Bessemer Venture Partners Byron Deeter, Mary D’Onofrio, and Elliott Robinson share a state of the cloud economy, tactical lessons and case studies for early-stage founders, private market analysis, alongside key predictions and trends driving innovation in SaaS around the globe.

Want more? Enter your email below for the latest SaaStr updates

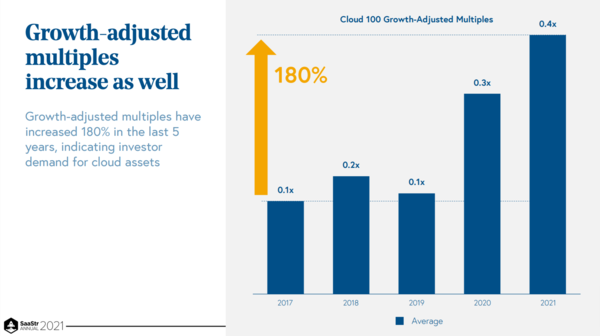

The top private SaaS companies (from the BVP Cloud 100) are valued at 0.4x growth-adjusted revenue multiples

While we have a few excerpts and takeaways below, we strongly recommend reading BVP’s entire slide deck here.

A significant portion of the excellent “Founder Confidential” CEO panel at SaaStr 2021 centered on “crazy valuations” in SaaS today with the implication investors are irrational. Throughout Annual, SaaStr CEO Jason Lemkin would make the point that these investors “are not stupid!” And BVP’s very helpful inclusion of growth adjusted revenue multiples in their deck supports that:

At first glance – with a 180% increase in this metric since 2017 – it would be yet another reinforcement of the “investors are nuts” talking point.

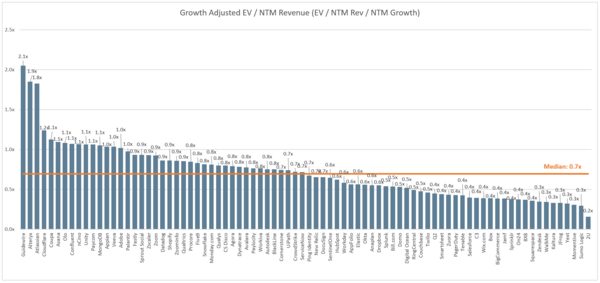

However, a comparison of growth-adjusted multiples of private SaaS (using BVP’s Cloud 100 here) versus public company SaaS (using Jamin Ball’s Clouded Judgement Substack) shows private market SaaS valuations might be quite rational.

The basic growth-adjusted multiple math:

- 0.4x for top private SaaS

- 0.7x for publicly traded SaaS

- equals a 43% discount

Given the size + depth of private capital markets today – with robust secondary marketplaces (like Forge and Equity Zen) and active “cross over” investors (like Tiger, Coatue, and Maverick) – a 43% discount is quite high and exceeds a normal illiquidity discount (typically 15%-20%).

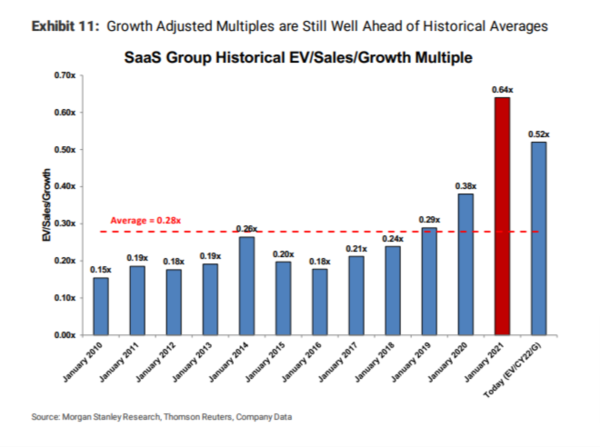

Of course, if publicly traded SaaS companies are in a bubble (plausible IMHO), this relative value arbitrage won’t really work. As context, public SaaS companies traded at an average of 0.28x growth adjusted pre-COVID (per Morgan Stanley, May 2021 “Software Gut Check – What’s Different This Time?” report):

Key Takeaways:

- Bessemer’s Cloud Index is up 12x in the eight years since its launch.

- Cloud has outperformed both Internet and Mobile public baskets in the past half-decade as evidenced by MT SaaS vs. FAANG stocks.

- We’re building in the age of the cloud decacorn: The average valuation of the top-10 company is $19.9 billion.

- Cloud growth rates continue to accelerate: The average Cloud 100 company grew +90% year-over-year in 2021, and the top quartile companies grew 110% year-over-year, faster than ever before.

The post The State of the Cloud 2021, How to Build a Cloud Unicorn with Bessemer Venture Partners (Podcast #484 and Video) appeared first on SaaStr.

via https://www.aiupnow.com

Matt Harney, Khareem Sudlow