So there was a pretty successful “small” SaaS IPO last year that you probably didn’t hear about — CS Disco.

“Disco” is a leader in next-generation eDiscovery software, i.e. managing documents around lawsuits. You could call Disco a vertical SaaS play, but sometimes that term is overused. Really, it’s a next-generation Cloud player in eDiscovery, one of the oldest and largest categories in legal tech (a $15B category already). Disco is one of a new generation of players, including Everlaw, Logikcull, and others, reinventing this category in the age of AI, Cloud, Slack, and more. And the first to IPO.

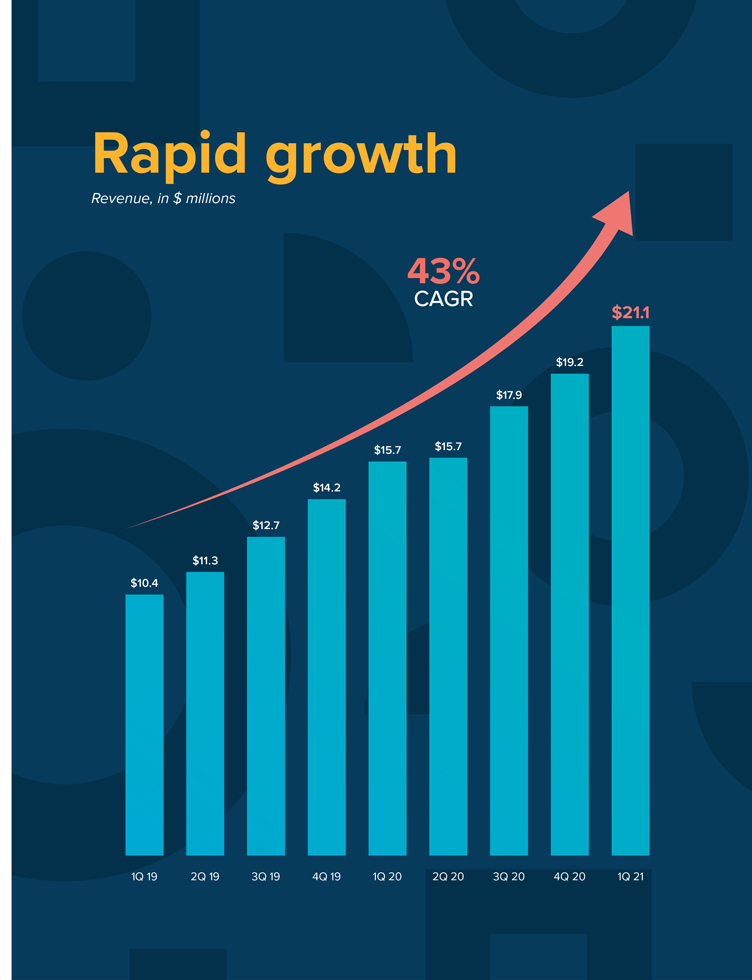

Disco IPO’d early — it filed to IPO at less than $100m ARR, and in the quarter just after hit $120m ARR. Even $120m ARR is about half of what most SaaS leaders have in ARR when they IPO. But its growth was very strong, up 67% at $120m, and it’s been rewarded with a strong market cap — $2.25 Billion even with the market correction. That’s almost 20x ARR from a “small” IPO. Albeit one with top tier growth.

5 Interesting Learnings:

#1. Huge acceleration in growth post-IPO .. from 37% to 67%. Disco’s growth has been more uneven than most. Growth was OK at IPO but then dramatically accelerated. It doubled. A visceral reminder you really can grow faster after $100m ARR.

#2. $100k average deal. With about 900 customers at IPO and perhaps 1,200 now, Disco’s average deal size is about $100,000. Selling to legal isn’t easy, otherwise I might have expected an even larger deal size. “Enterprise” sales to services businesses is often harder, with lower ACVs. But they are making it work.

#3. Usage-based revenue is 88% of revenue, subscriptions 12%. In the eDiscovery space, customers often prefer to pay by “matter”, i.e. per lawsuit or legal case. Thus, usage-based pricing aligns better with law firms’ own economics. This can lead to spikes in revenue, but also gave Disco less insulation when Covid hit and things briefly slowed down. They went through a brief flat period and a small round of layoffs in 2020.

#4. 12% of customers sign multi-year contracts. We don’t see this ratio set-out that often, so useful to see. Much of the revenue is usage and storage based, as noted above, not pure fixed price per seat. So 12% of usage-based customers “flip” to annual multi-year contracts.

#5. 95% of revenue from the U.S. eDiscovery is very country-specific, in large part due to different regulations around preservation, privacy, and most importantly, the very nature of legal discovery itself. Every country’s laws and legal processes are quite different. Disco doesn’t even claim it has ambitions to get this 5% revenue outside the U.S. It’s likely just too wildly a different set of customer needs. This is in vivid contrast to “standard” B2B and B2D apps like Asana where 40% of revenue is often outside the U.S.

And a few more interesting learnings:

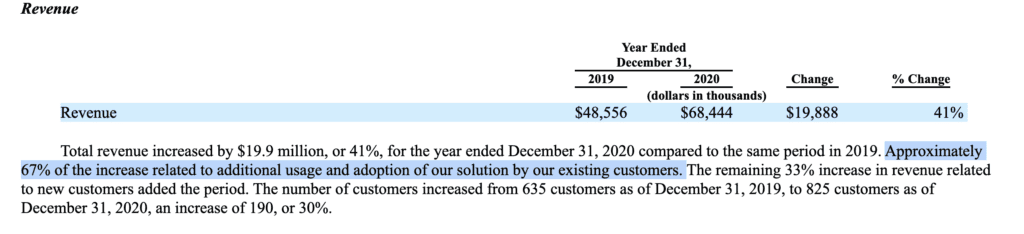

#6. 122% NRR — and 67% of its revenue growth comes from the existing base. We may see this 67% number come down a bit with Disco’s torrid growth, but perhaps not. Many SaaS leaders with 120%+ NRR see the majority of their growth from their base. CS Disco is one of them.

#7. Sales & marketing expense remains > 50% of revenue to fuel growth. Not uncommon, but nor is it low.

#8. 400 employees, or about $250,000 in revenue per employee. 164 of them in Sales & Marketing. And 117 in R&D. $250k per employee is at the slightly more efficient end of “normal”.

#9. 8.6% CEO ownership at IPO. No profound insight here, just something to track.

A pretty neat story. A quiet IPO that you may not have heard of, that IPO’d early in a $15B space that is slowly becoming “SaaS-ified”. And that picked itself up and grew twice as fast after its IPO. And was rewarded with a $2.2 Billion valuation for it!

We’ll check in again before $1B ARR!

The post 5 Interesting Learnings from CS Disco at $120,000,000 in ARR appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow