So we’re in the 5th or so “SaaS crash” since I’ve been doing SaaS. This one is the worst, not because SaaS companies aren’t’ doing well. No, they are doing better than ever. Not because valuations are terrible. No, they are still decent, in absolute terms.

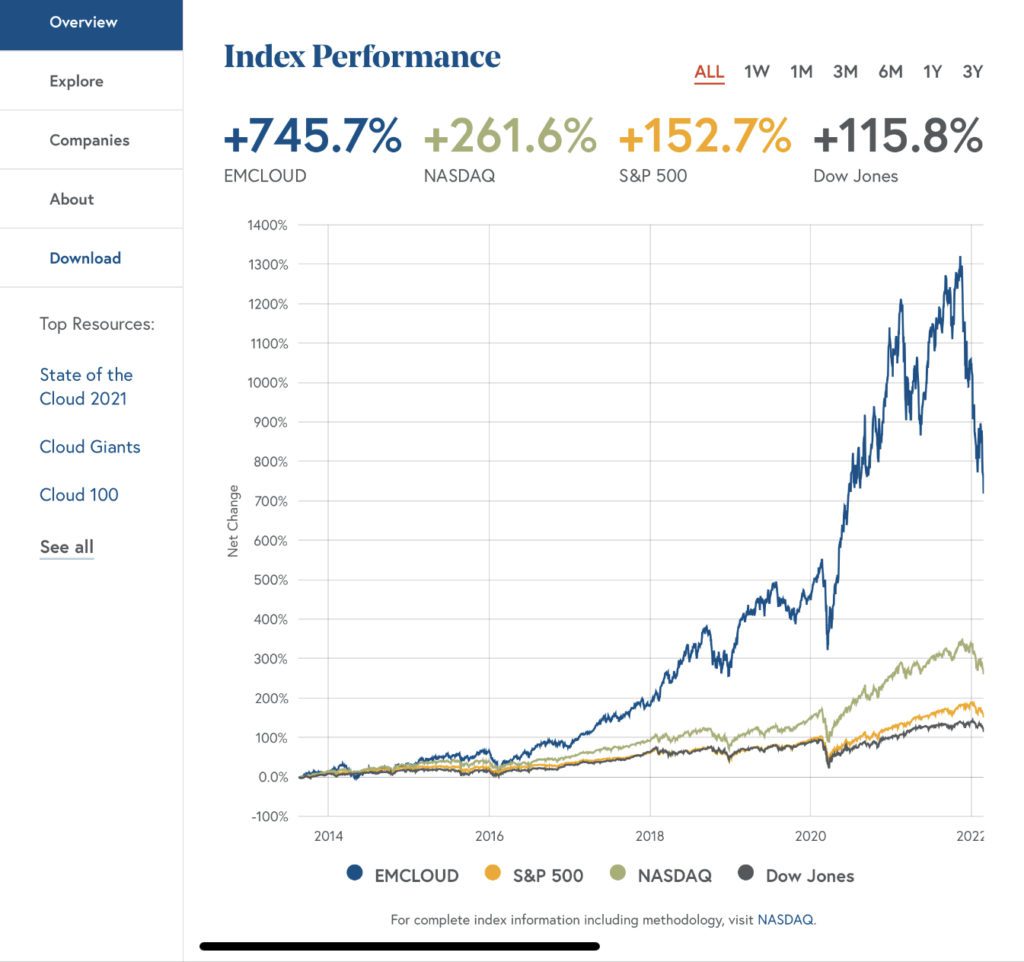

No, this SaaS Crash is so tough on VCs and public market investors because the market was just so, so high for Cloud stocks from mid-2020 to late 2021:

You can see above in the BVP Nasdaq Cloud Index that while these are still Great Times in SaaS, they aren’t the crazy days that peaked around Thanksgiving 2021.

You’ll have taken a real hit as a public investor if you bought a lot of Cloud stocks then.

But the bigger stress in many cases is on VC funds and high-burn rate VC start-ups. Why?

* Everyone was a genius in SaaS for a while. VCs could count on a 3x-5x “mark-up” to almost any round in a great startup. This not only made their paper returns look insane, it seemed to derisk the next round. You didn’t as a VC have to worry about the next round of funding, because of course it was coming. Now VCs are worried about the next round at least a bit, for all but their very top investments. Just like we used to, up until late 2020 or so.

* It was OK to be a bit sloppy around your burn rate. Yes, everyone still cares about capital efficiency, even in the best of times. But when you knew the next round was coming, and at a much higher price, neither founders nor investors had to worry too much if the burn rate was higher than it should have been.

Ok now things have changed, at least for now. Public “multiples”, or how much top public SaaS companies are valued at a multiple of revenue, have fallen by half since the peak in Q4’21. Albeit, only back down to where they were pre-Covid.

And the top SaaS companies are growing faster than ever. Monday grew 91% at $400m ARR last quarter! Asana grew 60% at $400m ARR! Twilio grew 54% at $3.4B ARR last quarter!

The flow of customer money into SaaS isn’t slowing down. Not for now, at least. Not in the enterprise, and not in SMBs.

So as a founder, what should you do in this new world? Basically, hunker down and carry on — if you have enough capital:

* Fundraising has already gotten harder. Assume it will be for you, too (even if in the end, it isn’t). How much harder is murkier, due to so much more venture capital being out there, and where the markets head in the next quarter or two. Venture capital also often has some lag from the public markets, but it’s not more than a quarter or two.

* Having 24+ months of runway is freedom. Especially now. Whatever bumps we are in, we’ll be in a different world in 24 months. And your startup likely will be 5x-20x bigger in ARR. So if you can get your capital to last 24+ months, you really can ignore a lot of the VC and even public market drama today.

* Maybe just assume current multiples are the norm. VCs are still struggling with this, but as a founder, maybe just assume valuations will be half of what they were in Q4. That may mean you have to grow into your target valuation, which may take 12+ months longer than you thought. It may mean you need to be a bit more conservative at the margin. But it seems prudent for now to assume the high multiples of the Covid era are in the rear view mirror.

* It’s OK. Times are still good. Again, the best in SaaS and Cloud are growing faster than ever. We just may need to budget another year or two to get to where we wanted to go. And we may need to be more capital efficient than we planned. And likely — getting to that coveted Unicorn or Decacorn status will be that much harder. But it’s OK. The customers and revenue are still there.

I think the top SaaS companies deserve the high multiples. I really do. And they may be back. We just don’t know. But for now, we have to run our startups again like it was 2019 or early 2020. That’s OK.

We know how to do that.

Just course correct to that.

The post Your VCs Are Worried About Public Multiples. Do You Need To Worry, Too? appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow