Q: What are the Pros and Cons of Seed Investing?

Seed investing is a bit of a sucker bet. At least on a relative basis to other types of venture investing.

What do I mean? Well, the “good news” for seed investing is you should have a much lower entry price than a Series A-B-C investor. I.e., the earlier you invest, the lower the price.

But … the benefits of that lower price is balanced against taking more risk (seed is earlier), and often and importantly, by much lower ownership.

That’s where seed investing comes up short compared to Series A-B-C+ investing.

Let’s look at why:

- Let’s say you have a $20m seed fund and want to do say 40 investments for diversification, and keep 50% in “reserves” for later checks into your winners.

- That means $10m for initial checks into 40 investments, or $400k per initial check. You can buy a lot at say a $2m valuation. But that’s not where internet valuations are now, even in seed, in many cases, in U.S. tech centers (SF, NYC, etc.).

- Let’s say you typically joining $1m deals that average $5m pre / $6m post today. That means you are buying 6.6% ownership in each deal ($400k/$6m) on average.

- Let’s assume each company raises 3 more rounds, leading to 50% dilution. So your 6.6% becomes 3.3%.

- At IPO / exit the fund ends up owning 3.3% of each investment on average.

- And the partners at the fund collectively generally share ~20% of the gains. So that means the partners will split 0.6% of each investment’s gains. Across 2-3 partners, that could be 0.2% each.

Now 3.3% at the fund level isn’t nothing in terms of ownership. But, the Series A or Series B investor can start off with a lot more ownership than 6.6%. They can start with 15%-25%. And they have more money to maintain that ownership.

Yes, your entry price as a seed investor is lower, and thus your “multiple” may be higher. I.e., you might make on average 10x your money if you are great at it, where a Series A investor might make 5x on average.

But the Series A/B investor will own so, so, so much more. And in companies with at least somewhat less risk by the time they invest. So even if they only make 5x instead of 10x, they will generally make 5x of so much more.

And thus, they will make a lot more at exit. Often, a lot, lot more.

And you can see why a lot of pure seed investors complain so much about rising valuations, even seemingly modest changes. About how they complained that Uber at $4m pre / $5m post was “too expensive”. It’s because their ownership ended up much, much lower than their friends at Series A, B and C firms. For more work. And more risk.

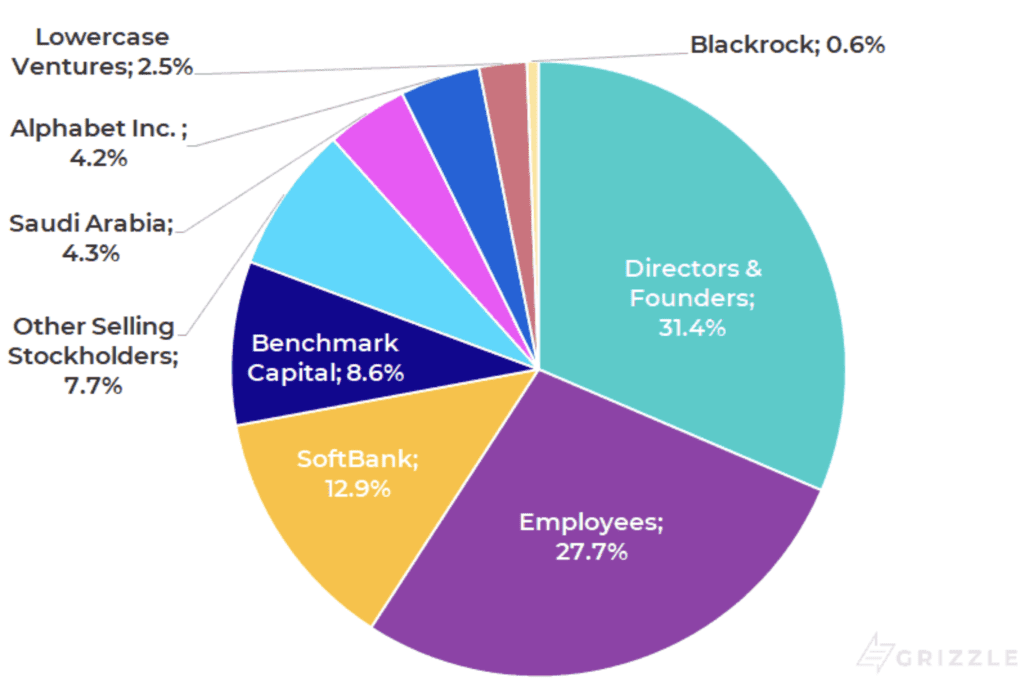

The chart below illustrates the point for Uber as just one extreme example. Lots of folks made lots of money, even with Uber’s dramas. But Benchmark, the Series A investor, made the most for the least relative risk:

The post Why Seed Investing Is Kind of a Sucker Bet (Relatively Speaking) appeared first on SaaStr.

via https://ift.tt/2Jn9P8X by Jason Lemkin, Khareem Sudlow