We haven’t spent as much time on SaaS security companies in the 5 Interesting Learning series as perhaps we should have. We’ve dug deep on Okta at $1B in ARR, but spent a bit less time at apps that run below the application layer. But there’s so, so much growth there. And CrowdStrike is a break-out leader.

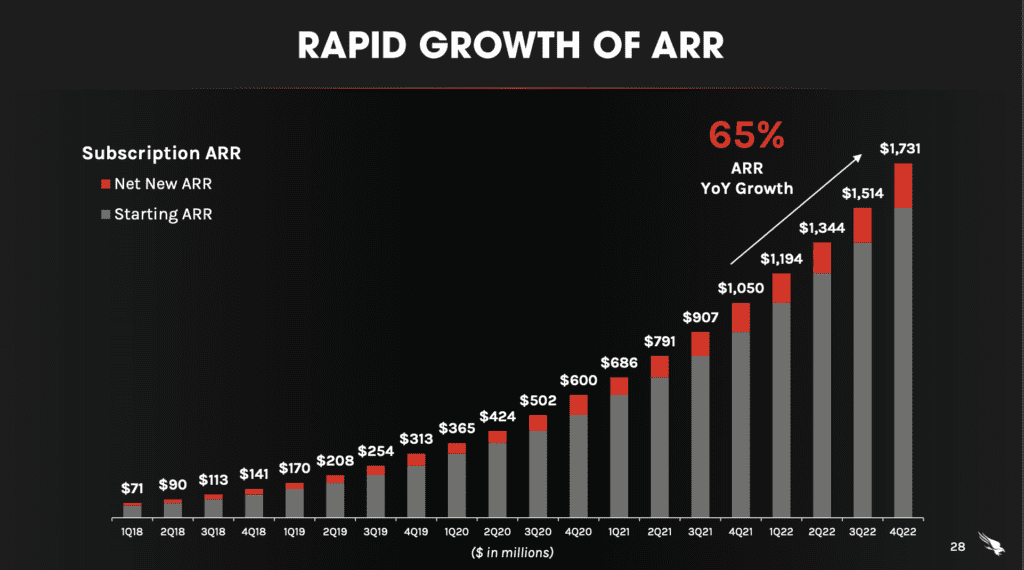

They’ve crossed $1.7 Billion in ARR growing a breathtaking 65% year-over-year.

5 Interesting Learnings:

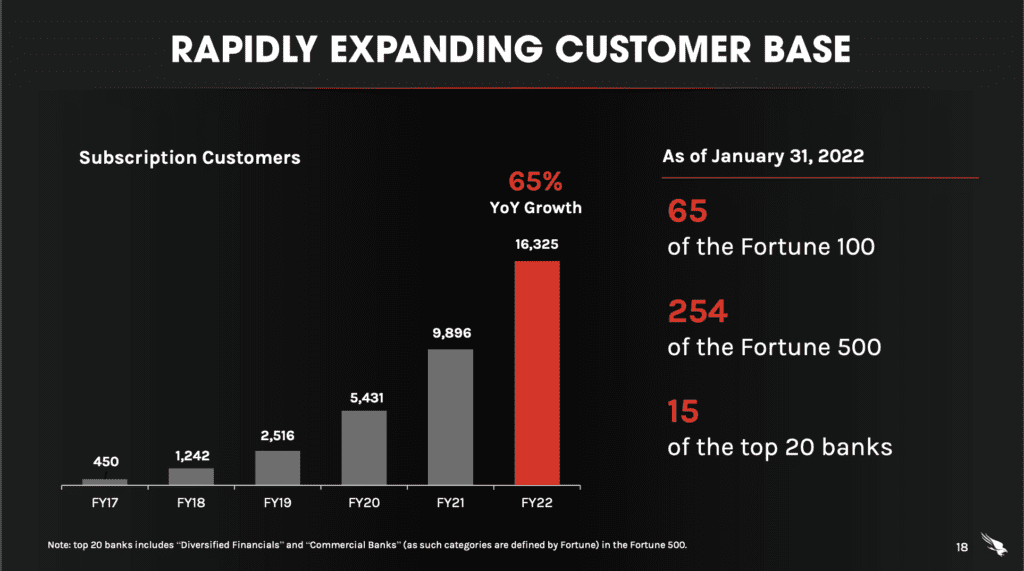

#1, 16,000 customers at an average of $100,000 per customer — with a mix of inside sales, field sales, and free trials. Pretty much the classic mix of going upmarket today. But going bigger is clearly the path to the most growth, with half the Fortune 500 being customers.

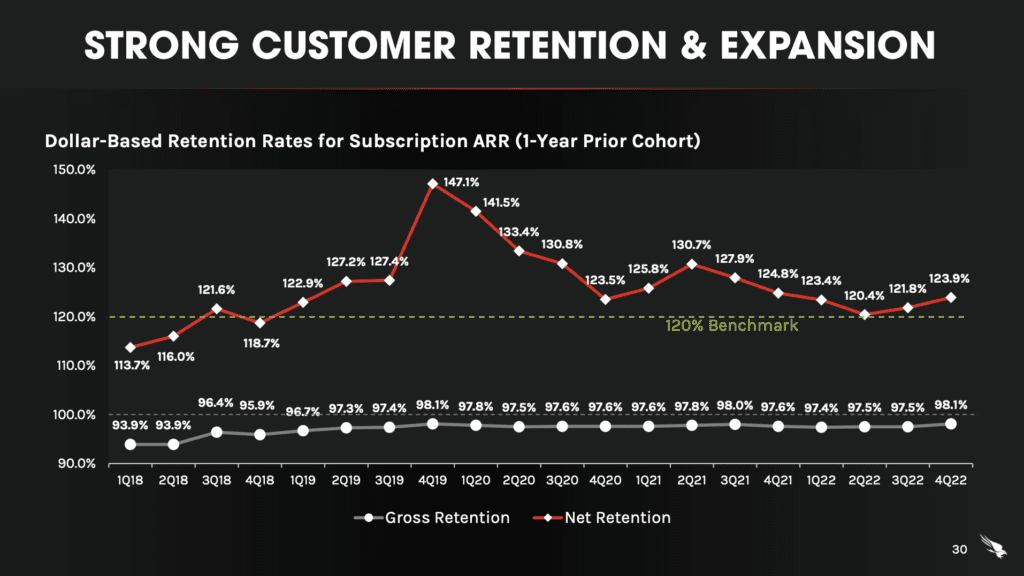

#2. Consistent NRR of 120%+. Again, another top Cloud leader that isn’t seeing any NRR decline at even $1B+ in ARR. A reminder high NRR really can last forever. This is the magic in enterprise SaaS and Cloud.

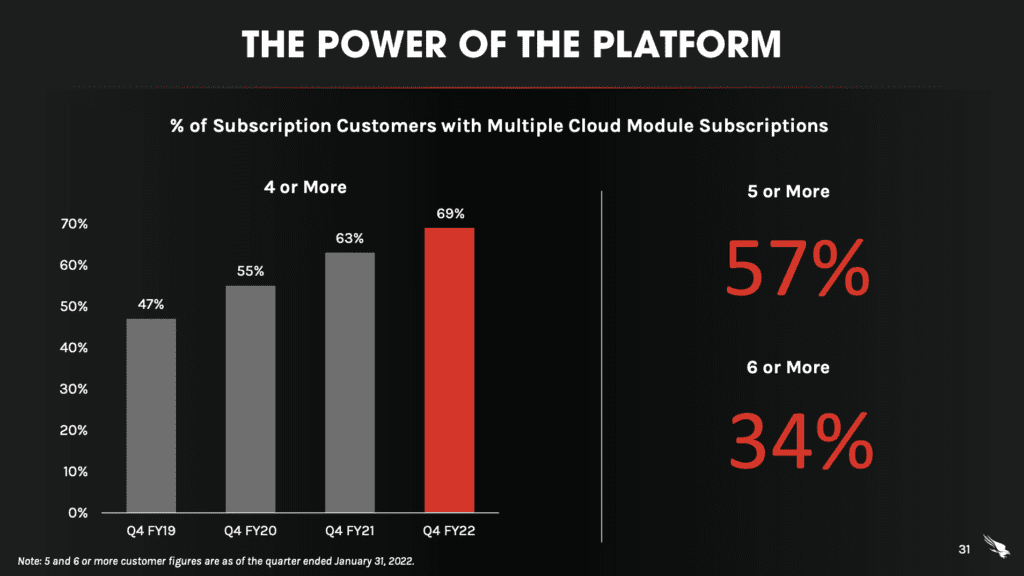

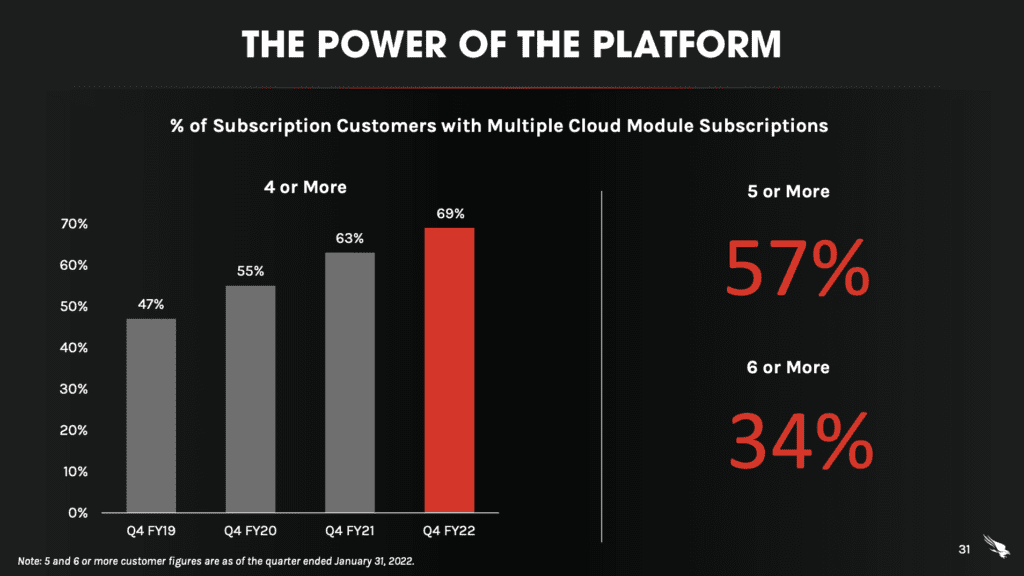

#3. Multi-product is the key to growth at scale. As we’ve seen so many times in this series, it’s hard to scale past $100m ARR or so with a single product line. At almost $2B in ARR, 57% of CrowdStrike customers buy 5 modules and 36% buy 6 or more.

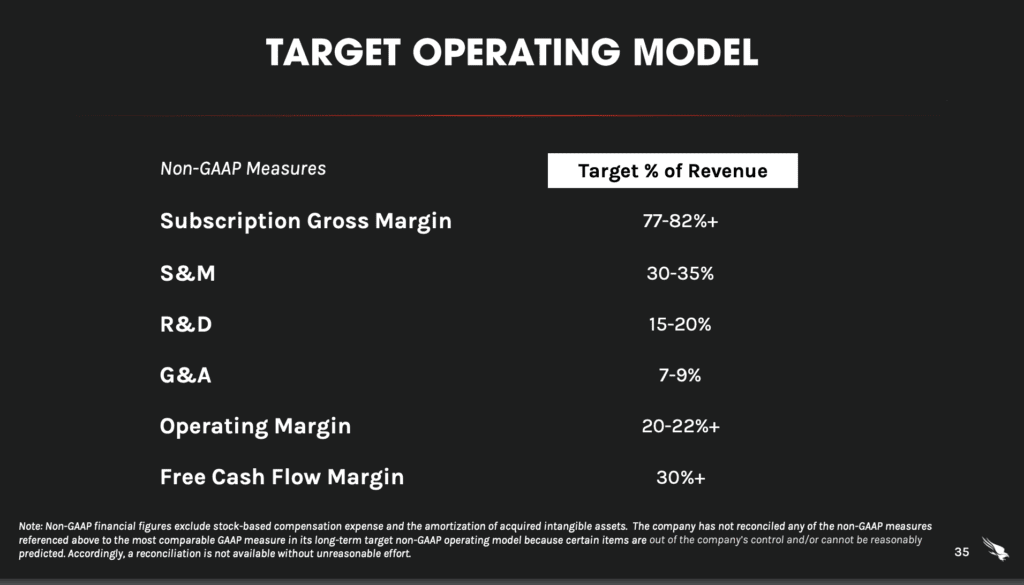

#4. Mediocre Gross Margins until the run-up to IPO, but then high margins (almost 80%) thereafter. We’ve seen this again and again, too, at everyone from Snowflake to Palantir with high COGS. Wall Street seems OK with low margins as you scale, so long as you see software-like Gross Margins (60%-80%) as you IPO.

#5. $600m in Free-Cash Flow on $1.7B in ARR. Yes, SaaS and Cloud can generate a ton of free cash-flow at scale. Their target is 30% free-cash flow.

And a few other interesting learnings:

#6. Professional Services only 8% of revenues, 27% gross margins on services. CrowdStrike does professional services, as most enterprise software companies do. But they are disciplined about it, making sure they don’t lose money on services (27% margin) and a relatively modest amount of total revenues (8%).

#7. Magic Number of 1.3. There’s no universal calculation for Magic Number, but it’s still very helpful to see public Cloud companies break it out. CrowdStrike has admirable sales & marketing efficiency. According to CrowdStrike, “Magic Number = Average of previous four quarters: ((Quarter Subscription Revenue – Prior Quarter Subscription Revenue) x 4) / Prior Quarter Non-GAAP Sales & Marketing Expense.”

Wow! What an incredible story. It’s as great as ever at CrowdStrike. As it gets ready to cross $2B in ARR. The Cloud is just so, so big.

And a great deep dive on going big here after $100m ARR, including CrowdStrike’s Sr Director of Partnerships:

The post 5 Interesting Learnings from CrowdStrike at $1.7 Billion in ARR appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow