The B2B payments space has seen an explosion in demand, and investor interest, in the wake of the COVID-19 pandemic as businesses try to figure out how to pay each other digitally. The challenges become even more complex when dealing with cross-border payments.

Startups that were formed before the pandemic stand to benefit from the shift. One such startup, Tribal Credit, launched its beta in late 2019 to provide payment products for startups and small to medium-sized businesses (SMBs) in emerging markets.

Today, Tribal Credit announced it has raised $34.3 million in a combined Series A and debt round led by QED Investors and Partners for Growth (PFG). Existing backers BECO Capital, Global Ventures, OTG Ventures and Endure Capital also participated in the round, along with new investor Endeavor Catalyst. The raise follows “10x” year-over-year growth, according to CEO and co-founder Amr Shady.

As part of the investment, Tribal received $3 million from the Stellar Development Foundation, a nonprofit organization that supports the development and growth of the open-source Stellar blockchain network.

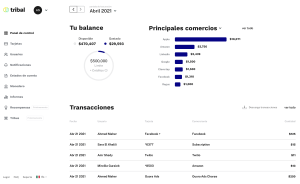

Tribal uses a proprietary AI-driven underwriting approval process to evaluate businesses and approve them for credit lines. Those businesses can then use those credit lines to spend on Tribal’s products, Tribal Card and Tribal Pay. Tribal Card is a business Visa card that allows users to create physical and virtual multi-currency cards. Tribal Pay allows them to make payments to merchants and suppliers that don’t accept credit cards.

The company says its value proposition lies not only in its ability to provide SMEs with virtual and physical corporate cards, but also a digital platform that allows founders and CFOs “to give access to and manage the spend of their distributed teams.”

“We’ve seen more demand for making B2B online payments amidst the ongoing COVID-19 pandemic, with many SMEs migrating to digital and spending more on online products and services,” Shady told TechCrunch. “Companies in this new economy are digital and global first. The need for a corporate card was accelerated. As card spend grew during the pandemic, this meant greater liability on founders’ using their personal cards, or other competing cards linked to their personal credit.”

Tribal, he said, underwrites the company without impacting the founders’ credit.

Another accelerator for its products was how the pandemic forced teams to work remotely. Founders and CFOs needed a way to provide access to corporate payments while maintaining control, Shady pointed out. Tribal’s platform aims to streamline financial operations for a distributed team.

Of course, Tribal is not the only company offering credit cards for startups. Brex, which has amassed $465 million in venture capital funding to date, also markets a credit card tailored for startups. While the companies are similar, there is a distinct difference, according to Shady: “Emerging market SMEs have different pains, particularly when it comes to cross-border payments.”

Tribal’s initial efforts are focused on Latin America, in particular Mexico, which is the startup’s biggest market.

Its new capital will go toward accelerating its growth in the region, according to Shady. In particular, the equity will go toward growing Tribal’s leadership team in Mexico, while the debt will fuel the company’s customers’ growing credit lines, Shady said.

“We have invested heavily in our product over the past year,” Shady said. “We’re the first mover in our segment in LatAm with a diverse suite of SME products that includes corporate cards, wire payments and treasury services. We’re incredibly excited by the future ahead of us in Mexico and beyond.”

Customers include Minu, Ben and Frank, Fairplay and SLM, among others.

Looking ahead, Tribal is exploring four other Latin American markets and expects to be operational in one new market by year’s end, according to Shady.

Image Credits: Tribal Credit

QED Investors partner Lauren Morton said her firm has been following payments and the lending needs of SMEs in emerging markets closely.

“Compared with everything else we’ve seen in this market, Tribal has a differentiated and superior product that meets customers’ needs in a way that no competitor can match,” she said in a written statement.

Morton went on to note that Tribal has had strong traction in Mexico, with adoption from “fast-growing startups” across the country, including many companies within QED’s own portfolio.

PFG is providing the debt facility for Tribal. In addition to funding from PFG’s global fund, the firm will be co-investing from its Latin America Growth Lending Fund in partnership with IDB Invest and SVB Financial Group, the parent company of Silicon Valley Bank.

Tribal Credit previously raised $7.8 million in a series of seed rounds. The latest round brings its total raised to $42.1 million. Tribal Credit also joined Visa’s Fintech Fast Track Program, a move that it said should accelerate its integration with Visa’s global payment network. The company currently has 75 employees, up from 31 last year.

via https://AiUpNow.com April 21, 2021 at 11:51AM by Mary Ann Azevedo, Khareem Sudlow,