A lot of our SaaS older times don’t quite know what to make with a lot of B2B startups these days, let alone some public SaaS companies.

So many startups these days are claiming they have “ARR” from revenue that … doesn’t recur.

Doesn’t ARR stand for Annual Recurring Revenue?

Well of course it does. But like “Cloud” and “SaaS”, its definitely has evolved. ARR now really means revenue with 100%+ Net Revenue Retention.

Let’s take a look at 3 great examples:

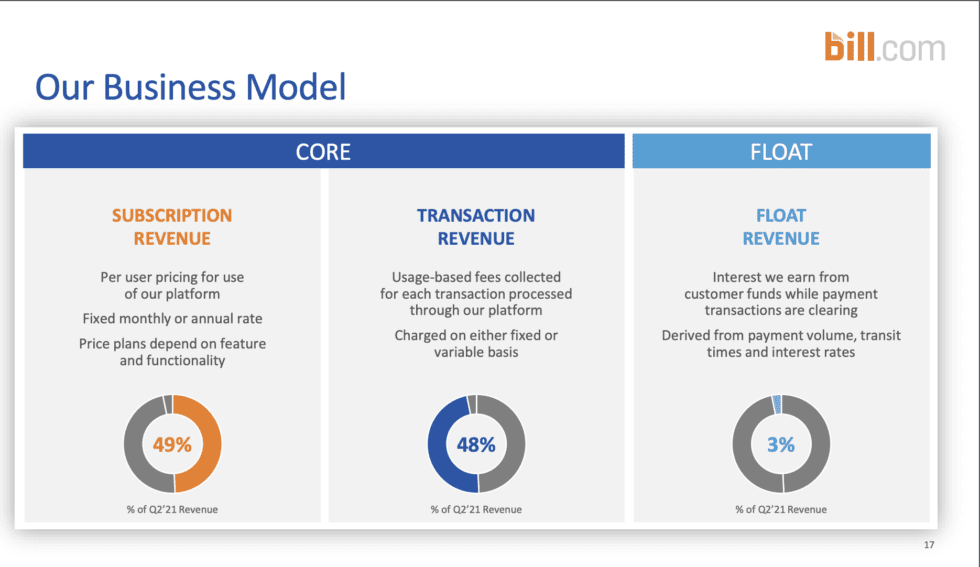

Example #1: Bill.com. $220m in ARR, $13B market cap. 50% revenue from software (recurring), 50% from payments (not-recurring).

Bill.com is one of my favorite sleeper SaaS companies. Half of its revenues comes from its software. And half from fees on transactions it processes:

Is this all really ARR? Well, if it were 2016, we’d say no. But it isn’t. With an incredible 121% NRR from SMBs, it all essentially recurs. It just doesn’t all recur under a contact. Only half does. More here.

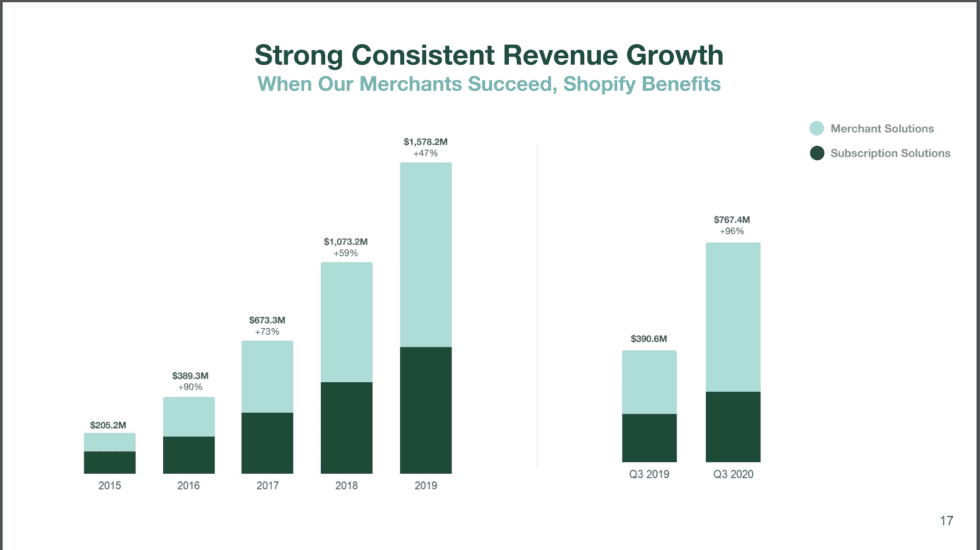

Example #2: Shopify. Shopify has exploded to $3B+ in ARR and a $135B Market cap, growing an incredible 96% during Covid. Woah. And yes, it’s a software company. You pay a subscription for websites to help you sell stuff.

But as Shopify scaled, its revenue as a percent of commerce on its sites — “Merchant Solutions” — began to eclipse its recurring SaaS revenues. Fast forward to day, Merchant Solutions is a much larger share of revenue than software subscriptions.

Does this all count as “ARR”? Well, alltogether NRR is still 100%. So again, this revenue as a whole recurs. It’s just only a minority is under a contract. And almost none is under a long-term contract. More here.

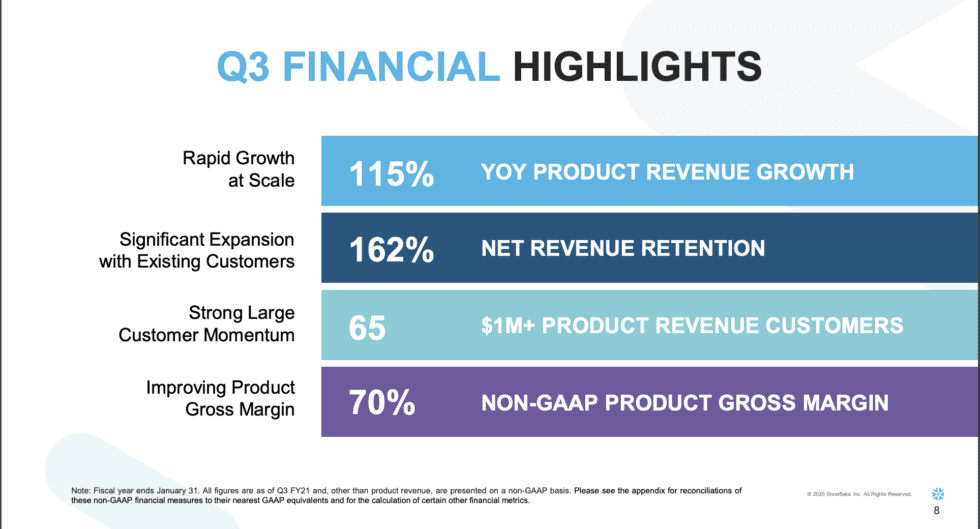

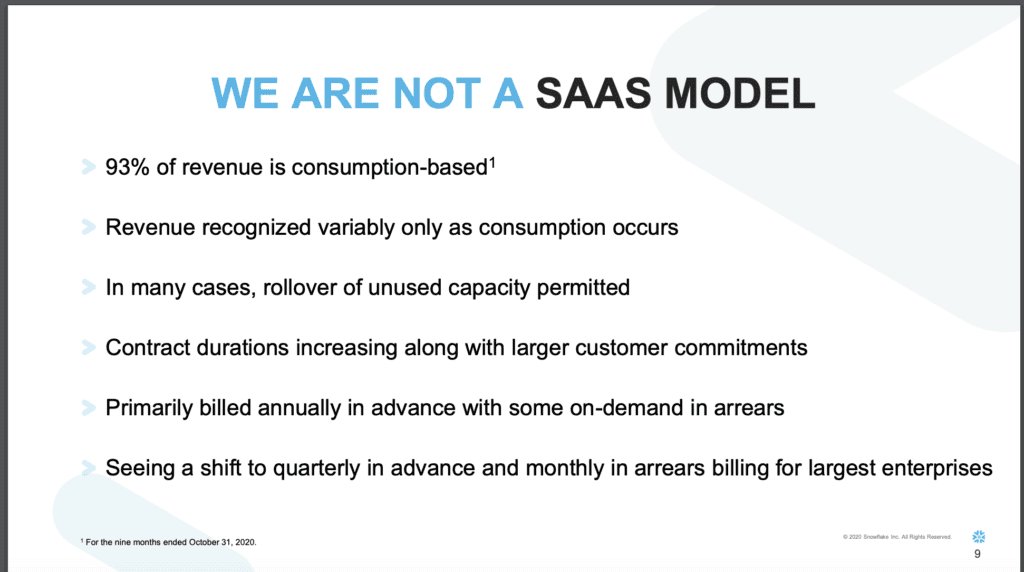

Example #3: Snowflake. Snowflake is growing 100%+ at $700m in ARR, with a $65B market cap. And 162% NRR. Wow! But almost none of its revenue is truly SaaS or provided under a fixed, recurring contract.

We could have picked many B2D services, like Twilio or others, too, which have primarily or substantial transaction pricing too. But Snowflake is especially fun because they are crystal clear they aren’t SaaS:

Now, as usual, it’s not that simple. First, Snowflake rolls its large customers into fixed comittments (as does AWS and many others), and bills them in advance. That ends up acting a lot like a traditional SaaS software contract at a practical level. And second, it blends together to a stunning 162% NRR. More here.

If you get to 162% NRR, who really cares how you get there.

Call it ARR.

Close enough, in any event.

The post Is it Really ARR? In 2021+, Yes. As Long As NRR is > 100% appeared first on SaaStr.

via https://ift.tt/2Jn9P8X by Jason Lemkin, Khareem Sudlow