Payroll can be defined as the process of paying your employees.

It differs from a salary in that it is an administrative process using a particular system to ensure all your employees are paid accurately and fairly. A salary is the exact amount an employee is paid depending on the terms of their contract.

Payroll is essential to any business, and in this article we’ll look at the reasons why and offer expert advice on how best to run your company’s payroll.

Below, we'll cover:

What is payroll?

Payroll was originally defined as a list of employees within a company and the amounts they are due to be paid. It has evolved over time to now refer to the wider process of paying employees, which involves a lot more than just wages.

It typically also involves administrative procedures, such as updating employees' bank details, actioned by a team of payroll professionals.

Payroll can be managed in a number of ways, such as:

- In-house, with your own dedicated payroll team

- Via an outsourced payroll service provider

- With the help of payroll software

As your business grows you will inevitably hire people to work for you. When this happens, the importance of understanding and implementing payroll cannot be understated.

This is because payroll is not just a system that keeps track of the amount you need to pay your employees. It has many other purposes, some of which are essential if you want to run a business lawfully.

How does it work?

In order to process payroll, you need to carry out the following steps each tax month. Tax months run from the 6th of one month to the 5th of the next:

- Record employees’ pay – including their salary and any statutory sick pay or holiday pay

- Calculate deductions from their pay – including tax, national insurance and any student loan payments. Payroll software typically does this automatically

- Calculate the employer’s (your business’) national insurance contribution – this needs to be paid on earnings above £184 a week

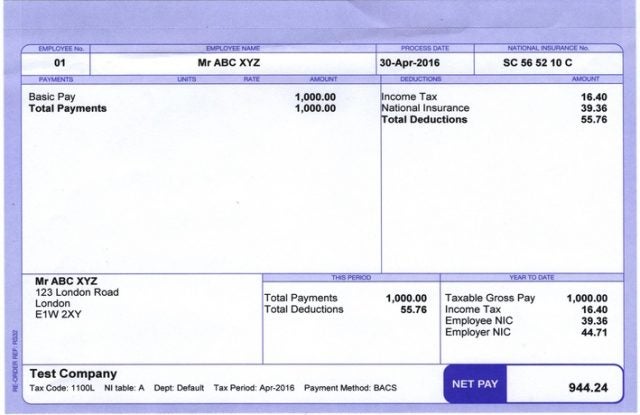

- Produce payslips for each employee – these can be generated by most payroll software or your payroll service provider

- Report your employees’ pay and deductions to HMRC – this is known as a Full Payment Submission (FPS)

What is payroll needed for?

Record keeping

Payroll is a useful tool for tracking payment records. It can be used to calculate how much each individual employee has made during their tenure at your company – which is vital for forecasting and budget planning.

Payslips provided through payroll can also be used to assess the amount of tax, NI, or pension contributions deducted from an employee's wage. They’re also requested when people are applying for mortgages or loans, as proof of employment and income.

Note that it’s important to keep records of pension contributions amongst other deductions.

Paying employees accurately

Do not underestimate the importance of payroll – it is a necessity if you want to pay your employees accurately and lawfully. This is because whether you’re using in-house payroll software or outsourcing to a service provider, everything will be done by the book, and all deductions will be properly calculated.

Visit our dedicated how to pay your employees page for more information.

Remaining HMRC compliant

In order for a business to operate lawfully in the UK, HMRC must be notified when a new employee is hired, and all employees must pay taxes depending on their assigned tax code. Payroll is important because it automatically sets and deducts taxes for each employee, and by managing payroll, you can keep up to date with any changes to HMRC rules and regulations.

Calculating other deductions and contributions

Payroll software will help you calculate things like national insurance contributions. It can even be set up to automatically deduct for a workplace pension scheme, which you’re required to offer by law.

To find out further details about the rules and regulations of running payroll, visit GOV.UK

Payroll categories

In order to pay your employees and process payroll, you need to have certain key information. Miss out on any of the below, and you could risk messing up your payroll and not paying staff correctly. Luckily for you, we’ve included a breakdown of all the elements that make up payroll.

Employee information

Although it sounds simple, ensuring you have accurate, up-to-date employee details is imperative to running payroll. You will need each employee’s:

- Full name (including middle names)

- Home address

- National insurance number (this is required to make NI contributions)

- Annual salary

It is best practice to update these details at least once a year – and be sure to encourage your employees to be proactive in notifying payroll of any changes to their address, salary, or names.

Salary, wages and payslips

Employees will be paid differently depending on whether they are on a salary or a wage.

So what’s the difference?

A pay packet that is received on a monthly basis. An annual sum is agreed between the employee and employer, and this is divided into 12 individual payments.

A payment that is calculated hourly, rather than a set annual amount. The total pay an employee will receive depends on the hourly rate agreed upon, and the number of hours worked over a particular period.

Payslips will look different depending on how employees are paid. But regardless of this, they must always include gross and net pay.

Gross pay is an employee’s total pay, whilst net pay is the amount the individual actually receives after tax and any other deductions.

Paying your employees based on their hours

For staff members on a salary, all you need to do is ensure that they are working their contracted hours. The amount they get paid monthly will not change unless they receive bonuses, commission or sick pay.

In regards to hourly paid employees, their pay may differ week on week depending on the number of hours they’ve worked.

It is important, not only for payroll and tax purposes but also for your business’ finances, that you keep a record of how many hours each employee has worked during each pay period.

A lot of businesses typically have a rota in place to pre-determine the hours each employee will work, and a clock-in, clock-out system to confirm this.

Some payroll software providers (including QuickBooks) allow you to submit timesheets to help streamline the process and make life easier for your payroll team.

Tax and deductions

Every employee must pay tax and national insurance before receiving their net pay. The total payment made by your business is the taxable gross amount, and the deductions are then made before the employee receives their pay.

It is your responsibility as the employer to calculate and arrange these deductions. If you don’t do this correctly or miss any HMRC deadlines, you could risk a hefty fine.

Gross pay deductions are always tax and national insurance contributions. However, there are other additional deductions that are conditional payments dependent on an individual's circumstances.

Additional deductions and payments

Some employees will be making payment contributions towards other things, while others will be receiving additional payments. These can include:

- Pension scheme contributions – as a registered business you should be offering all employees a workplace pension scheme that they can contribute to, and it is your responsibility to ensure this is set up correctly in payroll. It is also important to mention that an employee can opt in or out of a scheme at any time – and this must also be reflected in payroll.

- Student loan repayments – once an employee reaches the payment threshold, they must start repaying their student loan. This can be taken out of their salary/wage.

- Commission – in some industries, particularly sales, many of your employees may work on a commission basis. This means each payment may be different depending on the amount of commission they’ve earned – and it is your responsibility to pay this correctly.

- Bonuses – unlike a commission, bonuses are typically a pre-agreed amount paid annually after a milestone or target has been reached.

How to run payroll

Now for the important part: deciding the best way to run payroll for your small business.

There are three primary ways, each with its own pros and cons, for you to manage your payroll:

- In-house, manually with your own dedicated payroll team

- Via an outsourced payroll service provider

- Using payroll software

As payroll experts at Startups, we recommend you run payroll either by outsourcing (at least partly) to a trusted payroll service provider, or by managing it all in house using the latest payroll software.

Of course, you could choose the traditional method of managing payroll manually (by hand) – but there are a lot of issues with this method, which we will discuss.

Using a payroll service provider

This is a popular option because it allows smaller businesses that don’t have the capacity to hire a dedicated payroll team to outsource all payroll duties to a service that does.

Essentially, by outsourcing your payroll you hand all of the responsibility over to a service provider, such as IRIS or Sage. They will look after all of the administrative tasks and processes to ensure you remain HMRC compliant, and will make sure your staff are paid accurately and on time.

The great thing about outsourcing payroll is that you have the flexibility to choose how involved you want your service provider to be.

The majority of payroll service providers offer fully managed, partly managed, and administrative level plans to support you according to your business needs.

Pros and cons of outsourcing payroll:

- Your payroll is managed by a team of certified payroll specialists, meaning you can be confident that the service provided is reliable, accurate and HMRC compliant

- There’s flexibility to choose how much you want your payroll service to be involved in the payroll process depending on your requirements

- The provider can deal with the more complex tasks surrounding payroll, including annual P60s

- Some payroll services come with HR functionality and support

- You may be tied into a long contract depending on the provider you choose

- Can be an expensive option – particularly for micro-businesses that need to have payroll fully managed, as the cost per payslip overshadows the benefits

Say you're already sold on payroll services for your company. Now you just need to ensure you get the best possible deal for your small business, as the last thing you want is to be tied to an expensive contract with a poor provider.

This is where we come in. Our free comparison tool will match you with the right provider for your company’s needs, providing you with direct payroll service provider quotes that you can easily compare.

All you have to do is fill out a few details, and we will take care of the rest.

Payroll software

Payroll software is an application that assists you in organising, managing and automating employee payments. It can either be an on-premises or cloud-based solution, but is typically cloud based.

The role of payroll software is to ensure you remain compliant with tax regulations and the requirements set out by HMRC. It also streamlines and automates payroll processes, so you can save time and reduce the cost of employing a large team of payroll professionals and administrators.

If payroll software sounds like the ideal solution for your business, check out our guide to the UK's top payroll software providers.

Payroll software is great because it doesn’t involve the huge expense of outsourcing to a service. However, even if you are managing your own business’ payroll using software, you will need to employ at least one payroll professional/administrator to be in charge. You’ll usually need to pay them between £20,000–£45,000 per year.

Payroll software pros and cons:

- It streamlines and automates payroll processes, so you can save time and reduce the cost of employing a large team of payroll professionals and administrators

- The majority of payroll software comes with in-depth reporting functionality – which is great for business forecasting and reviewing finances

- Free trials offered by some software providers give you the flexibility to try before you buy

- Contracts are shorter (typically month-to-month) than they are for outsourcing payroll

- Software is HMRC compliant

- Great third-party integrations with accounting and HR software are available

- In order to use some payroll software, you have to use a provider’s other platforms too, including its accounting software

- Although support is available, it is not as dedicated and tailored as it is with a managed payroll service

- Onboarding issues can arise more frequently than with a fully managed payroll service

Manual payroll

Some businesses opt to run payroll manually, meaning they do everything by hand and keep physical copies of all records and files.

This is a very traditional, old school method of managing payroll, and it can actually be quite expensive and inefficient.

In order to manage your payroll team entirely in-house, you’ll need to employ at least two to four payroll specialists, and an additional payroll administrator depending on the size of your business.

This can prove incredibly costly, and it will be far cheaper to either outsource your payroll entirely or set up payroll software and employ one payroll specialist to manage things in-house.

Manually submitting payroll can also be time consuming, especially for larger businesses.

Pros and cons of manual payroll:

- If you already have an established payroll team, you could save yourself money by processing everything manually

- If you haven’t got a team of payroll professionals, this will be incredibly expensive to set up

- Very time consuming way of submitting payroll. Meanwhile, software has been designed to streamline and automate processes, saving you time and money

- Room for human error – as with all things done manually, the risk of making mistakes will increase, which could lead to employees being mispaid

Need a quote?

Now you’ve understood what payroll is and the best ways you can manage it for your business, it's time to shop around for the best options on the UK payroll market.

Whether you are looking to outsource your payroll or get going with payroll software, you’ll want to receive personalised quotes from some of the best providers in the industry.

The best way to do this is by using our free, easy-to-use payroll cost comparison tool, which can provide you quotes from the likes of IRIS, Moorepay and ADP.

It is incredibly simple to use, has zero obligations on your part, and is guaranteed to save you time and money.

- What are outsourced payroll services?

Outsourced payroll services look after your payroll needs and can be fully or partly managed. In order for your payroll to be fully managed, you must outsource every single aspect of it to your selected provider. The provider will manage everything from employee BACS payments to P60s. Part-managed payroll service involves a mixed, somewhat 50/50 approach to handling your payroll.

- How much is payroll software?

The cost of payroll software will range depending on the size of your business and the type of software plan you select. One of the cheapest available plans is by Sage Business Cloud and is £7 per month for up to five employees. On the other end of the spectrum, Xero’s premium plan is £38 per month. On average, payroll software costs range from between £7–£50 per month.

- What’s involved in payroll processing?

Processing payroll involves a number of key tasks, such as: paying your employees accurately and on time, ensuring all deductions and additional payments are included, reporting all employee wages/salaries to HMRC, sending out payslips to all employees, and completing Full Payment Submissions and end-of-year P60s.

via https://www.AiUpNow.com

March 24, 2022 at 10:09AM by Ross Darragh, Khareem Sudlow