So more of our 5 Interesting Learnings series has been on the iconic SaaS companies we all know. From how Asana got to its first $250m in ARR, to how Slack got to $1B ARR, to how Zoom got to $3.5B ARR, and more.

But there are a bunch of quieter SaaS and B2B public companies under the radar. Some are under the radar because they are niche. But others are under the radar because they are just slower growing and smaller. One is Model N.

Model N was founded waaay back in 1999 (!) as a contract management solution for life sciences, and its built modules and more features on top of that, into a true revenue management solution. Today it’s valued at almost $1 Billion, at $200m in revenue growing … 11%. A very long and slow burn to a billion dollar market cap.

But one we can learn from

5 Interesting Learnings:

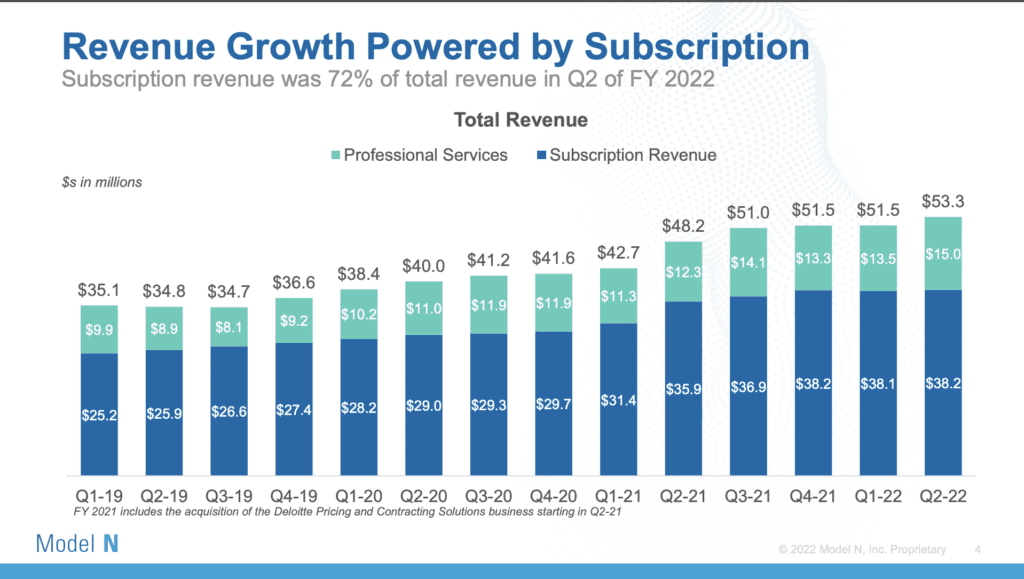

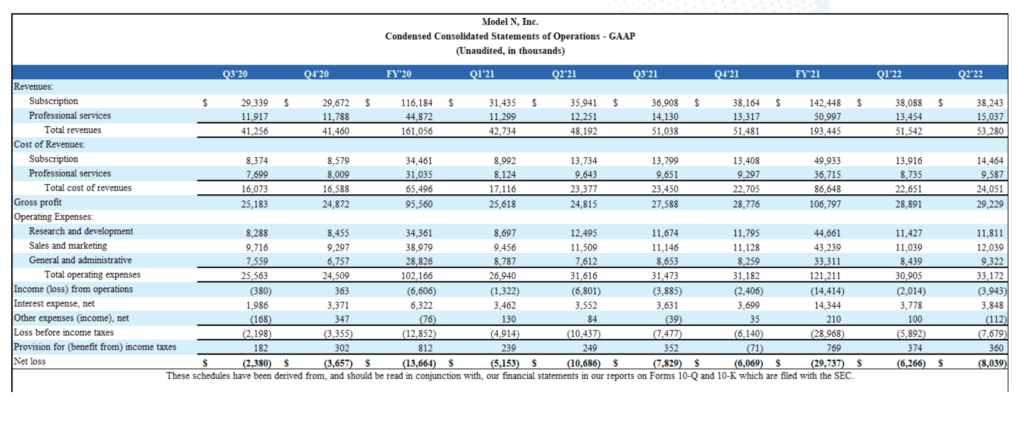

#1. 28% of Revenues from Professional Services — Dragging Down Gross Margins. Model N’s margins are dragged down by some of the highest ratio of professional services in SaaS. 28% of their revenues come from services. While they don’t lose money on them like Workday does, for example, the margins are still low at just 33%. That draggs overall gross margins down to just 55% — very low for a software company. But it’s up from 51% last year.

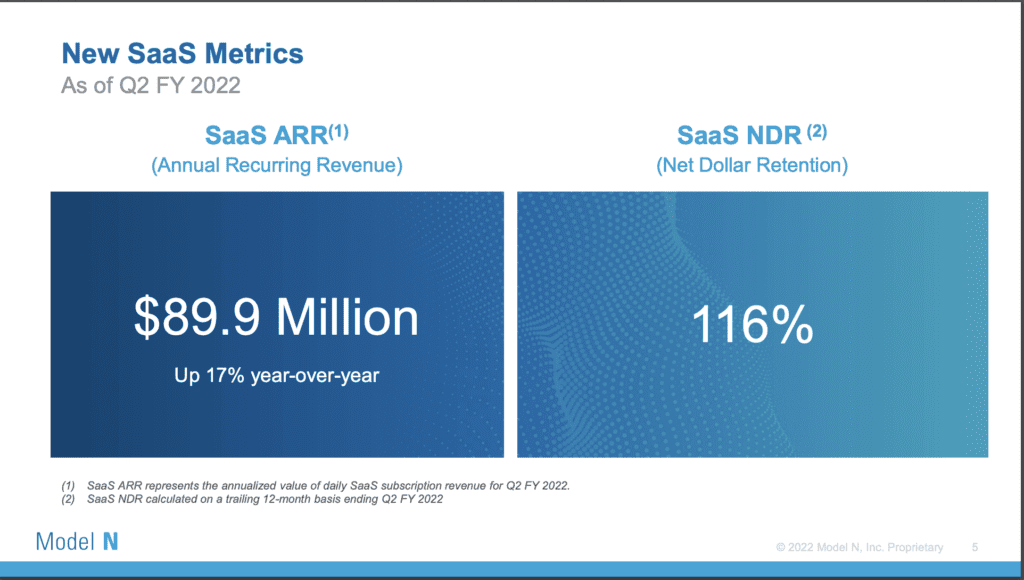

#2. NRR / NDR still high-ish at 116%, so almost all growth is from installed base. With NDR of 116% and growth of just 11% … well, almost all their revenue growth is from existing customers. Something to be wary of when you see slowing logo growth. But also a reminder of just how long enterprise customers really last in B2B and SaaS. Decades, often.

#3. Still not profitable after 23 years, but free-cash flow positive. OK a bit of a bummer this one. While Model N is worth close to $1B today, it’s still not profitable on a GAAP basis. It’s still losing $30m+ a year on a GAAP basis. But it is free cash flow positive, if not massive slow. It generated $18.5m in free-cash flow last year, or about 9%. The cash is coming, just not a lot of it, nor any true profits after 23 years. SaaS can be hard here.

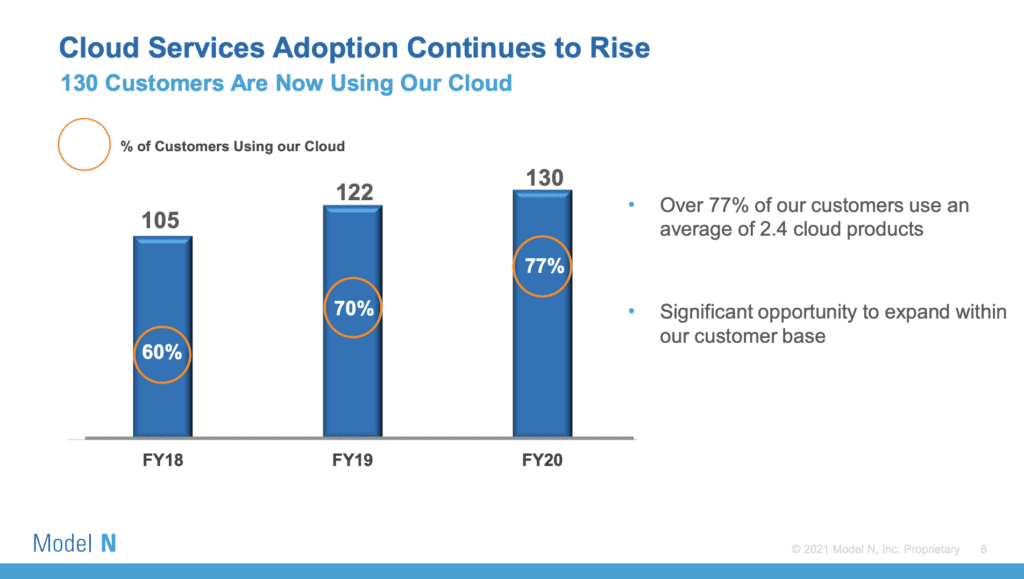

#4. A small, concentrated enterprise customer base paying ~$1m a year that has moved to the Cloud. Model N has about 200 customers after 23 years in business, and the majority (77%+) are now on their Cloud product. They each pay on average $1m or more, so that’s the power of going Enterprise. But also the risks of not expanding your niche. Veeva targeted a somewhat similar niche, but expanded its product suite and platform substantially. Veeva today is worth $30B.

#5. Most customers use 2-3 of their Cloud products. Another reminder of how important being multi-product usually is after $100m ARR or so.

I’ve met so many great people from Model N over the years, and it’s a testament to them never quitting, and the power of even decent NRR (110%+) in the enterprise. Their existing customers fuel most of their growth now at $200m ARR.

But it’s also a story that you want to ideally move more quickly than this. 23 years is a long path to $200m ARR and $1B in ARR.

The post 5 Interesting Learnings from Model N at $200,000,000 in ARR appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow