As we go into 2020 the IoT Analytics team has again evaluated the main IoT developments of the past year in the global “Internet of Things” arena. This article highlights some general observations as well as our top 10 stories from 2019. (For your reference, here is our 2018 IoT year in review article.)

A. General IoT 2019 observations

Faster than expected IoT device growth – 9.5bn active IoT devices

According to IoT Analytics estimates there were roughly 9.5 billion connected IoT devices at the end of 2019. That number is significantly larger than the forecast of 8.3B devices. The 3 main drivers:

- An explosion of consumer (particularly Smart Home) devices

- Much stronger than expected cellular IoT/M2M connections

- Particularly strong device connectivity growth in China.

The number of total connected IoT devices is now expected to reach 28B by 2025, further driven by new low-power wide-area (LPWAN) connections as well as 5G. (Please note: The number of connected IoT devices does not include laptops, smartphones, tablets or similar)

More and more large-scale roll-outs

Despite global softness in manufacturing throughout 2019 (Note: Manufacturing is the largest IoT segment on a dollar-basis), IoT markets continued to record a strong year.

Roll-outs are happening at scale (in the hundred of thousands or even millions of devices category). Recent announcements such as the Landis+Gyr 1 million smart NB-IoT meters roll-out in Sweden is not a rarity anymore. ThyssenKrupp now has more than 100,000 connected elevators, Tesla more than 0.5 million cars on the road that have the ability to perform over-the-air updates, and Maersk now has 380,000 connected refrigerated containers deployed on ships around the world. IoT platforms account for a significant portion of those device connections. The Bosch IoT suite (one of 620 IoT Platforms on the market) for example now connects 8.5 million devices.

Positive outlook with some caution

The overall picture for IoT technology, going into 2020, looks bright, although some macro concerns regarding the global economic outlook as well as weaknesses in certain industries (e.g., automotive) should be followed closely.

B. Top 10 IoT 2019 Stories

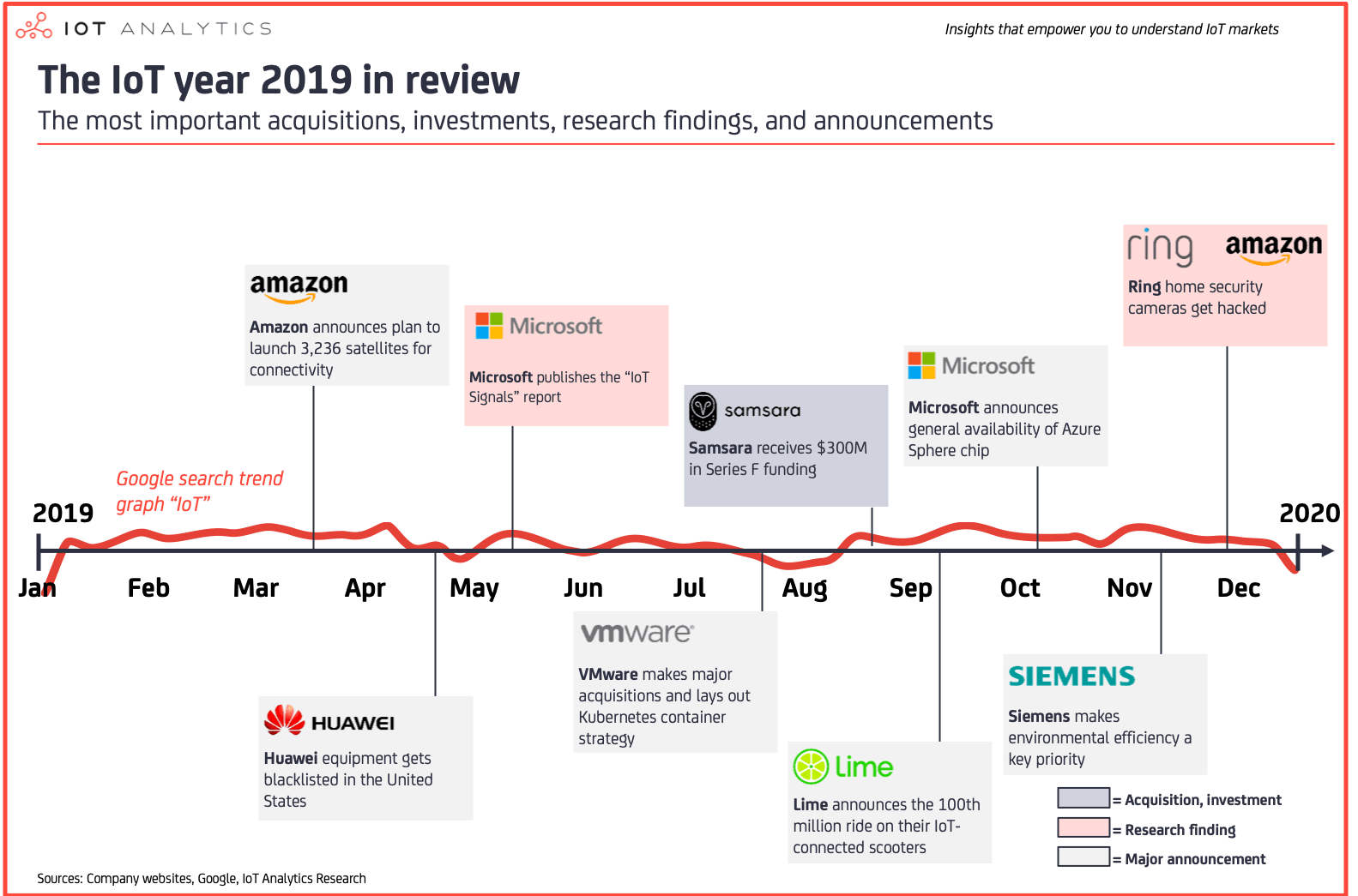

Throughout 2019, we monitored major developments around IoT technology. In our opinion, these are the top 10 stories of IoT 2019 (in chronological order):

1. Most exciting new IoT connectivity technology: Nano satellites

In the 2018 year in review article, we discussed the first commercial launch of 5G networks. Despite the fact that many more 5G networks were switched on in 2019, we did not consider 5G as the connectivity story of the year as the global roll-out of 5G networks was largely foreseeable.

The fact that several companies are launching IoT nano-satellite services that promise to provide ubiquitous connectivity, even in places where no connectivity has reached before, is really exciting. Eutelsat in November announced that it will launch 25 satellites to serve the IoT market. The company is partnering with Sigfox and is targeting transport, oil and gas, and agriculture deployments with its new technology. The Eutelsat news comes on the back of several startups that hope to capitalize on the same opportunity, including Switzerland-based Astrocast and Australia-based Myriota and Fleet Space Technologies. Only 24 hours after launching its Lora-based satellite network “Project Galaxy”, in February 2019, Fleet Space reported that 1 million devices were registered to be connected. In May 2019, Myriota became the first company to connect to Amazon’s new IoT satellite service called AWS Ground Station.

In a similar move, in April 2019, Amazon (AWS), announced that it plans to launch a constellation of 3,236 satellites into low Earth orbit in order to provide internet to “unserved and underserved communities around the world”. The company did not specifically mention IoT applications as a target.

2. Most controversial IoT story: Huawei 5G equipment ban

One of the major tech stories of IoT 2019 involved the Chinese company Huawei and its 5G equipment. In May 2019, the US government blacklisted Huawei due to accusations of helping the Chinese government with espionage. The US has major concerns regarding the upcoming rollout of 5G base stations across the country and believes Huawei may be sharing data with the Chinese government.

Some experts initially predicted that other countries would follow the U.S. with a similar blacklisting strategy, however this did not happen. Although the blacklisting represented a major blow to Huawei’s international business, the company managed to shrug off the news by posting an 18% top-line revenue growth in 2019, compared to 2018. This was in part driven by Chinese consumers who majorly backed Huawei during the dispute with the US.

The whole story has a twist that is not too positive for the U.S.. Huawei, which was a major customer for several US-based chip manufacturers has now switched a majority of its chip supplier basis to Chinese, Taiwanese, and European firms instead.

3. Most influential publication: Microsoft IoT Signals

In July 2019, Microsoft published a comprehensive IoT research report, called IoT Signals. The report stands out due to its large sample size of n=3,000 IoT adopters. It gives a candid look at the current state of IoT adoption, highlighting the top use cases in various verticals among other things. The report also found that “Security” is becoming less of a challenge and that one-third of IoT projects fail in proof of concept (POC) – which is in sharp contrast to a 2017 study published by Cisco claiming that “60% of IoT initiatives stall at the Proof of Concept (PoC) stage”

4. Most important IoT technology evolution: Containers/Kubernetes

IT architectures are fundamentally changing. Modern (cloud-based) applications build on containers, thereby bringing a whole new set of flexibility and performance to deployments. This is also becoming true for any centralized or edge IoT deployment.

It is fair to say that by now, Google’s open-source platform Kubernetes has largely won the race of container orchestration platforms, and Docker is the most popular container runtime environment (desipite the companies financial issues)

2019 saw several heavyweights in the IT and OT industry refine their container strategy:

- VMware. In August 2019, at VMworld 2019, leading virtualization software provider VMWare laid out a holistic Kubernetes strategy. The company believes that “Kubernetes will prove to be the cloud normalisation layer of the future”. It launched VMware Tanzu, a cloud platform that manages Kubernetes container distribution and allows to build and deploy applications.

- Cisco. The networking giant which had launched its “Cisco Container Platform” in early 2018 and announced joint projects with Google Cloud and AWS, in July 2019 completed its big 3 cloud partnership portfolio by announcing that Microsoft’s Azure Kubernetes Services are now natively integrated into the Cisco platform

- Siemens. Industrial giant Siemens in October 2019 bought Pixeom, a software-defined edge platform, with the goal to embrace container technology for edge applications in factories. The Pixeom technology is built on the Docker runtime environment.

Further notable news saw HPE launch its own Kubernetes container platform in November 2019, and high-flying startup Mesosphere changed its name to D2iQ in August 2019 and shifting its strategy partially away from its own “Mesos” standard to focus further on Kubernetes deployments.

5. Largest startup funding: Samsara

In September 2019, Samsara, a San Francisco-based maker of IoT hardware and software, raised $300M in Series F funding. This round represents the largest single startup funding round in IoT 2019.

Samsara is quite a story. Founded in 2015, the startup has gone from 0 to 1,500 employees in less than 5 years, backed by well-known VC fund Andreessen Horowitz. Samsara makes both IoT software and hardware components. The hardware portfolio includes (among other things) cloud-based machine vision systems, industrial controllers, gateways, HMIs, and environmental sensors. The firm has a strong focus on IoT in transportation and fleet management. Samsara claims to serve over 10,000 customers and is active in 10 countries. Many of the customer case studies on the Samsara website highlight IoT projects with logistics and trucking companies as well as with cities as Samsara’s initial product was geared towards these firms.

Notable other investment rounds of 2019 (with relevance for IoT) included:

| Name | Funding stage | Amount | Country | Category |

| Terminus Technologies | Series C | $286M | China | IoT Platform & Smart City Solutions |

| Infarm | Series B | $100M | Germany | IoT-based vertical farming |

| Armis Security | Series C | $65M | USA | IoT Security |

| InfluxData | Series D | $60M | USA | Time-series database |

| Tile | Series C | $45M | USA | Consumer asset tracking |

6. Largest M&A Deal: none (but many small acquisitions)

2019 saw no IoT-related mega deal as in the previous years (for example, we highlighted the $34B Red Hat acquisition by IBM last year).

The reason for the lack of mega acquisitions in IoT 2019 may be the combination of two factors. Firstly, many publicly listed companies achieved new all-time high valuations, thereby making the acquisition multiplies higher than in the past.

Secondly, the majority of the most visible IPOs in 2018 and 2019 disappointed in their first year of being public. Most notable are ride-sharing companies Uber and Lyft which both declined 30-40% in value since their IPOs earlier in 2019. We highlighted the Sonos IPO last year as an IoT story; that stock is down 25% since its IPO. When talking to investors, it also becomes clear that the story of the failed WeWork IPO (which saw WeWork’s valuation plummet from $47B to $10B in a matter of weeks) is overshadowing investment decisions and leading to more caution going forward.

Notable acquisitions of 2019 (with relevance for IoT) included:

| Acquirer | Acquired company | Deal size | Category |

| Siemens | Pixeom | undisclosed | Edge Computing |

| Aspen Tech | Mnubo | $102CAD | Analytics |

| Vodacom | IoT.nxt | undisclosed | IoT Platform |

| Geotab | BSM | undisclosed | Telematics |

| Digi Intl. | OpenGear | $140M | Remote Infrastructure Management |

| Cisco | Sentryo | undisclosed | IoT Security |

| Microsoft | Express Logic | undisclosed | Real-time operating system |

| Avnet | Witekio | undisclosed | Embedded Software |

| PowerFleet | Pointer | $140M | Telematics |

| Dialog Semiconductor | Creative Chips | undisclosed | Semiconductor |

| Palo Alto Networks | Zingbox | $75M | IoT Security |

| Cognizant | Zenith Technologies | undisclosed | IoT System Integration in Life Sciences |

Note: The acquisitions of CarbonBlack ($2.1B) and Pivotal ($2.7B) by VMware in the summer of 2019 may be regarded as IoT-related acquisitions in the wider sense but were not considered further here as IoT is not mentioned as an acquisition rationale.

7. Consumer IoT breakthrough: Micromobility

Light IoT-enabled vehicles such as smart scooters, electric skateboards, and shared bicycles swamped the streets of hundreds of cities throughout the world in 2019. These new modes of transportation make up a new and burgeoning category of products referred to as micromobility solutions. Leading providers include Uber Jump, Lime, Bird, and Spin in Europe and North America as well as Meituan / Mobike, Ofo, Hellobike and Didi Qingju in China.

The explosive growth of micromobility in 2019 is breathtaking. Lime, which is now active in 120 cities around the world, in September celebrated its 100 millionth ride, a 16-fold increase from its 6 million ride landmark achieved just 14 months earlier.

Despite the impressive growth of micromobility solutions questions linger whether these new services are a short-term fad that will vanish, whether the companies supplying the bikes actually will become profitable, and whether regulation will stand in the way of their success in 2020. Regulators around the world have been targeting micromobility, with France imposing 25 kmh speed limits and banning scooters from pavements and Singapore imposing a “zero-tolerance” ban on the use of personal mobility devices (PMDs) on pedestrian footpaths. Meituan already retracted its growth ambitions by pulling out of non-Chinese markets in March 2019.

8. Most promising new technology: Secure cloud-ready chips

In October 2019, Microsoft announced that its Azure Sphere microcontroller (MCU) would be generally available in February 2020. Microsoft Azure Sphere is a promising new microchip technology that allows any device manufacturer to create equipment with native, highly secure cloud integration. The new offering presents a way to securely connect the billions of MCU-based devices which cannot currently be connected in a secure fashion very easily due to their limited compute and storage capabilities. Current hardware partners of the technology include chip makers MediaTek, NXP, and Qualcomm as well as Avnet, seeed and a few more.

Starbucks is an early adopter of the new technology. The company retrofitted some of their coffee machines with an external device called a “guardian module” in order to securely aggregate data and proactively identify problems with the machines.

Cisco, in December 2019, also announced its own silicon architecture, called Cisco Silicon One as part of its new “Internet of the Future” initiative. The company claims that Silicon One is the industry’s first networking chip designed to be universally adaptable across service provider and web-scale markets, designed for both fixed and modular platforms. Instead of maintaining numerous chip architectures across different devices, Cisco will now just focus on one programable ASIC. It is part of Cisco’s strategy that will see networks become more converged, cloud-enhanced, and fabric-based.

9. Most promising upcoming new theme: IoT and the environment

2019 goes down as the year in which a new era of climate change awareness started. Driven by Greta Thunberg and the Friday’s For Future initiative, 2019 saw two globally coordinated multi-city protests involving over 1 million students each. In May 2019, Thunberg was featured on the cover of Time magazine, which named her a “next generation leader” and noted that many see her as a role model.

It seems that this new awareness for climate action and sustainability not only reached millions of individuals but is also leading large corporations (in the IoT domain) to reprioritize their top-level strategies.

In September, wireless sensor network hardware and software provider Libelium, published a report examining at how IoT contributes to the United Nations Sustainable Development Goals and how the company is providing the right technology that supports achieving these goals.

In November 2019, leading industrial conglomerate Siemens let the world know that it is witnessing that customer requirements are changing and that from now on “environmental efficiency is just as important as productivity, flexibility and time-to-market”, something the company hadn’t spelled out that explicitly before. Siemens highlighted how it uses IoT and related technology to help a chocolate manufacturer reduce primary energy consumption by 20% and how the use of Digital Twins and the MindSphere IoT Platform may lead its customer Grundfos to save 50 billion liters of fresh water in the future. One of Siemens’ main competitors, Schneider Electric, uses a similar theme to describe its top-level company strategy: Schneider Electric is now positioning itself to provide “Energy and automation digital solutions for efficiency and sustainability”.

Many IoT providers now have sections on their websites that are dedicated to the environment, sustainability or simply “IoT for good”. Example include connectivity providers Aeris Communications, AT&T as well as Lora/Semtech.

10. Consumer IoT failure of the year: Smart Home Security Cameras

In early December 2019, a series of hacks of the popular home security camera system Ring (which was purchased by Amazon in 2018), shocked the world. Hackers in various U.S. locations managed to get access to the video live stream of unsuspecting Ring users, in several instances talking to and scaring children in their bedrooms. The first victims of the hacks are now suing Amazon over the incidents.

On December 30, 2019, another major Smart Home Security firm, Seattle-based Wyze, reported that it also had become the target of a major hack that is estimated to have affected 2.4 million customers. The hack exposed user email addresses and information about the last time they logged in, and it is reported that some customers even had their health data leaked.

While home security firms Ring and Wyze may have been the most prominent examples of IoT device hacks, there were many other attacks on consumer IoT products that received much less attention. Kaspersky reported that it had detected over 100 Million IoT device hacks in the first half of 2019 alone, a 9x increase from the same period in the previous year.

In July, two security researchers discovered that a user database belonging to a Chinese company called Orvibo, which runs an Internet of Things (IoT) management platform, had been left exposed to the Internet without any password to protect it. The database included more than 2 billion logs containing everything from user passwords to account reset codes and even a “smart” camera recorded conversation.

In August, Microsoft exposed a group of Russian hackers that were responsible for an IoT-based attack on a number of Microsoft customers.

C. Further information:

For a deeper look at current trends in IoT markets, check out our semi-annual “State of the IoT” market update (note: this is Enterprise subscription-only content).

Our IoT coverage in 2019:

If you would like to take a deeper look at current IoT markets, you may be interested to know that IoT Analytics publishes a semi-annual “State of the IoT” market update (Enterprise subscription-only content).

Our IoT coverage in 2020: For continued coverage and updates (such as this one), you may subscribe to our newsletter. In 2020, we will keep our focus on important IoT topics such as IoT Platforms, IoT Connectivity, Industry 4.0, and Smart Cities with plenty of new reports due in the first half of the year.

For a complete enterprise IoT coverage (Enterprise subscription) with access to all of IoT Analytics paid content & reports as well as dedicated analyst time, your company may subscribe to the Corporate Research Subscription.

Much success for 2020 from our IoT Analytics team to yours!

Follow us on Linkedin or on Twitter

The post IoT 2019 in Review: The 10 Most Relevant IoT Developments of the Year appeared first on IoT Analytics.

via https://www.aiupnow.com

by Knud Lasse Lueth, Khareem Sudlow