It’s data season, with groups like Silicon Valley Bank (SVB), CB Insights, PitchBook, and Crunchbase News putting out datasets that we’re having fun exploring. This morning, we’re adding one more to our arsenal.

The Exchange spent some time this week diving into the SVB “State of the Market” report for the fourth quarter. As is common from the bank’s publications, it’s a dense riff of charts and notes, ranging from economic data and trade figures to venture capital statistics.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

While perusing the collected information, we found an interesting pattern: Venture capital investors are racing to pay more to buy smaller pieces of startups that are less profitable than before.

While that may sound somewhat rude, it isn’t. Instead, the capital crush that we’ve seen overtake startups around the world, the round pre-emption that has become common, the rising valuation marks that have become the entry-price to hot startups’ cap tables, and investments into growth have all come together to create a venture capital market unlike any that I can recall.

SVB gave The Exchange permission to share a few charts, so what follows is a graphical dig into the data, proving that I am not a brat for claiming that venture investors are getting a rawer deal than usual, but merely sharing what the data indicates.

SVB gave The Exchange permission to share a few charts, so what follows is a graphical dig into the data, proving that I am not a brat for claiming that venture investors are getting a rawer deal than usual, but merely sharing what the data indicates.

Less for more

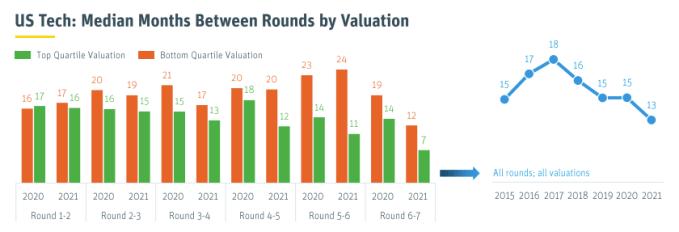

First, let’s examine how the time between funding rounds has fallen. SVB data shows a useful 2020 versus 2021 differential, with an aggregate chart tracking the same data over a longer time period on the right:

Image Credits: SVB

As you can see in both charts, venture capitalists are accelerating the pace at which they make successive investments into startups. This is what we meant by faster.

via https://www.aiupnow.com

Alex Wilhelm, Khareem Sudlow