Every marketplace or platform startup has to decide how much they should charge for transactions on their platform, known as the “take rate.”

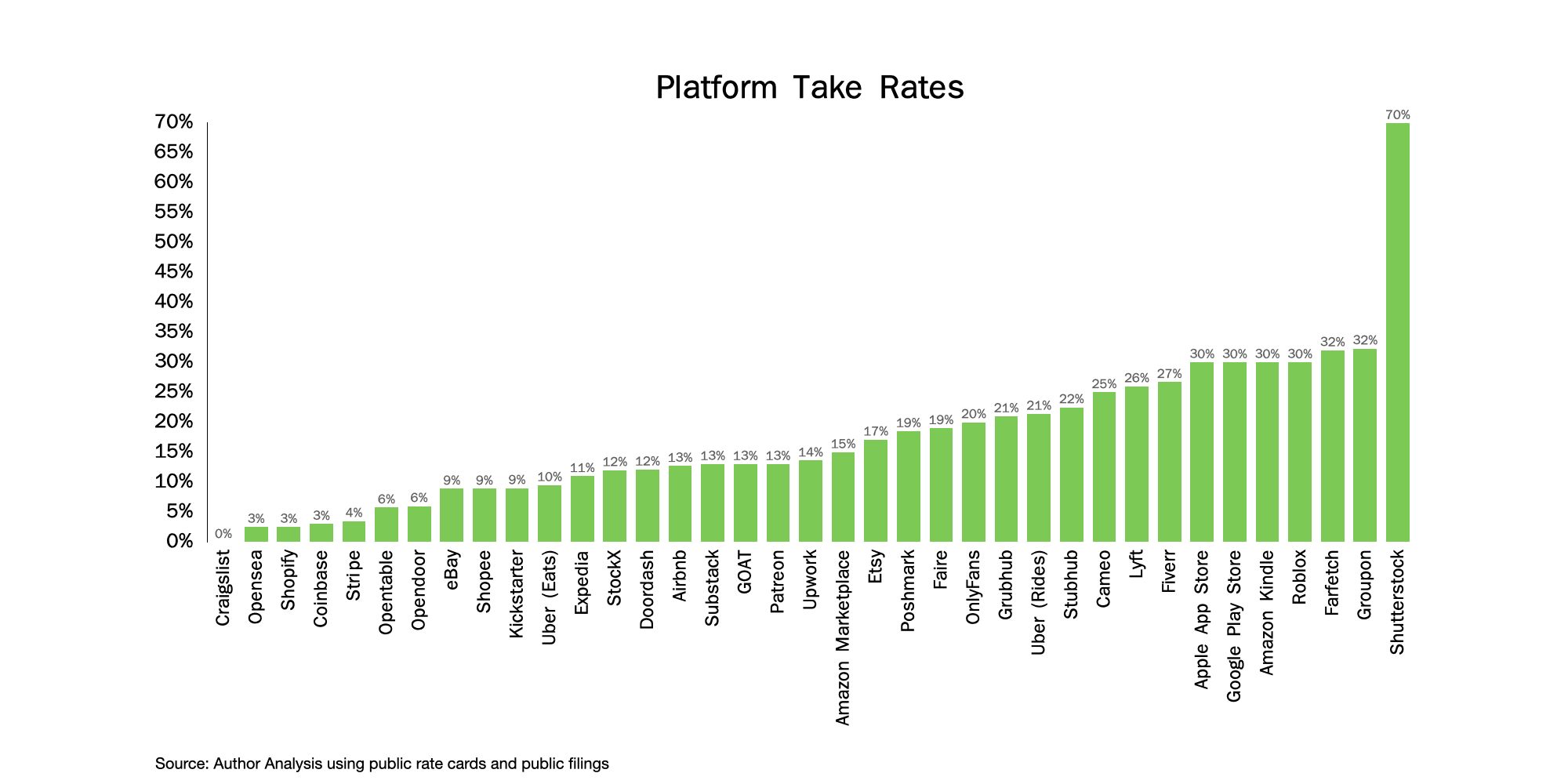

While there is no formula set in stone, I’ve analyzed the take rates of over 25 private and public marketplaces below. I’ll use these to help shed light on some considerations for founders to guide their decision.

Note that the definition of “take rate” used in this piece will be a percentage, which is calculated by dividing the revenue made on the transaction by the platform by the total value of the transaction.

Maximizing take rate isn’t the goal

It’s important for founders to remember that maximizing the take rate of the platform is not the goal.

A higher take rate typically leads to lower transaction volume, and depending on the stage a company is in, it may be advantageous to charge a lower take rate than what you can sustain to gain a strategic advantage.

Image Credits: Tanay Jaipuria

You can see startups do this when they are going after relatively nascent markets that they are trying to grow. A great example of this is OpenSea, which charges a 2.5% fee on transactions, which is quite low compared to other marketplaces. However, given that NFTs were relatively nascent, their low fees helped reduce friction to trading and grow the size of the market.

This also happens in markets that are extremely competitive and have some winner-take-all dynamics of economies of scale. Here, a marketplace could start with lower take rates to try to grab share or achieve scale.

The more value a marketplace provides via value-added services, the higher the take rate it can charge.

A general rule of thumb to remember is that the goal is to maximize long-term profit: (take rate x average transaction value – variable cost) x (number of transactions).

Note that:

- The take rate and number of transactions will often trade off with each other.

- A lower take rate in the short term can lead to better outcomes in the long term.

- Charging lower take rates than what you can “get away with” may lead to higher retention and value creation in the long run.

Understand the nature of your market

Referring to the chart above, it’s clear that take rates are extremely variable, even within industries. However, certain market-driven factors play a role in determining the ranges in which you can operate.

For instance, certain companies such as Uber have to charge very different take rates in delivery (~10%) versus ride-sharing (~20%).

When trying to understand the nature of the market, founders should consider:

Is the product being sold digital or physical, and how much margin is available?

via https://www.aiupnow.com

Ram Iyer, Khareem Sudlow