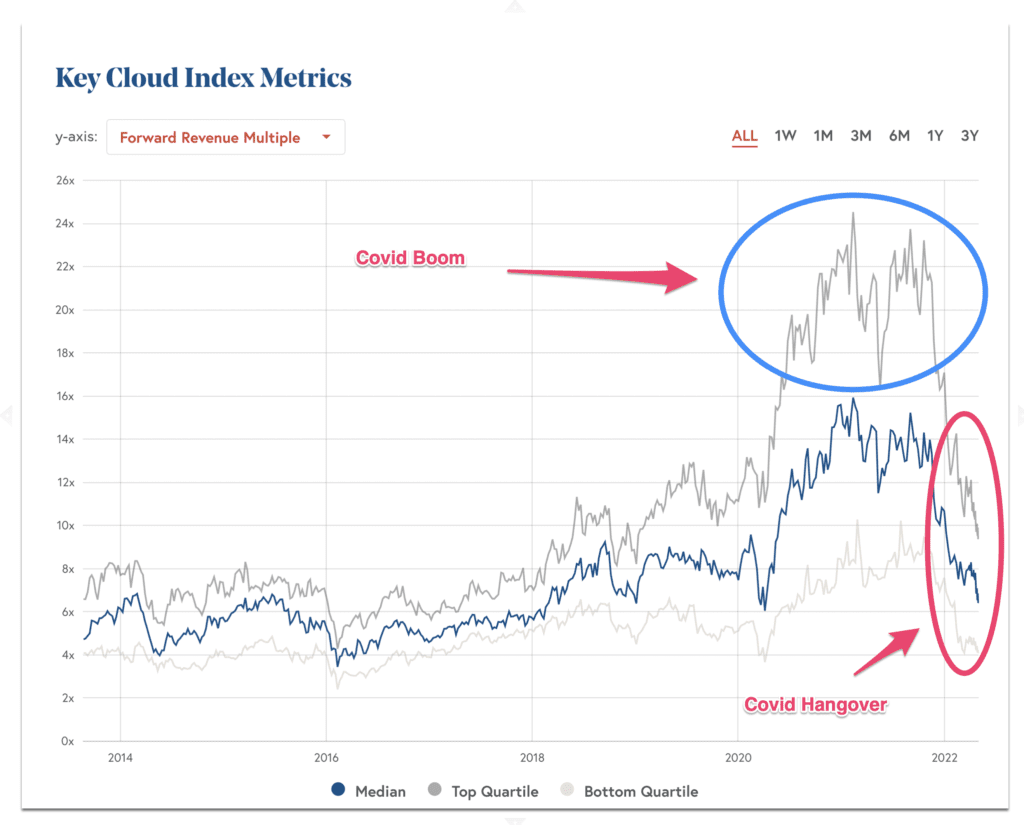

So the public markets are in tumult. Many SaaS and Cloud leaders are down more than 50% from their all-time highs. But Covid did create a lot of artificial demand for Cloud products, especially the lockdown phase. The boosts Zoom (can’t go to the office anymore), Shopify (can’t go to a store anymore) were real, but could never be sustained. It makes sense the “Covid Boost” is over, and that there would be a hangover. And indeed there is today! A Covid Hangover in SaaS stocks.’

It’s been a rough day – and 6 months – in public tech land.

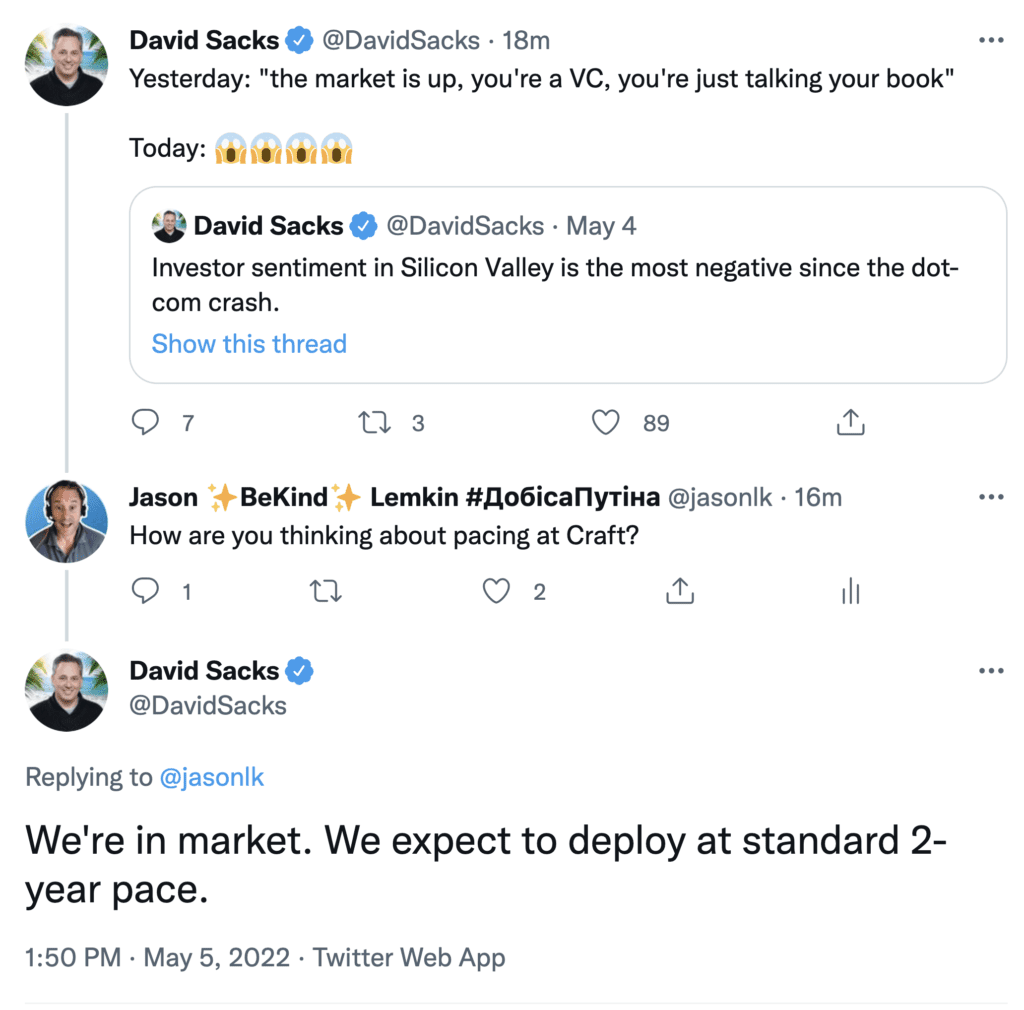

This is just starting to roll through the private markets and is going to make a bumpy rest of the year. Buckle up. pic.twitter.com/JNnzizB82v

— Byron Deeter (@bdeeter) May 5, 2022

But what matters most for founders? Ultimately — revenue multiples.

Update on cloud software multiples, charted alongside the 10Y and 5 year pre-covid NTM rev multiple average. On my index the current median, despite the massive correction, is only 5% below pre-covid long term averages. Lots more quality exists now, but still makes you think. pic.twitter.com/nTpARN30cC

— Jamin Ball (@jaminball) May 5, 2022

Revenue multiples are how much VCs, investors, and ultimately, an IPO and public markets will value each dollar of revenue. The reality is, the high multiples are, the easier it is to get funded, the more everyone’s shares are worth, and more. And the lower multiples are, the harder anything involving external financing matters. Revenue multiples don’t affect customers, or even revenue itself. But they are very important to just how hard the journey will be.

And what you can see here from the Bessemer Cloud index is that Forward Revenue Multiples are at their lowest in 3+ years:

And yet … even with a multiple crash since Peak Covid, times are still really good in SaaS. Customers are buying more than ever. Amazon AWS, Microsoft Azure and even Google Cloud are on fire, adding insane amounts of revenue this year. The top SaaS and Cloud leaders are even accelerating at $1B in ARR, for goodness sakes!! It’s not all tough news, folks.

So let’s take a look at 3 practical scenarios from here, just looking at past SaaS multiples (before the Covid Boom and Hangover), and thinking about how SaaS is growing faster than ever:

#1. The Bear Case: Multiples are still elevated compared to the pre-2018 period.. You can see a lot of VCs and others talking about this on Twitter. The point is that SaaS multiples are still higher than where they were from 2010-2017. So they can fall another 20%-30% just to revert back to that mean:

SaaS was already on a tear starting in 2018. It just went nuts during Peak Covid. The argument here is that SaaS even in 2018 was overvalued.

The Bears do have a lot of years of history on their side — all the years up to 2018. But I personally think this is just too pessimistic. SaaS companies are just so much bigger and better than even 4 years ago. And generating real cash flow at scale.

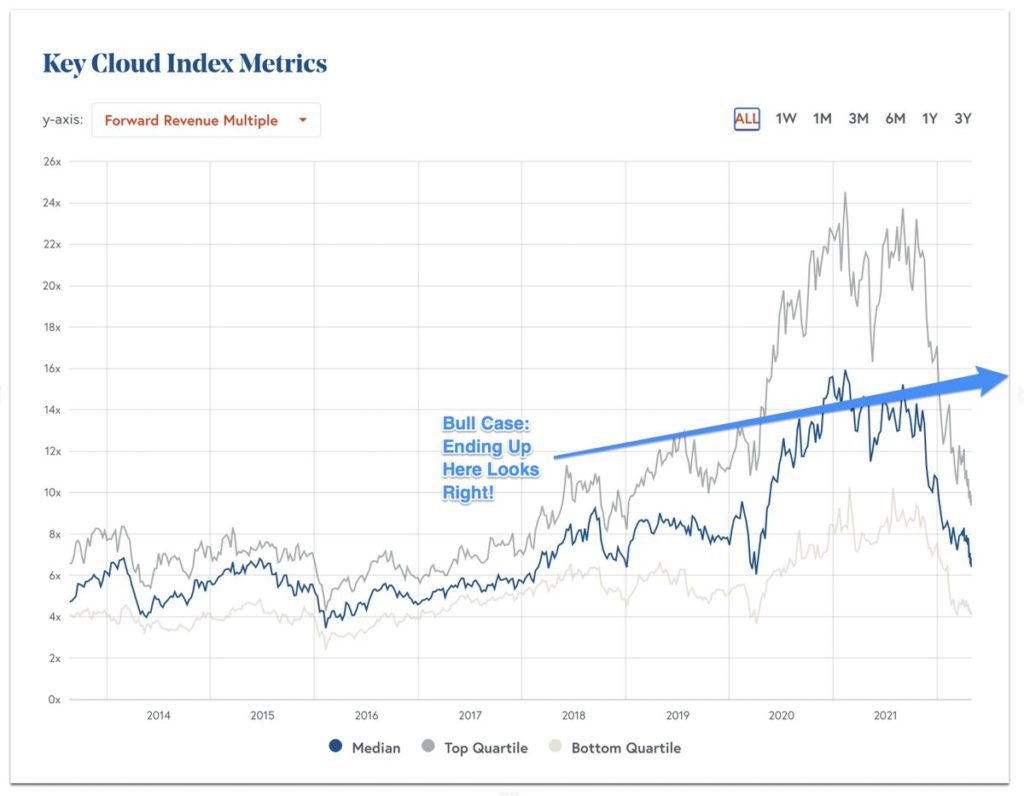

#2. The Bull Case: SaaS is growing faster than ever — absent the insane Covid boosts Zoom, Shopify, etc. saw during lockdown, we should still end up somewhere in the middle. With revenue multiples higher than pre-March 2020 but lower than the peak:

I don’t see too many folks arguing the Bull Case, but they should be. The Bull Case is fairly straightforward. SaaS companies are better and growing faster than ever before. So just ignore the Covid Boost and Hangover. Draw a straight line and assume multiples gradually expand at the same rate as they were growing from 2017-2019.

This does make a lot of sense. And what it says it times will bounce back pretty strong. Never quick what they were at the peak of Covid, at least not for a long time. But stronger than they were before in terms of multiples.

And this is exactly what is what it is happening at SaaS companies themselves. So personally, I think this is the most likely scenario. SaaS companies are just so much strong, faster growing, and enduring than before. And more profitable in many cases. That revenue multiples should rise from where they were in 2019. But I’m hardly sure this will happen in practice.

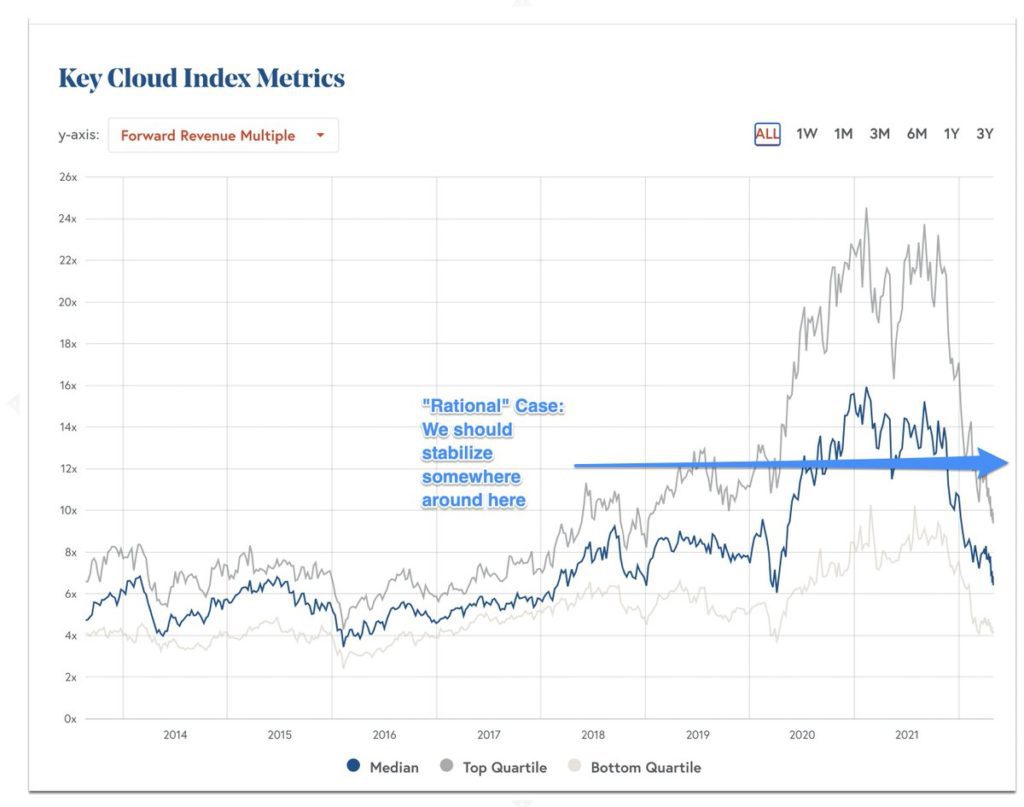

#3. The Rational-Positive Case: It’s hard to figure out multiples, but should at least bounce back to pre-Covid. The best in SaaS are just minting cash now, from ZoomInfo to Zoom. So it can’t all be about cash-flows It makes no sense for multiples to be lower than pre-Covid:

This is probably what you should use for planning IMHO. That Covid was an anomaly for so many things, including SaaS revenue multiples. And that we’ll settle back into where we were before all this. We’ll lower than that in terms of revenue multiples right now.

If you have 24+ months of cash runway, you don’t have to worry about all that much of this on a daily basis. But it has huge impacts of venture funding, IPO, M&A, etc. So you need to have a plan.

Just pick one of these 3 scenarios and plan around them for now. Calmly.

Personally, I’m betting on #2 (The Bull Case), planning using #3 (The Rational-Positive Case), and advising startups to extend the cash they do have at least another 6 months. In case #1 (The Bear Case) is right — and I’m wrong.

The post SaaS Multiples Are At a 3+ Year Low. Where It Goes From Here. appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow