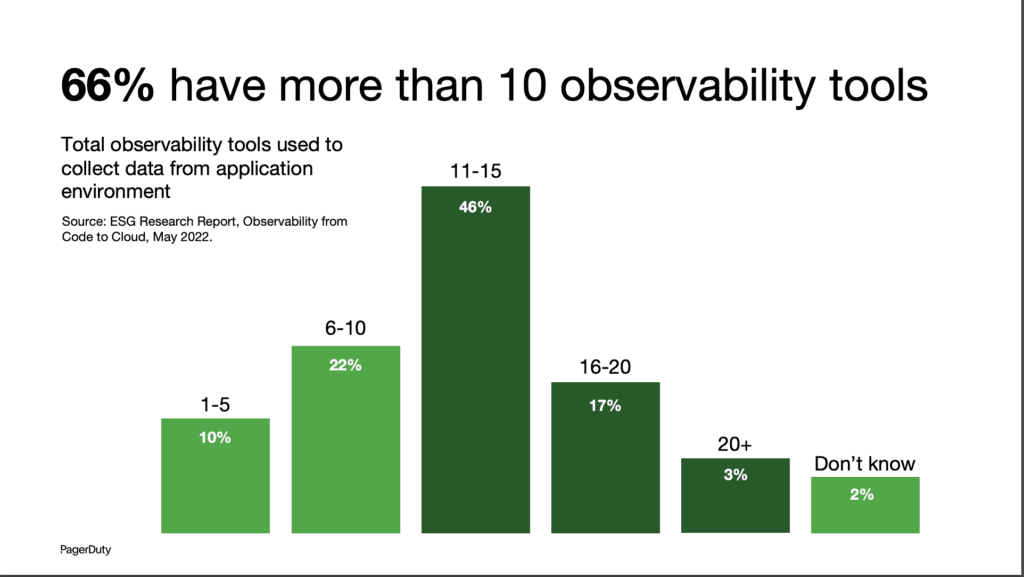

#4. We all use a lot of SaaS tools now. The average PagerDuty customer uses more than 10 observability tools! A reminder of how multi-product and multi-vendor we all have become.

#5. International Revenue consistent at 23% of revenue. This hasn’t changed much over time, but again a reminder most SaaS companies without legal or other reasons to “stay local” should aim for at least 20%-25% of their revenues to be outside of North America.

Wow, PagerDuty!

Pretty amazing and consistent execution at $360m ARR. Steady and consistent solid growth at 33%-34%. A clear path to a profitable, strong business at $1B in ARR.

And yet, in today’s world, even amazing execution isn’t always perfectly rewarded. This is the tough part of 2022. PagerDuty’s market cap at the moment is stuck at $2 Billion. That’s just plain too low. And a challenge to everyone. SaaS itself remains on a tear. The buyers are there, the momentum remains so, so strong. But the public multiples are brutal today.

That just puts tough pressure on everyone. Pressure that just wasn’t there back in the go-go days of 2021.

And an amazing session on how PagerDuty does it from CEO Jennifer Tejada here:

The post 5 Interesting Learnings from PagerDuty at $360,000,000 in ARR appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow