So DigitalOcean is the quiet Cloud platform that keeps on growing. Focusing on smaller developers, in some ways it’s been a bit overshadowed by AWS, Azure, and Google Cloud. But it’s a great case study on how nailing a niche, and staying focused on a core ICP in a huge market, can pay off. Even if you’re far smaller than the Huge Guys.

DigitalOcean is growing an impressive 37% at $500,000,000 in ARR, and staying very SMB with 600,000+ customers, but still driving deal sizes up a bit. A deep dive on how they do it with their A+ CEO here:

5 Interesting Learnings:

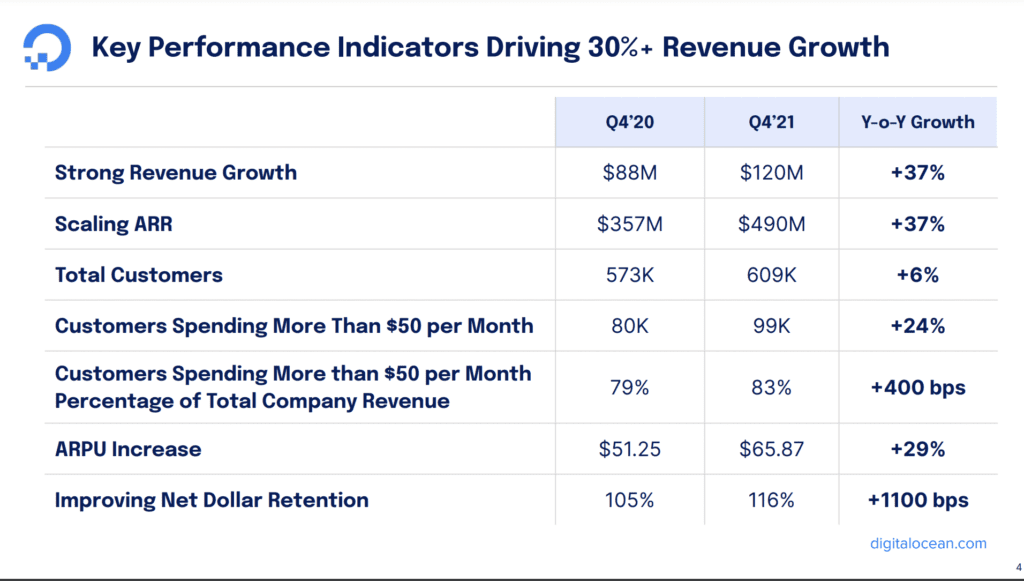

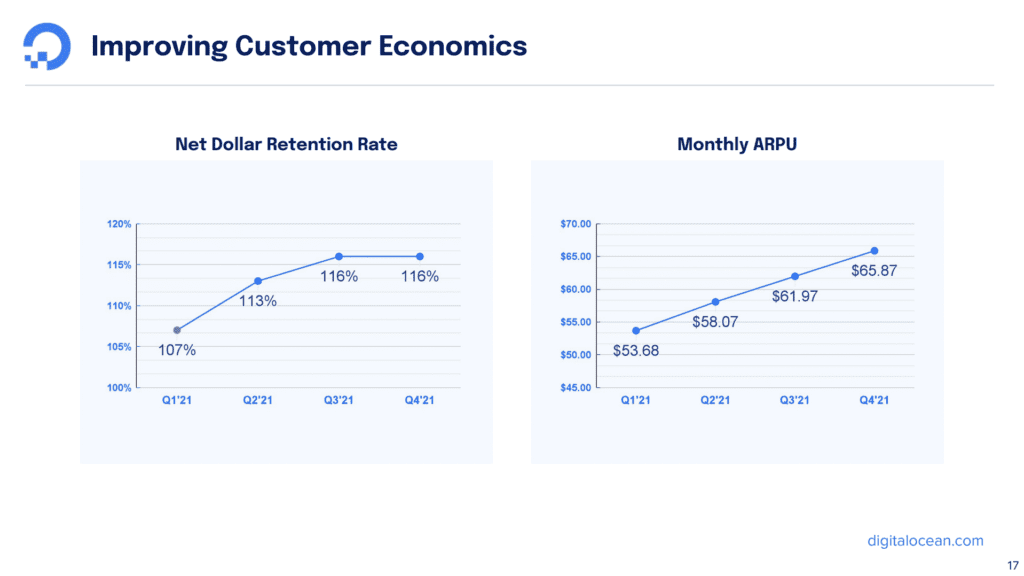

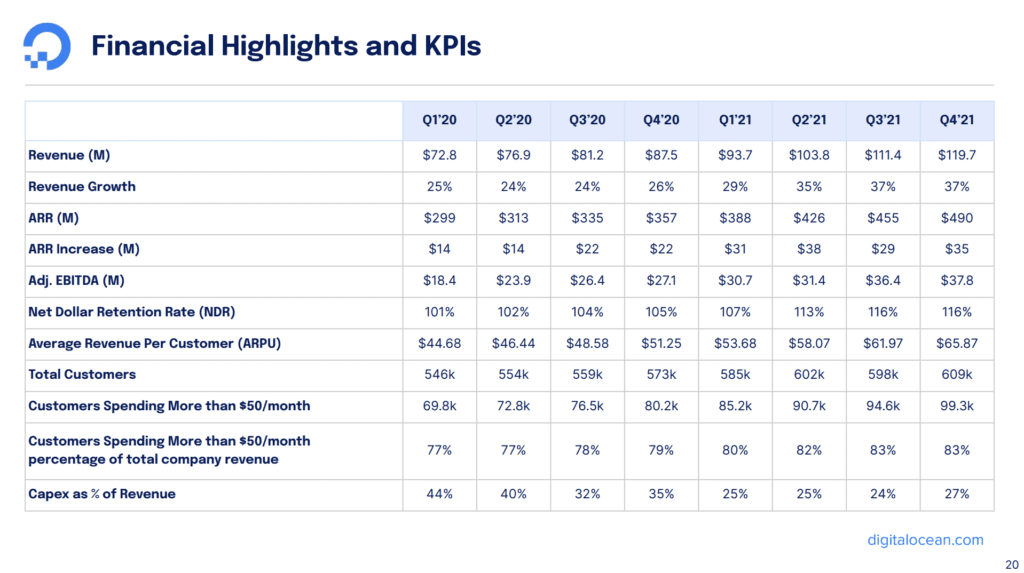

#1. From so-so NRR (101% in 2020) to Top-Tier for SMBs (116%) in 2 years. Digital Ocean, even with customers that pay in many cases less than $50 a month, has maintained 100%+ NRR. But lately with a focus on just a little bit bigger customers … more than $50 a month, versus less … they’ve driven NRR up from 105% to 116%

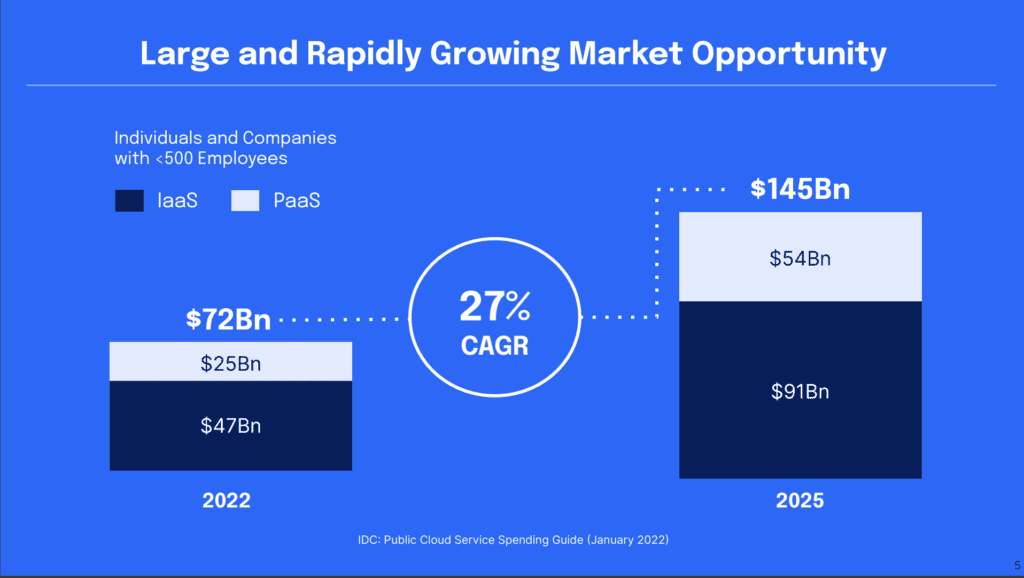

#2. Sticking to their knitting of companies with < 500 employees. DigitialOcean doesn’t want to take AWS, Azure and Google on in the enterprise and doesn’t really try. It knows its strengths and the SMB Cloud segment is still growing 27% a year.

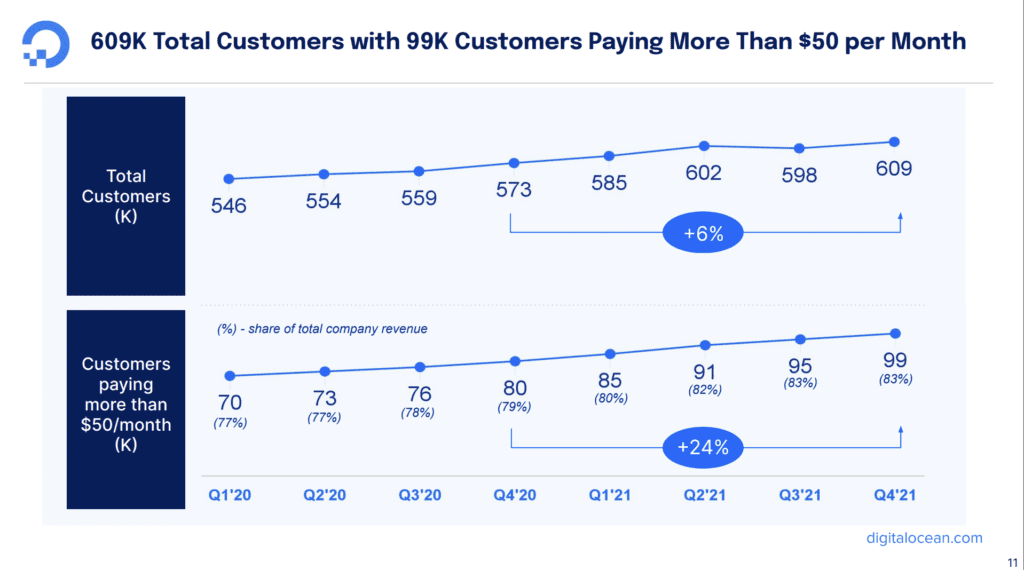

#3. The Growth is in the 100,000 customers paying more than $50 a Month. They are only 15% of the customers, but 83% of the revenue. Even in the smallest of SMB, you can still tilt a little upmarket — and Digital Ocean has. It’s sub $50 a month customers, while 85% of their base, are only growing 6% year-over-year and now are just 17% of their revenue overall. But it’s 100k $50+ a month customers are growing quickly, at 24% year-over-year.

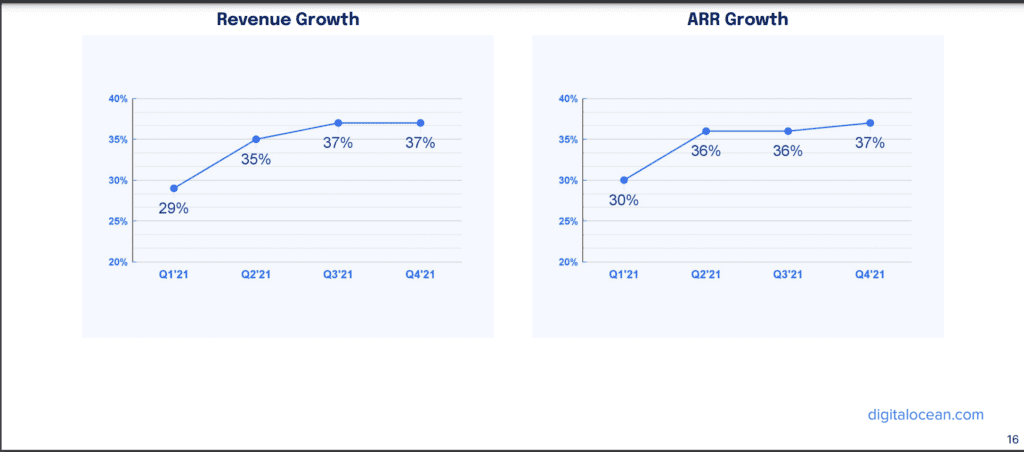

#4. Growth accelerated after $300,000,000 in ARR. Another great challenge to the idea growth has to always slow in Cloud and SaaS. Growth for Digital Ocean did slow for a while, but they reignited the past 2 years:

#5. A 25% increase in ARPU fuels growth. A benefit from both growing NRR and focusing on $50+ a month customers. A big piece of Digitial Ocean’s acceleration after $300m ARR has come from driving up Monthly ARPU:

And a few bonus learnings:

#6. Digital Ocean is generating significant free cash flow — $152m of EBITDA on $490m in ARR. That’s impressive. 31% of each dollar flows to free cash flow.

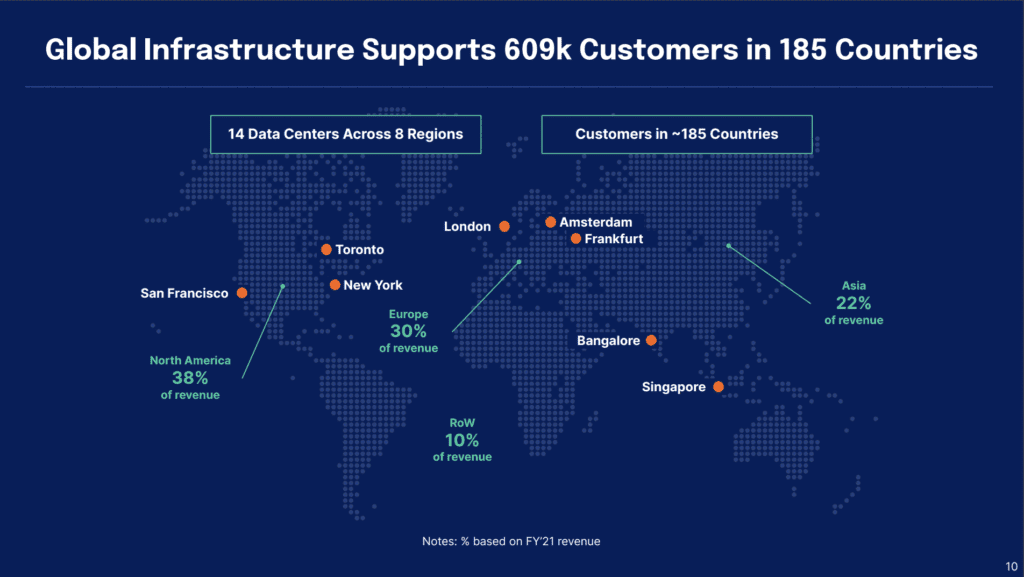

#7. Only 38% of revenue in North America. The Cloud is global, and Digital Ocean has followed it. With 30% in Europe, and 22% in Asia, Digital Ocean’s revenue is truly global.

Wow what a story!! A niche of a free and super-cheap Cloud for individual and small developers that just grew and grew into a $500m ARR engine. Even as the Big Guys went more and more enterprise.

The post 5 Interesting Learnings from DigitalOcean at $500,000,000 in ARR appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow