So in theory, SMB SaaS is better than enterprise, at least 9 times out of 10:

- Deals close much faster

- Customers don’t expect as much in terms of security, compliance, etc.

- Customers often can deploy on their own

- There is often just 1 stakeholder to sell to

- Often can avoid procurement, RFPs, and so many other headaches

- Customers don’t expect you to build a feature before they buy

- Don’t need as much sales experience

- Often easier to get started here with less capital and/or if bootstrapped

- Force you often to build a better product, as they lack a deployment team

- Etc. etc. etc.

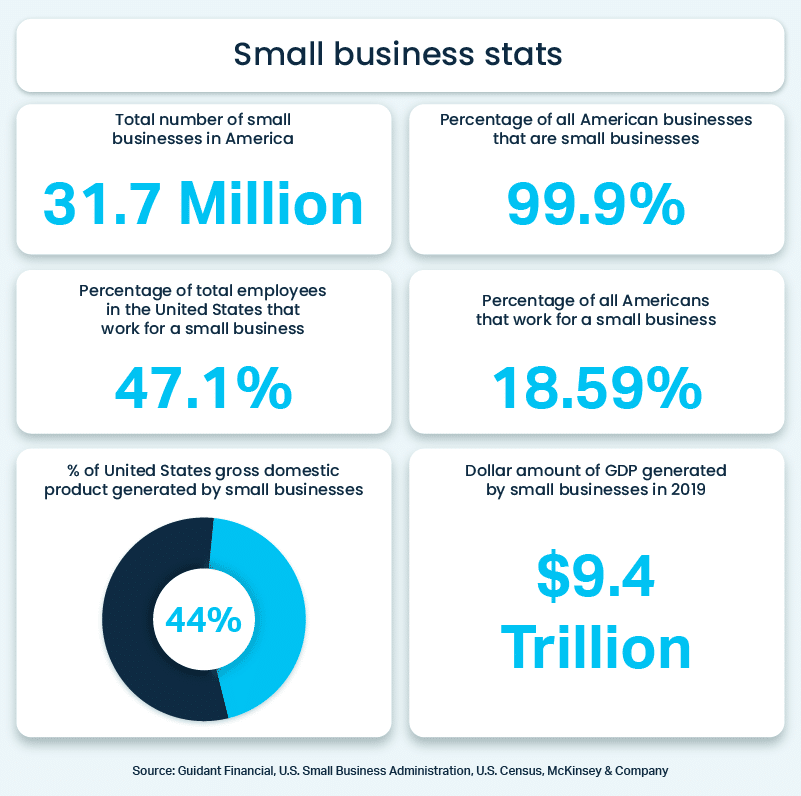

And importantly, there are just so, so many SMBs. 30,000,000+ of them. Or maybe it’s 15,000,000. Different counts are out there, but however many it is — it’s a lot.

But beyond all the other Pros and Cons of SMB vs enterprise, there’s one looming issue with SMB SaaS:

Churn.

Endemic churn. The type of churn you almost can’t do anything about. Why?

- SMBs go out of business, and quickly. Enterprises take decades to go under.

- SMBs pay monthly, and often scrutinize every expense

- SMB owners often literally pay out of their own pocket, or feel that way

- SMBs don’t really budget for much, so if the business goes down, software purchases often go down very quickly too

Net net, most true SMB SaaS products often churn on the order of 3% per month almost no matter what you do. Almost. And we’ll get to that in a moment.

Now that makes things hard enough as you scale, but even worse, in SaaS, churn is often masked by high growth when you have early product-market fit. For example, if you are growing 13% a month in the early days, and churn is 3% a month … you’re still growing 10% a month. That can look mighty impressive. And it is.

But then what happens when you merely double new bookings, which is hard enough as it is — and churn remains 3% a month? Well, all of a sudden you’re adding 6% a month (doubling) but losing 3% … and your growth is cut in half to 50%.

I see this again and again with fast-growing SaaS companies selling to SMBs and they know it, but they don’t chance enough, or fast enough, and get caught in a Churn Trap once growth slows from top-tier rates.

Ok so what’s to do here? A few thoughts — and then let’s look at some case studies from Bill.com, Shopify, Smartsheet, and more.

In general:

- Be honest about your churn and report it monthly and honestly. If you hide it or bury it in overall MRR growth numbers, it won’t get addressed. It will burn you somewhere between $5m-$20m ARR if you are growing quickly. Because at some point, growth slows to 100% year-over-year even at the best SaaS companies. And then 3% a month churn cuts your growth in half.

- Be relentless about building features that increase retention. Even modest impacts to churn for SMBs can have a huge impact on your business. What features are so valuable that customers don’t just buy — but they stay? I don’t see enough SaaS SMB company relentlessly talking about the impact of new features on retention. And measuring it.

- Get better at onboarding. A lot of churn lurks in poor onboarding. This gets addressed in the enterprise with high levels of staffing. But it rarely gets enough attention with SMBs.

- Learn the true churn rate for your competition — and challenge the team to beat it. No matter what, you can do better than the direct competition. Find out. Go ask.

So in the end, you have to find a way with SMBs to at least drive to 100% NRR, and ideally, higher. The best have found a way. Even if it was often much higher in the earlier days.

A few things the best in SMB SaaS have done well to get NRR up above 100%, and churn down:

#1. Bill.com added payments late, but went deep here and saw NRR shoot up to 110% and then 121%! More in my convo with CEO Rene Lacerte here and on SaaStr here.

#2. Smartsheet, Zendesk and More Went Slowly Upmarket. Even just a bit can help a lot with NRR. Today, Zendesk’s big push is $1m deals. But it didn’t start that way. It started very SMB. But even going a bit upmarket can drive NRR well above 100%. Asana has about 100% NRR from SMBs (still impresive), but this grows to 140% for its $5k+ customers.

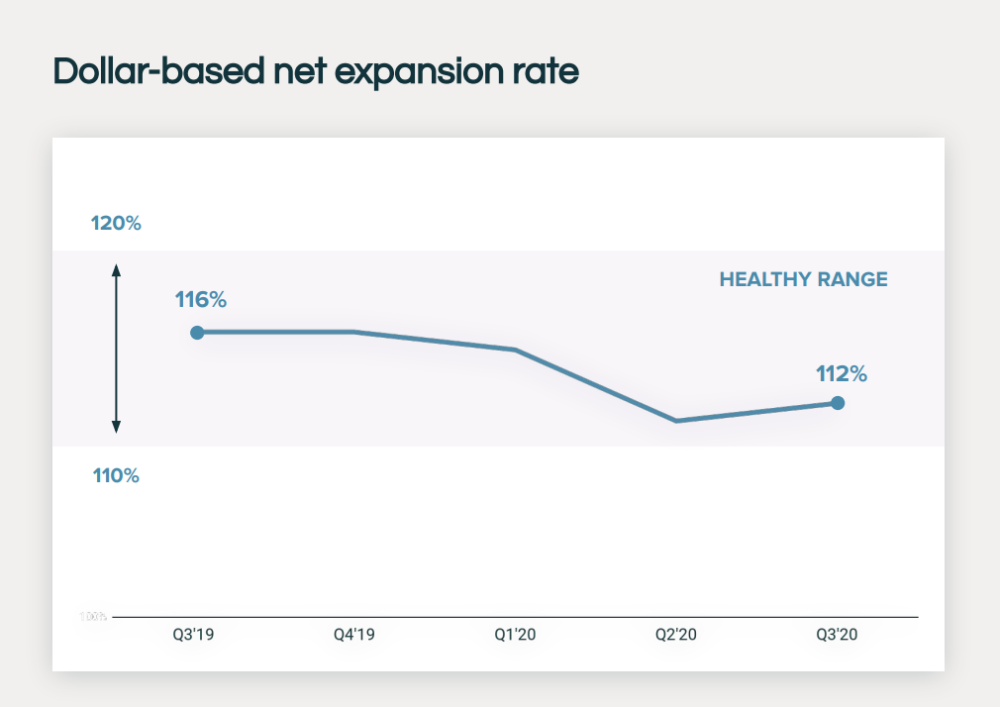

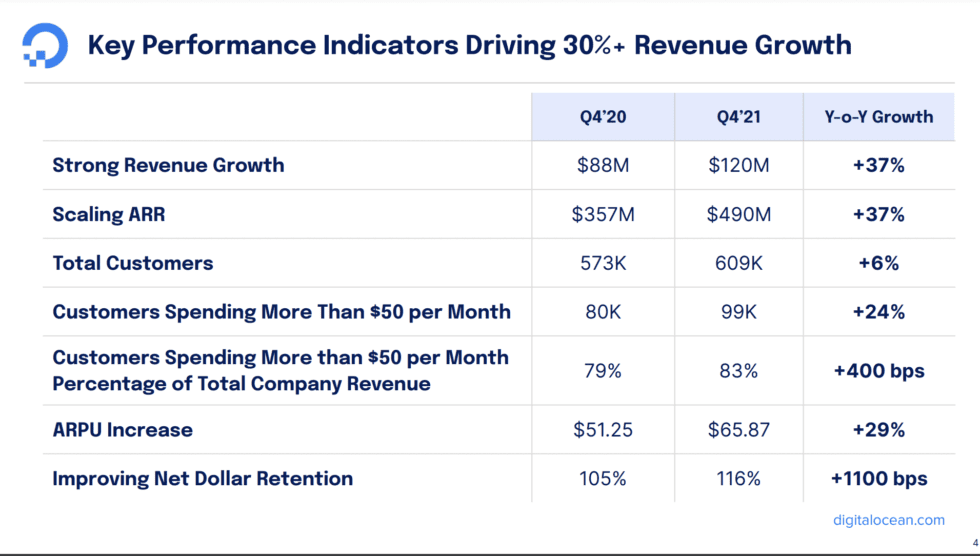

#3. Digital Ocean went from 100% NRR to 116% NRR from SMBs in just 2 years by focusing on customers that could pay just a bit more ($50/month) — but got a lot more value. This isn’t going enterprise. It’s just focusing on SMBs that value the product the most.

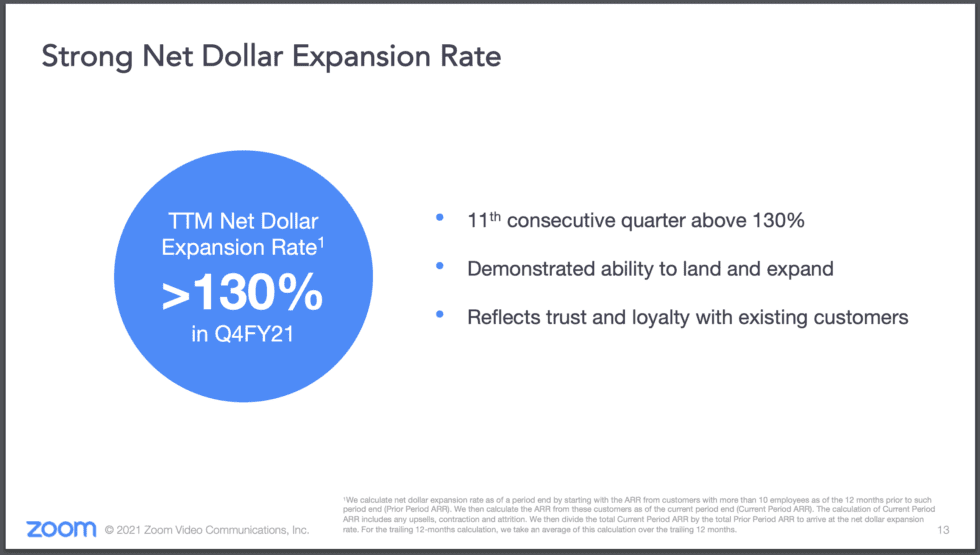

#4. Maybe don’t even charge some SMBs at all, like Zoom did. Zoom’s SMB growth finally slowed, but not until $3.5 billion in ARR. It had insane SMB NRR of 130%+ until then. Part of the key was making the Free version so good, they didn’t have to deal with churn from users who wouldn’t really benefit from the Paid version. See, also, Slack.

More here:

The post The Challenge with SMB SaaS: High Growth Can Only Mask High Churn For Just So Long appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow