So UserTesting is a case study on how great SaaS can be (innovating and creating a market leader, and driving it to $160m+ ARR) … and also hard SaaS can be. I love the company and the product, and the value add. While hardly the only vendor doing automated product insights, UserTesting has been doing it for quite a while (founded way back in 2007) and doing it well, with over 2,100 customers including many tech leaders. And they brought on a great CEO, Andy MacMillan, who took them IPO in 2021.

Anyone who drove through SOMA and SF, well back when folks worked in the office, and in SOMA, could never miss UserTesting’s prime office on Townsend:

And yet, for all that hard work, they’ve gotten to $160m+ in ARR, growing 47% … very, very solid numbers, if not epic … yet today, their market cap is only $880m. That’s really a tough multiple for what they’ve accomplished, and a challenge to everyone that thinks they’ve earned a spot in the 100x ARR club. It’s not that easy out there in SaaS land these days, folks. If you want to be a real unicorn, you have to do even better than this.

Now, the markets have taken a beating, it’s tough out there. Multiples may well rebound. But if UserTesting is at $160m ARR, growing 47%, with accelerating growth (from 33% the year before), and isn’t even a unicorn anymore … how many SaaS unicorns that haven’t gotten as far really are unicorns?

It makes you wonder. These are still great times in SaaS. Just not quite as crazy strong as 2021.

5+ Interesting Learnings:

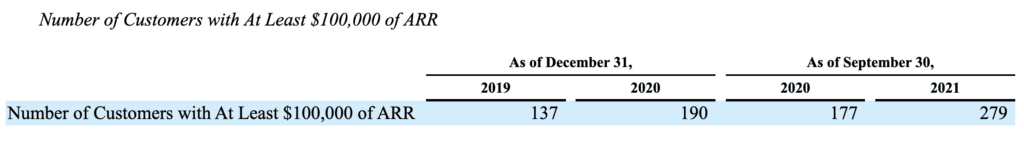

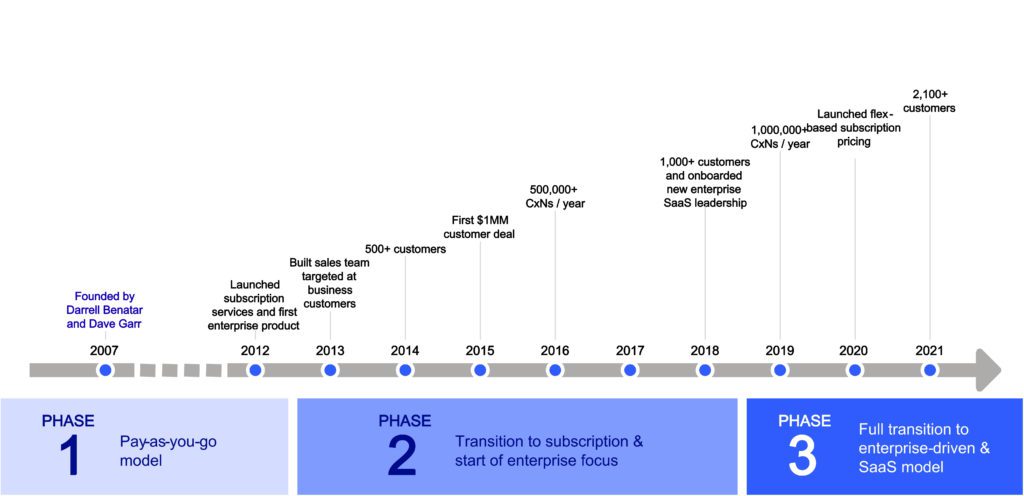

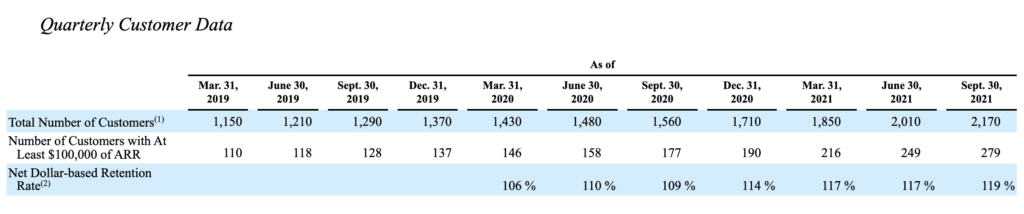

1. 2100 total customers, 279 $100k+ customers, and 9 $1m+ customers. UserTesting moved quite upmarket over its history in 3 phases. With 2,100 customers, it’s left its early roots serving customers of any size behind, with a steady focus on bigger and bigger deals.

Put differently, their $100k+ customers grew 58% in 2020, much faster than the overall base. UserTesting didn’t start enterprise, quite the opposite. They started as pay-as-you go and pretty SMB / PLG. But it sure is enterprise today.

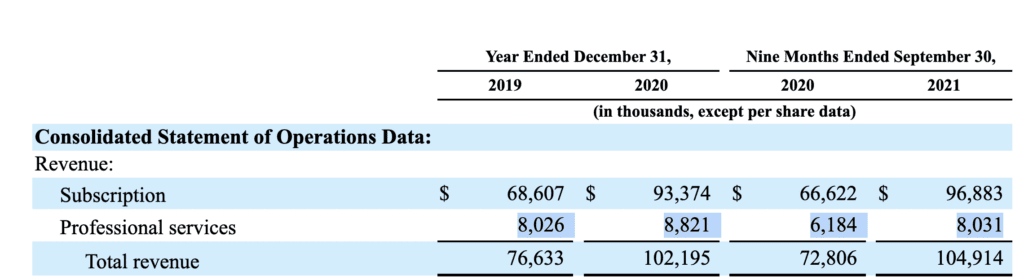

2. Strong growth acceleration in 2021 and in run-up to IPO. After settling into a fairly mature growth rate of 33% from 2019-2020, UserTesting exploded in 2021+, growing at 44%. That’s a lot of acceleration, and impressive. Never let anyone say you can’t grow faster after $100m ARR. UserTesting has.

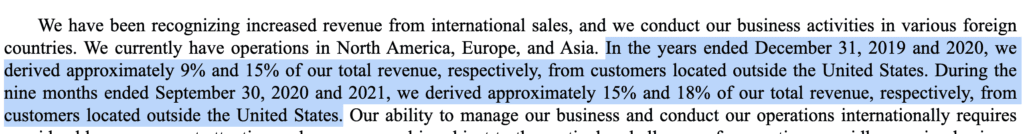

3. Only 18% of revenue outside the U.S, but growing faster now, and was only 9% in 2019. UserTesting has opened offices in EMEA and APAC but has a bit lower international growth than I’d expect, given how global software development is now. Room to grow. But there is more focus there now, with international growing 76% last year, vs. 47% overall. And it’s way up from 9% in 2019. UserTesting was late to go international — but it’s working.

4. Pro Services about 8% of revenues. They’ve kept this fairly lean, considering how much larger enterprise clients likely would pay to deploy the product, and its trending down as a percent of revenue. Pro Serve is modestly profitable — they don’t make much, but they don’t lose money on services.

5. Didn’t add an enterprise sales force until 2016 (9 years after founding), didn’t add “enterprise platform” until 2012. Yet bigger deals and enterprise is all their growth today. A reminder you really can do enterprise later, if that’s where the journey (and your customer base) takes you. A decade later for UserTesting! Fast forward to today, and the majority of their revenue is from enterprise customers, and they have 9 $1m+ customers. You can see the 3 phases below:

And a few other interesting learnings:

6. Stuck with per-seat pricing from 2007-2020, but added flex pricing in Q4′ 2020 — and quickly went to 20% of revenue. The times they are a ‘changing here. A lot of UserTesting customers want flex pricing. 20% switched in just 1 year.

7. 119% NRR, up from 109% in 2020. Good, but nothing special given how mid-market and enterprise they have become.

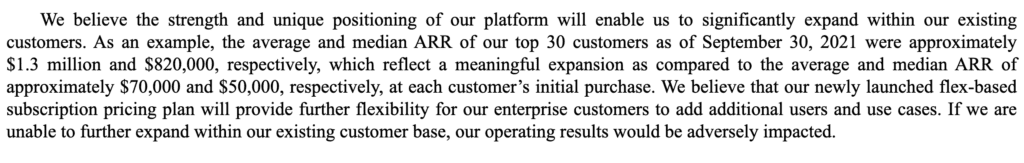

8. Top 30 customers pay on average $1.3m — up from $70k at initial purchase. An interesting way to see it segmented, and incredible account expansion over time. They grow $70k accounts to Top 30 accounts. Booom!

9. 705 total employees — with 309 employees in sales & marketing, 166 in R&D. That’s OK efficiency at $230k per employee. Not great but OK. And fairly sales-heavy, at 43% in sales and marketing. But that’s similar to other sales-led orgs at this scale.

A great SaaStr session with UserTesting’s Chief Insights Officer here:

The post 5 Interesting Learnings from UserTesting at $160,000,000 in ARR appeared first on SaaStr.

via https://www.aiupnow.com

Jason Lemkin, Khareem Sudlow