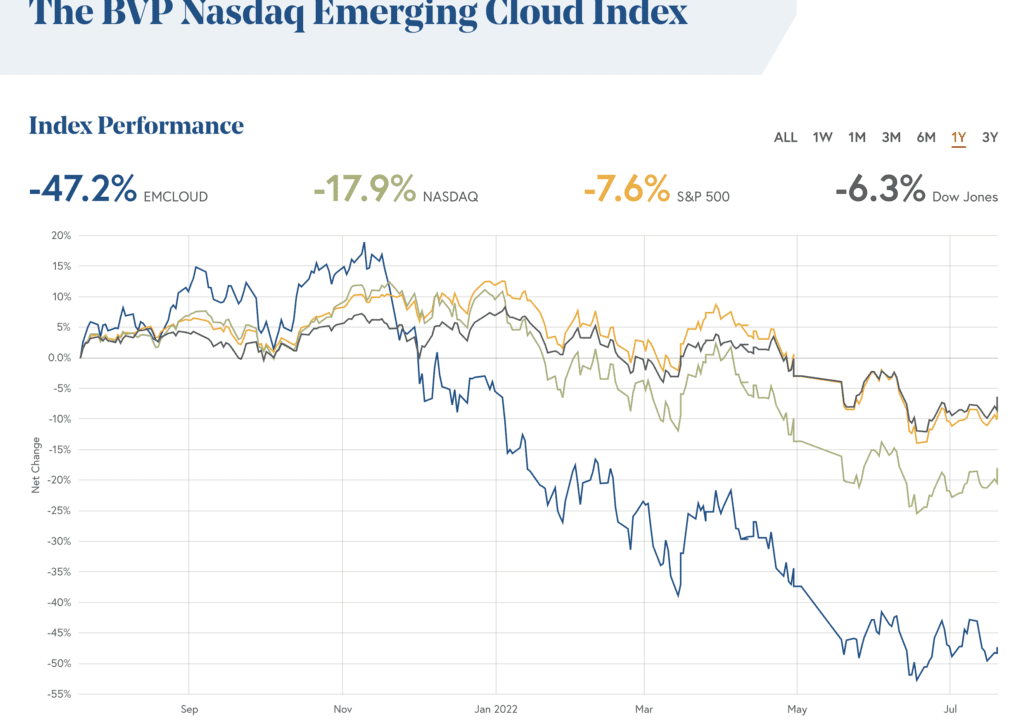

Yes, valuations are way down

But less discussed is the evaporation of liquidity:

– Founder's secondary is way down, now absent in most rounds

– IPO market frozen

– M&A way down

We acted in 2H'20-Q1'22 like liquidity didn't matter

We'll see if in the end it does or not

— Jason

2022 SaaStr Annual Sep 13-15

Lemkin (@jasonlk) July 19, 2022

At this point, any founder in SaaS should know the public markets have fallen 50% or so from the peaks in 2021. It’s profoundly frustrating as revenue growth — hasn’t fallen. The best in SaaS are growing faster than ever, even past $1B or more in ARR. And yet, they are still worth half of what they were just a few months ago.

Now that the downturn in valuations is stretch out to months or longer, the next phase of issues will begin to set in. It’s not just that Snowflake, Datadog, Zoom, and so many other iconic leaders are worth half of what they were. That alone ultimately should cut venture valuations in half over time.

But a bigger reckoning may come around liquidity.

When times are great, everyone piles into illiquid assets like startups. No one worries about getting their cash out. They just want to get it in. In fact, they want to get it in so much, they just assume they’ll be able to get much more of it out.

But when times get tougher, liquidity freezes up. It’s freezing up now:

- Founder secondary liquidity gets a lot harder and rarer. And the amounts smaller. Venture markets were so hot in 2021, that many SaaS founders could sell a few million dollars worth of their shares even in a Series A. They used to have to wait longer, and it was hotter. And some of the hottest B2B founders in unicorns and decacorns took $20m, even $100m out in some cases (!) in secondary sales. This really only happens when there is much, much more demand for shares that supply. VCs don’t really want to buy founder common. They want to buy traditional preferred. But they’ll do it if there is no other way to get shares. As demand overall ebbs, it gets much harder to get material founder secondary. More on that here.

- The IPO market is mostly frozen. A scale-up with incredible numbers can always IPO, at any time. Google and Facebook IPO’d during tough times in the market, and I’m sure Zoom, Slack, Datadog, Snowflake, etc. with their IPO numbers could have IPO’d any time they wanted. But for all but the best, it’s very hard to IPO today. And again, valuations are likely half or less of a year ago, even for the best in SaaS.

- M&A (acquisitions) is way, way down. This is a bit counterintuitive. You’d think when assets are cheaper, more would be purchased. But it doesn’t work that way in practice. First, many potential acquirers own stock prices are way down. Which makes acquisitions sometimes more expensive in terms of dilution, if not cash per se. Second, it’s easier to pay up when your own stock price is on a tear. Salesforce bought Slack for 27x ARR. Today? I doubt it would pay even 10x. And third, many folks just don’t want to sell when prices are down. It’s easy to buy mediocre assets in a down market. They all become available. But top assets often become even less willing to sell at half or less the price of just a few months back.

The bottom line is a short period without much liquidity in venture doesn’t matter. The industry is built for that.

But if it lasts the rest of the year? That will change things.

We all acted like liquidity didn’t matter when times were so, so good in the SaaS public and private markets. But when things freeze up, sometimes we realize liquidity is more important than ever.

A related post here:

liquidity image from here

The post Down Markets And the Evaporation of Liquidity appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow